TradingLounge Iron Ore (SGX TSI Index Futures) Elliott Wave Analysis

SGX TSI Iron Ore Index Elliott Wave Analysis

Iron Ore Elliott Wave Technical Analysis

The SGX TSI Iron Ore Index serves as a vital benchmark in the iron ore market, providing essential insights for traders, miners, and steelmakers involved in contract settlements and managing price risks. This index is grounded in actual transactions within the iron ore spot market, making it a reliable indicator of market trends.

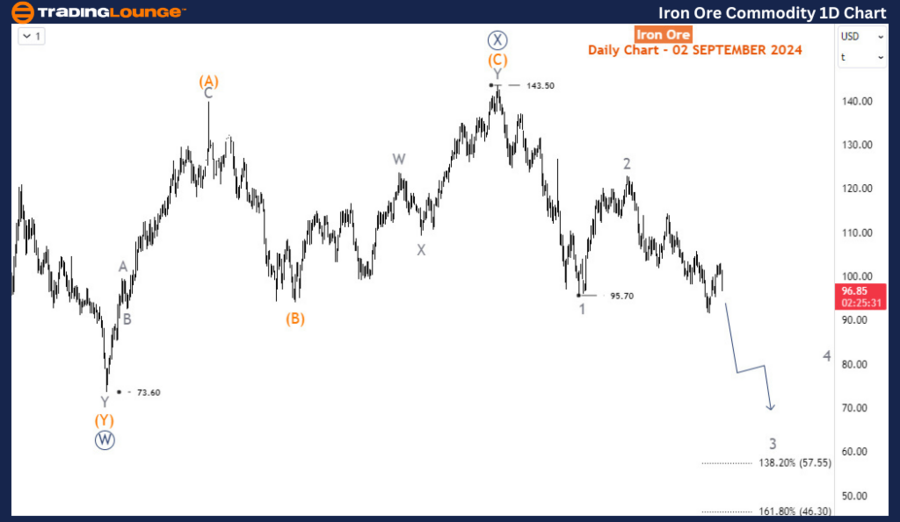

The index reached a historic peak of around $233 per dry metric ton in May 2021, fueled by robust demand from China and supply disruptions among key producers. However, this high signaled the onset of a significant correction, with the index plunging by over 68% to $73 by October 2022. A recovery phase ensued, elevating the index to $143.5 by December 2023. Despite a strong rebound in April and May 2024, the index has since reversed direction, continuing the downtrend that began in January 2024.

Long-Term Elliott Wave Analysis

In May 2021, the SGX TSI Iron Ore Index entered a bearish corrective phase, forming a primary W-X-Y wave pattern at the primary degree. The initial leg, wave W (circled), completed at the October 2022 low, followed by wave X (circled) which peaked at the January 2024 high of $143.5. The current wave Y (circled) began at this January 2024 peak and is expected to unfold into a 3-wave structure, comprising intermediate degree waves (A)-(B)-(C).

At present, the index is developing wave 3 of (A), which could potentially drive the price down to $45, indicating a bearish long-term outlook. This wave structure suggests that the overall trend remains negative, with additional downside anticipated as wave Y completes its formation.

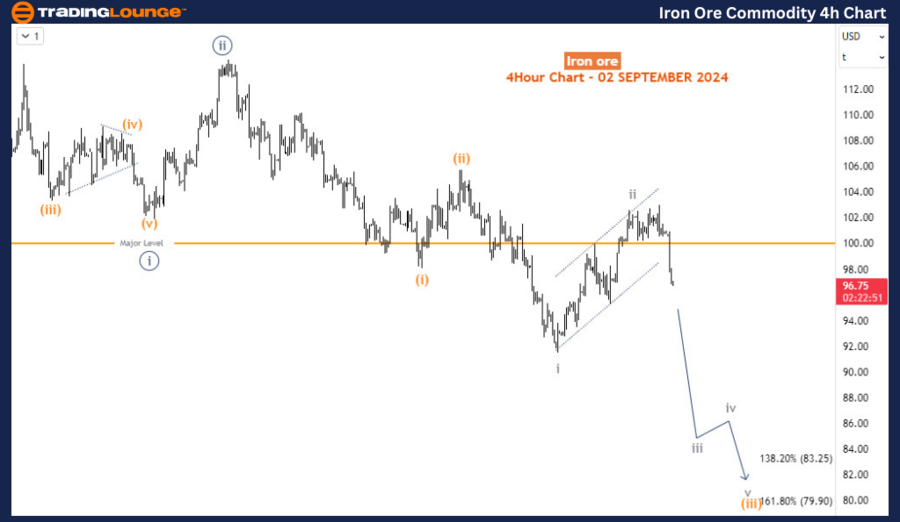

Iron Ore H4 Chart Analysis

Focusing on the H4 chart, wave 3 commenced at $122.9 and is currently advancing through its 3rd sub-wave, wave iii (circled) of 3. Within this framework, the price is progressing through wave (iii) of iii (circled) of 3. Short-term projections indicate that wave (iii) could push the index down to $85 before experiencing a corrective bounce in wave (iv). After this brief retracement, the downward trend is expected to resume, consistent with the broader bearish outlook indicated by the long-term Elliott Wave structure.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support