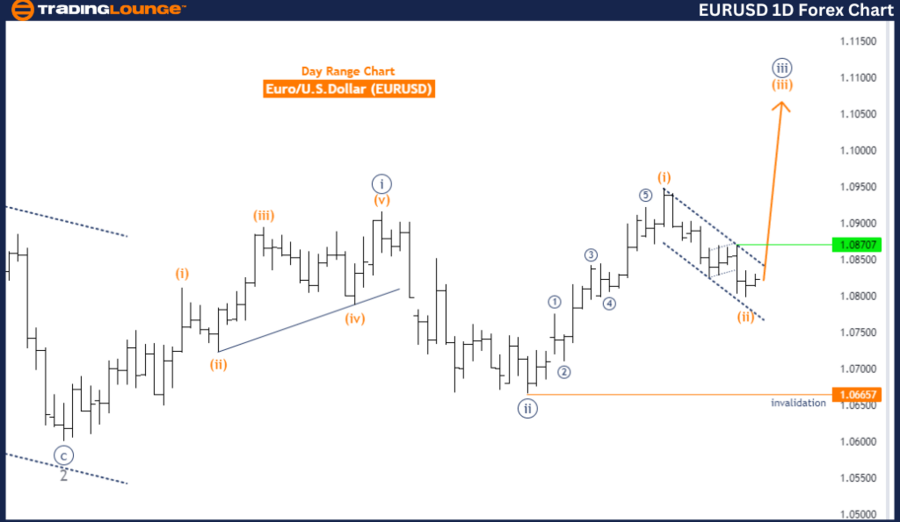

TradingLounge Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis - Daily Chart

Euro/ U.S. Dollar (EURUSD) Daily Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 4

Details: The current Elliott Wave analysis on the EURUSD daily chart reveals an ongoing upward trend in an impulsive mode. The wave structure is identified as Orange Wave 3 within Navy Blue Wave 3, indicating a robust upward movement characterized by impulsive price action.

Orange Wave 2 has likely concluded, paving the way for Orange Wave 3's active progression. This transition from a corrective phase to a more vigorous upward trend suggests the currency pair will likely continue its upward trajectory in the short term.

Following the completion of Orange Wave 3, a corrective phase, identified as Orange Wave 4, is expected. This phase will likely involve a temporary retracement or consolidation before the primary upward trend resumes.

The wave cancel invalid level is established at 1.06657. This critical threshold serves as a validation point for the current wave analysis. If the EURUSD price drops below this level, the current wave count would be invalidated, necessitating a reassessment of the wave count and overall market outlook.

Summary: The EURUSD Elliott Wave Analysis on the daily chart shows the pair in an impulsive upward trend within Orange Wave 3, positioned in Navy Blue Wave 3. With Orange Wave 2 completed, Orange Wave 3 is currently in play, followed by the anticipated Orange Wave 4. The wave cancel invalid level at 1.06657 is crucial for validating the current wave structure and requires reevaluation if breached.

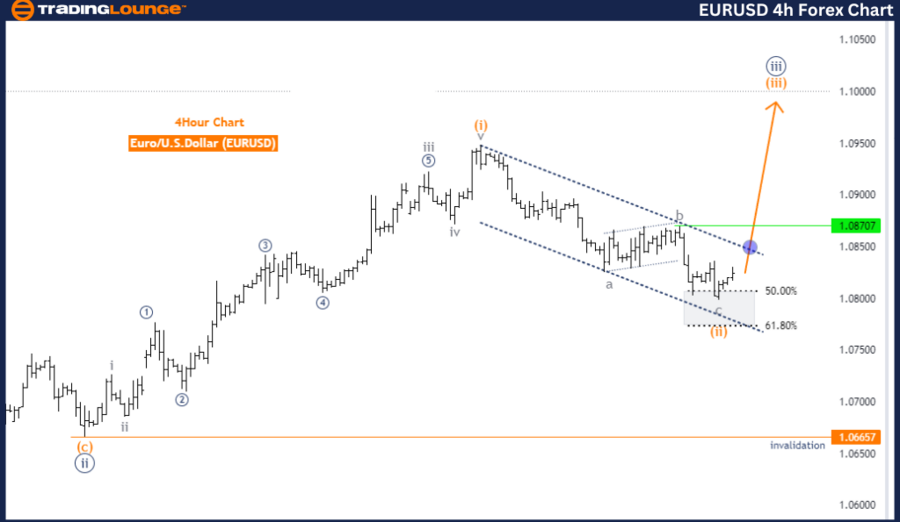

TradingLounge Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis - 4-Hour Chart

Euro/ U.S. Dollar (EURUSD) 4 Hour Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 4

Details: The EURUSD 4-hour chart Elliott Wave analysis indicates a continuing upward trend in an impulsive mode. The current structure is Orange Wave 3, situated within Navy Blue Wave 3, pointing to a strong upward movement with impulsive price characteristics.

The completion of Orange Wave 2 has led to the progression of Orange Wave 3. This shift marks a transition from a corrective phase to a more dynamic upward trend, suggesting the currency pair will maintain its upward momentum in the near term.

The next lower-degree direction is identified as Orange Wave 4, expected to commence following the completion of Orange Wave 3. This corrective phase is anticipated to include a temporary retracement or consolidation period before resuming the primary upward trend.

The wave cancels invalid level remains at 1.06657, serving as a critical validation point for the current wave analysis. A decline below this level would invalidate the current wave count, indicating the need for a fresh analysis of the wave count and overall market conditions.

Summary: The EURUSD Elliott Wave Analysis on the 4-hour chart depicts an impulsive upward trend within Orange Wave 3, positioned in Navy Blue Wave 3. With Orange Wave 2 completed, Orange Wave 3 is now underway, and Orange Wave 4 is expected to follow. The wave cancels invalid level at 1.06657 is essential for validating the current wave structure and necessitates a reassessment if crossed.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURGBP Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support