TradingLounge Commodity Trading using Gold Elliott Wave Analysis

Gold Elliott Wave Technical Analysis

Gold has experienced a remarkable ascent, surging by over 22% in 2024 so far. The precious metal is nearing another peak within just over a week, highlighting strong momentum in its ongoing rally. Technically, the price action indicates that Gold is poised for a significant breakout after a week of range-bound movement. This potential breakout could propel Gold to new heights, reinforcing its bullish outlook.

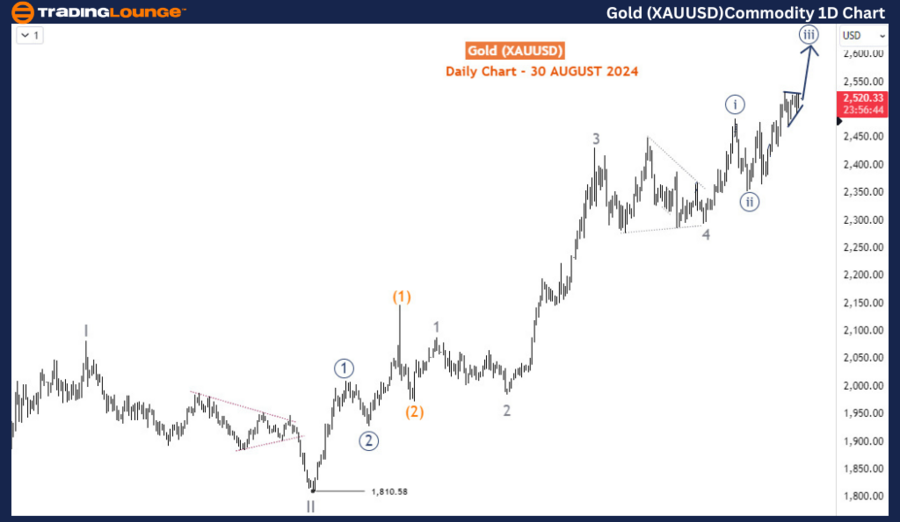

Gold (XAUUSD) Daily Chart Analysis

On the daily chart, Gold has recently completed the supercycle wave (IV), marking a corrective phase in the long-term bullish trend that began in December 2015. The completion of wave (IV) has paved the way for the emergence of a new impulse wave, labeled wave (V). This wave (V) is part of a larger Elliott Wave structure, anticipated to carry Gold to significantly higher levels.

Within wave (V), the first two sub-waves, I and II, were completed in May and October 2023, respectively. Currently, Gold is progressing through wave (3) of III (circled), a crucial segment in the overall wave structure. Wave (3) of III is typically the most powerful and extended wave in an Elliott Wave sequence, and the current move aligns with this pattern. The ongoing wave (3) of III has the potential to push Gold beyond the 2600 level before concluding.

The consolidation phase observed between April 12th and June 26th corresponds with wave 4 of (3), a corrective phase that allowed the market to absorb previous gains. Now, Gold is in wave 5 of (3), which is expected to drive the price past previous highs and establish new records, further solidifying the strong bullish sentiment dominating the market.

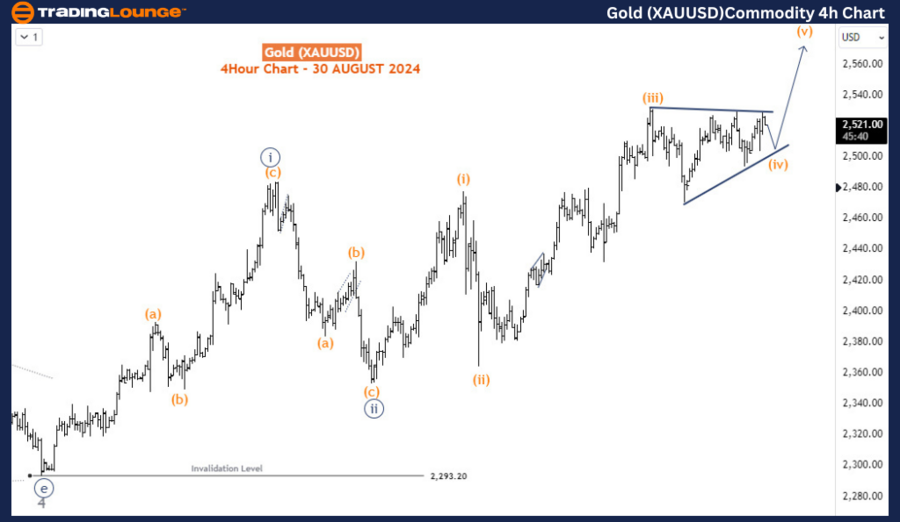

Gold (XAUUSD) 4-Hour Chart Analysis

Zooming into the H4 chart, Gold is currently in wave iii (circled) of 5, within the broader wave (3) of III. The price has been trading within a one-week triangle range, identified as wave (iv) of iii (circled). This pattern is a classic Elliott Wave setup, often leading to a strong breakout. A decisive upside break is anticipated, leading to the completion of wave (v) of iii (circled), with near-term targets in the 2550-2600 range. This breakout would mark another significant milestone in Gold's ongoing rally as it continues to ascend towards new heights. The overall bullish outlook remains robust, underpinned by strong technical factors.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support