Berkshire Hathaway Inc., Elliott Wave Technical Analysis

Berkshire Hathaway Inc., (BRK.B:NYSE): 4h Chart 10 November 23

BRK.B Stock Market Analysis: We have been anticipated a potential diagonal in wave 1 and we successfully retraced into what seems to be wave {a} of 2. There is a bullish scenario where instead of 1 we had wave A, nonetheless we should expect one more leg lower.

BRK.B Elliott Wave Count: Wave {b} of 2.

BRK.B Technical Indicators: Above all averages.

BRK.B Trading Strategy: Looking for one more leg higher in wave {c} of 2.

TradingLounge Analyst: Alessio Barretta

Source : Tradinglounge.com get trial here!

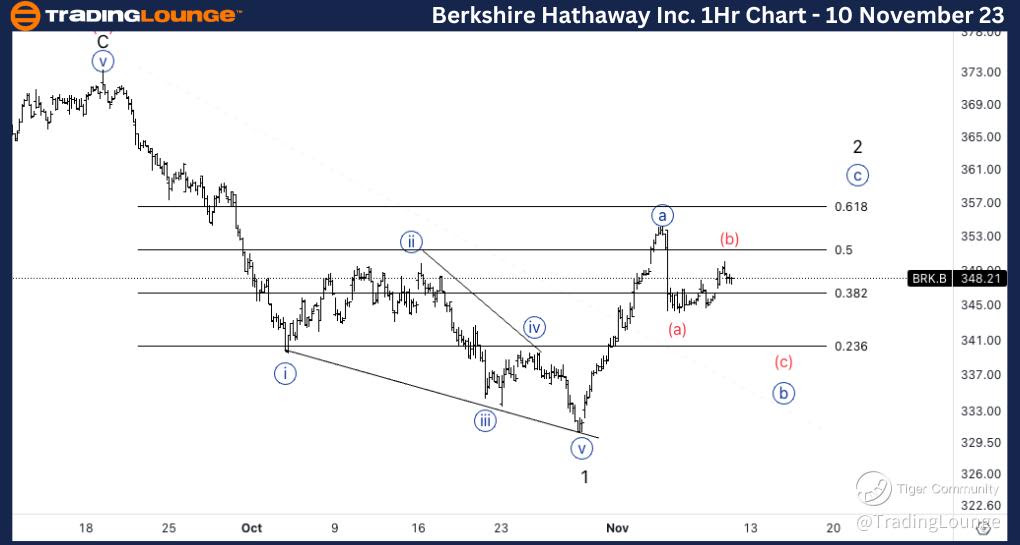

Berkshire Hathaway Inc., BRK.B: 1-hour Chart 10 November 23

Berkshire Hathaway Inc., Elliott Wave Technical Analysis BRK.B Stock Market Analysis: After a sharp move lower in what seems to have been wave (a) of {b} we could continue lower in wave (c) of {b} to complete wave {b} and then continue higher. We could expect support around 338$.

BRK.B Elliott Wave count: Wave (b) of {b}.

BRK.B Technical Indicators: Above all averages.ss

BRK.B Trading Strategy: Looking shorts into wave (c)