ASX: MINERAL RESOURCES LIMITED - MIN Elliott Wave Forecast & Technical Analysis by TradingLounge

Our latest Elliott Wave analysis for MINERAL RESOURCES LIMITED (ASX: MIN) highlights a favorable bullish outlook. The recent completion of a Wave 4 correction sets the stage for an impulsive Wave 5 upward movement. This review defines projected price targets and essential invalidation levels for technical traders.

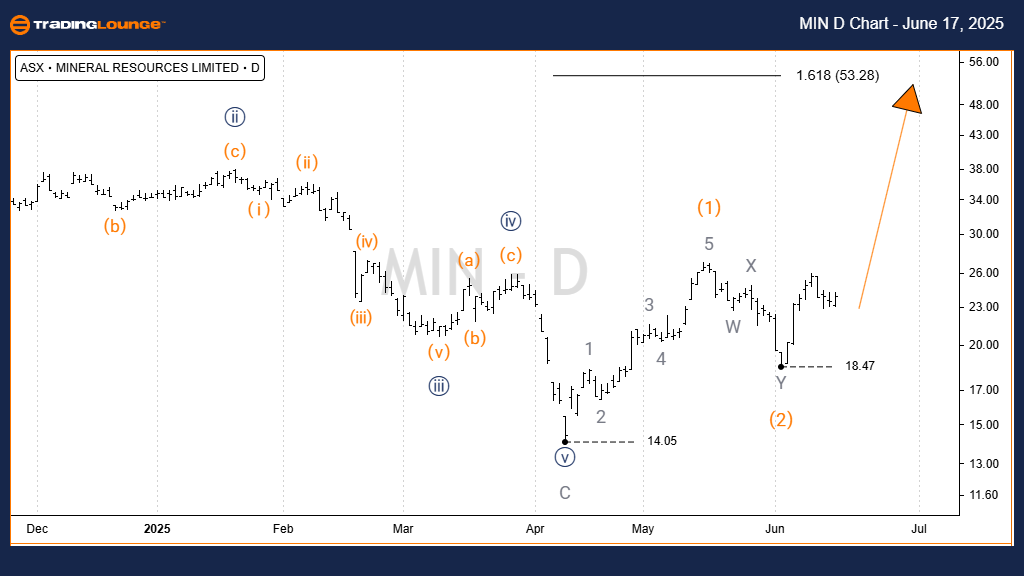

ASX: MINERAL RESOURCES LIMITED 1D Chart Analysis Overview (Semilog Scale)

Function: Primary trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Current Wave Count: Wave 3 (orange) within Wave 5 (navy)

Technical Breakdown:

The corrective phase has ended at the $14.05 price level.

A new impulsive structure is now anticipated to lead the stock higher.

Immediate upside targets are forecasted between $50.00 and $80.00.

The bullish scenario is considered valid only if prices remain above $14.05.

Key Invalidation Level: $14.05

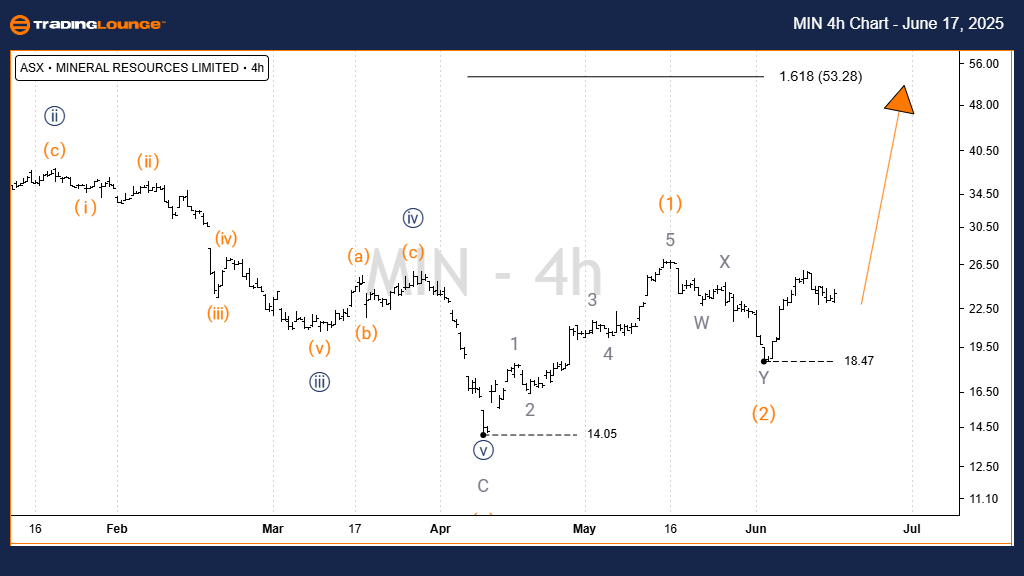

ASX: MINERAL RESOURCES LIMITED 4-Hour Chart Technical View

Function: Primary trend (Intermediate degree, orange)

Mode: Motiv

Structure: Impulse

Current Wave Count: Wave 3 (orange)

Technical Breakdown:

Wave 1 (orange) successfully completed at $14.05, confirmed as a five-wave structure.

Wave 2 (orange) followed with a Double Zigzag corrective pattern, ending at $18.47.

The chart now suggests Wave 3 (orange) is in motion, aiming for the $53.28 target.

Key Invalidation Level: $18.47

(Bullish scenario remains intact only if price sustains above this point)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave technical forecast for ASX: MINERAL RESOURCES LIMITED (MIN) delivers a structured analysis of potential price movement. It emphasizes key support and resistance levels, reinforcing the wave count accuracy. This helps traders navigate the market with greater confidence and clarity, using an evidence-based strategy.