COCHLEAR LIMITED - COH Elliott Wave Technical Analysis | TradingLounge Update

Greetings,

Today’s Elliott Wave analysis for COCHLEAR LIMITED (COH)—a prominent ASX-listed stock—suggests that the stock has likely completed a Wave 2 correction and is initiating a Wave 3 advance. This movement could indicate a new upward trend. This report outlines the next price targets, the key invalidation level, and potential medium-term trends for COH.

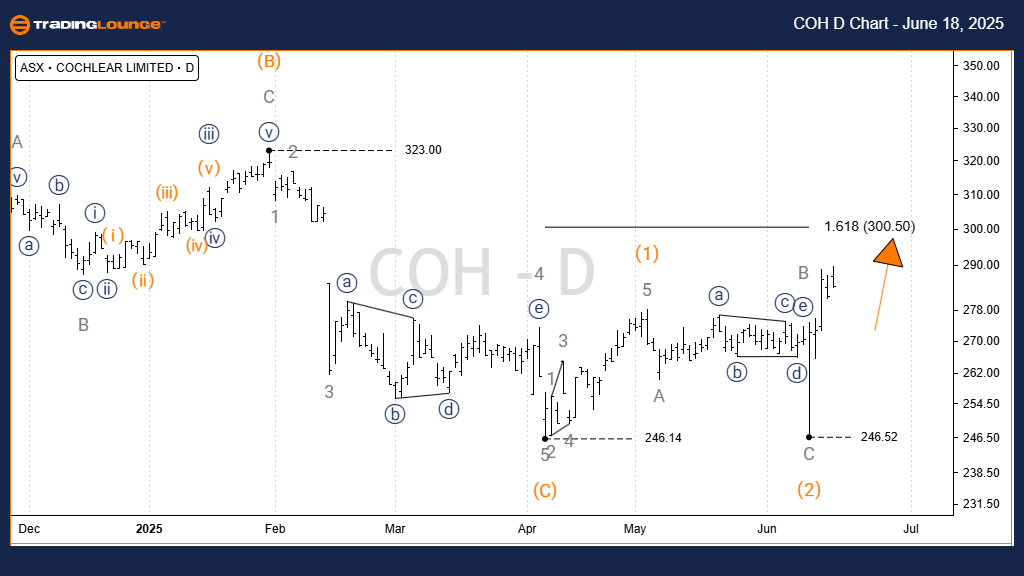

COCHLEAR LIMITED - COH | Elliott Wave Technical Analysis (1-Day Chart – Semilog Scale)

Function: Primary trend (Intermediate degree, Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave 5)) - navy

Technical Summary:

Wave 4)) - navy seems to have ended as a clear A-B-C) correction—marked in orange. Present price behavior indicates the onset of Wave 5)) - navy, aiming to push COH stock prices higher. Upside potential targets the $350.00 range, which corresponds with the high of Wave 3)) - navy.

Key Invalidation Level: $246.52

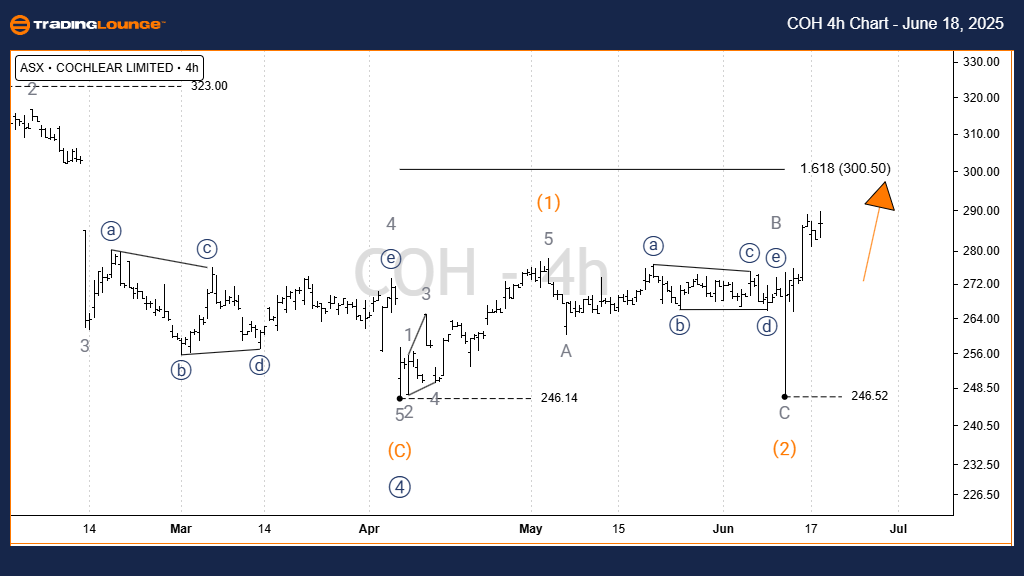

COCHLEAR LIMITED - COH | Elliott Wave Technical Analysis (4-Hour Chart)

Function: Primary trend (Intermediate degree, Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave B - grey of Wave 2) - orange

Technical Summary:

On the 4-hour chart, after forming a Diagonal Wave 1) - orange, COH underwent a sharp retracement during Wave 2) - orange, which took the form of a classic Zigzag correction. This move appears to have bottomed at $246.52, setting the foundation for Wave 3) - orange, which could target $300.50 or higher in the next leg up.

Key Invalidation Level: $246.52

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This technical update provides a structured outlook for COCHLEAR LIMITED (COH) using Elliott Wave principles. The analysis highlights both medium-term and short-term trends, equipping traders with actionable insights. Defining validation and invalidation levels adds confidence and clarity to the wave count, enhancing decision-making through reliable, professional-grade market forecasts.