NORTHERN STAR RESOURCES LTD – NST Stock Analysis & Elliott Wave Technical Forecast

Welcome to today's Elliott Wave forecast for Northern Star Resources Ltd (ASX:NST). Our current analysis signals a potential short-term decline, with prices likely heading toward the 16.86 level. At this stage, there are no indicators suggesting a bullish reversal. Our updated wave count maintains a bearish perspective.

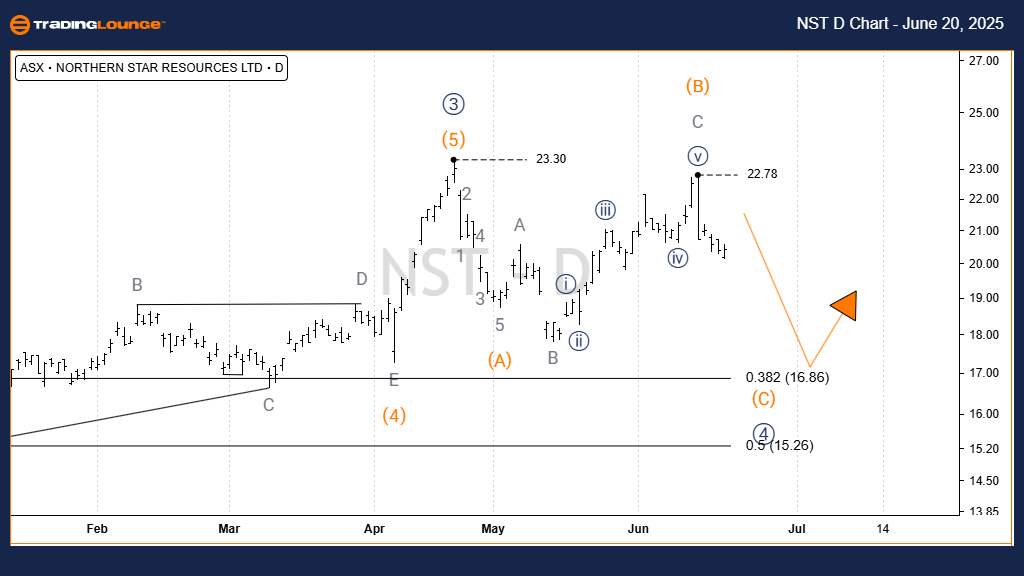

NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis | 1D Chart Analysis

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Position: Wave C)‑orange of Wave 4))‑navy

Details:

The corrective Wave 4))‑navy is evolving as a classic ABC‑orange zigzag pattern.

Waves A) and B)‑orange are already completed.

Currently, Wave C)‑orange is progressing downward, aiming for the 16.86 price level.

Invalidation Point: 23.78

Conclusion: There are no bullish signals. The short-term trend remains bearish.

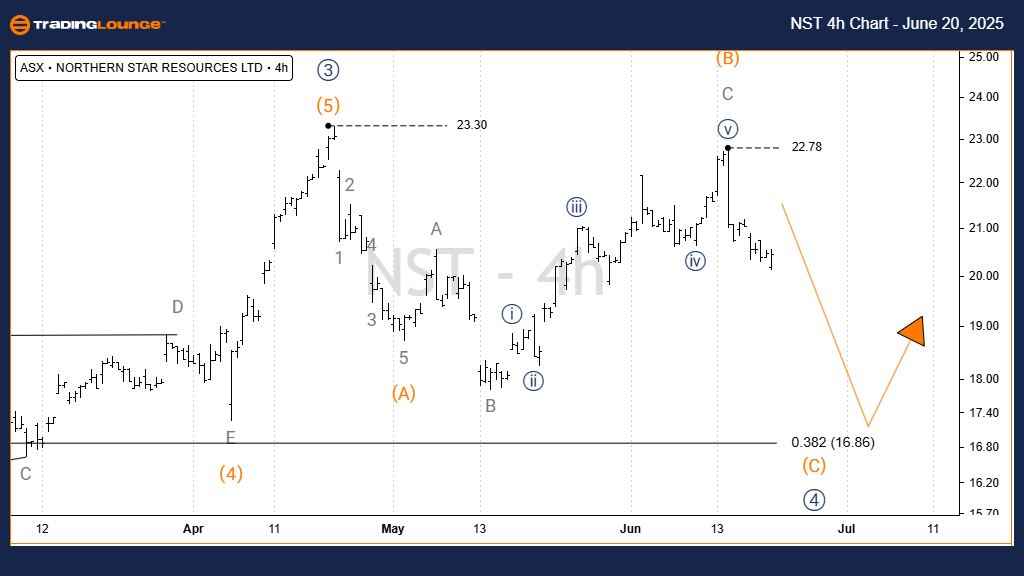

NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis | 4‑Hour Chart Analysis

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Position: Wave C)‑orange of Wave 4))‑navy

Details:

Confirming the 1D view, Wave C)‑orange is extending downward after peaking at 22.78.

The projected downside target is near 16.86.

Invalidation Point: 22.78

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The Elliott Wave model continues to support a bearish short-term outlook for ASX:NST. Key technical levels—16.86 as the downside target and 23.78 as the invalidation threshold—provide traders and investors with clear reference points. This analysis delivers a structured and professional forecast, aimed at helping market participants make informed decisions based on actionable chart signals.