SGX TSI Iron Ore Elliott Wave Technical Forecast – Trading Lounge Analysis

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

The SGX TSI Iron Ore Futures contract, listed on the Singapore Exchange (SGX), reflects iron ore with 62% iron content shipped to China. It serves as a global benchmark for pricing in the iron ore futures market.

Market Overview and Current Price Action

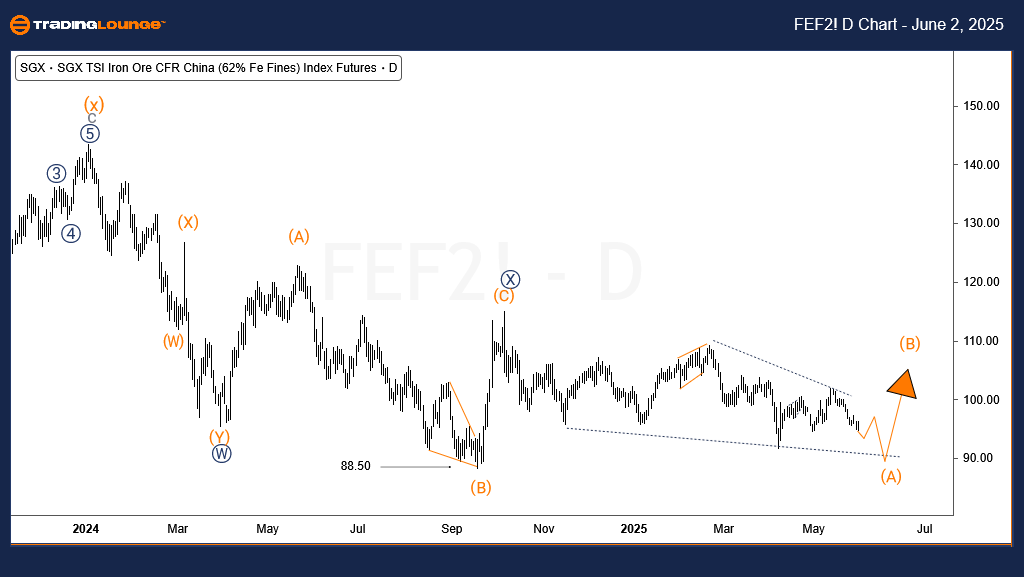

Since October 2024, SGX TSI Iron Ore Futures have shown uneven movement. After a strong rally earlier in that month, prices began to reverse, initiating a corrective phase. Recent chart patterns suggest the development of a potential Elliott Wave structure that could produce further price volatility in both upward and downward directions in the near term.

SGX TSI Daily Elliott Wave Chart Overview

In the broader trend, the index is undergoing a double zigzag corrective pattern beginning from its May 2021 high of approximately $234. This high was followed by a steep drop that reached about $74 in October 2022, completing the first zigzag wave.

Subsequently, the market rallied again in another zigzag, peaking at $153.5 in January 2024. The latest leg reflects another zigzag correction, contributing to a complex (w)-(x)-(y) wave structure. Wave (y) is still unfolding, with downside projections suggesting a potential move toward $45 in the upcoming sessions or months.

SGX TSI 4-Hour (H4) Elliott Wave Chart Insights

On the H4 timeframe, the price action from October 2024 resembles a leading diagonal, which could be wave (A) of ((Y)) of w of (y). Once this diagonal ends, a countertrend bounce as wave (B) may develop, followed by a final push lower in wave (C) of ((Y)). This pattern indicates a bearish trend continuation scenario.

As long as prices remain below key resistance levels at $115 and $143.5, the bearish setup holds. Traders should look for selling opportunities after corrective rallies and closely monitor resistance zones for signs of renewed downward pressure.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support