ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis | TradingLounge

Greetings traders,

Today’s updated Elliott Wave forecast focuses on Newmont Corporation (ASX:NEM).

The analysis indicates that ASX:NEM is advancing within an extended third wave. This review outlines the key bullish targets and defines a clear invalidation level to monitor trend continuation or possible reversal.

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis | 1D Chart (Semilog Scale)

Function: Primary Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Wave Position: Wave iii) - orange of Wave iii)) - navy of Wave 3 - grey

Technical Breakdown:

Wave ii) - orange appears complete near the 74.25 low, forming a classic a-b-c zigzag correction (grey). Since then, Wave iii) - orange has been moving upward, with a projected upside price target near 100.00.

Invalidation Level: 74.25

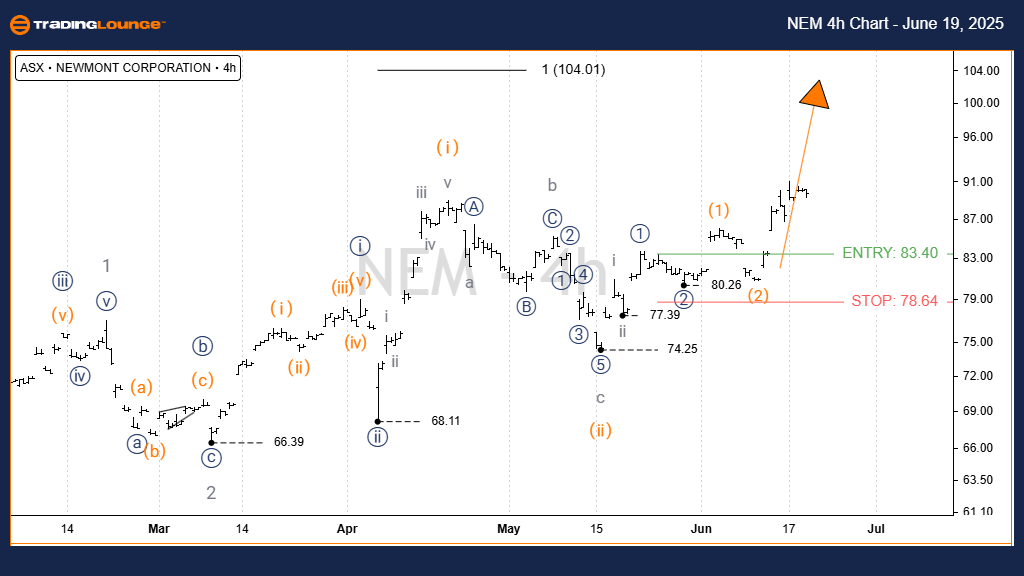

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis | TradingLounge (4-Hour Chart)

Function: Primary Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Wave Position: Wave iii) - orange of Wave ((iii)) - navy of Wave 3 - grey

Technical Breakdown:

Short-term Elliott Wave structure continues to support the bullish trend seen in the daily timeframe. Wave iii) - orange is currently extending upward with a near-term resistance target around 90.00 and an upper resistance zone approaching 100.00.

Invalidation Level: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COCHLEAR LIMITED - COH Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis of Newmont Corporation (ASX:NEM) provides traders with a comprehensive outlook across both daily and intraday charts. Key Fibonacci levels, bullish price zones, and the established invalidation point allow for enhanced risk management and trading precision. This interpretation aims to maintain a data-focused, unbiased view of the current trend using Elliott Wave Theory.