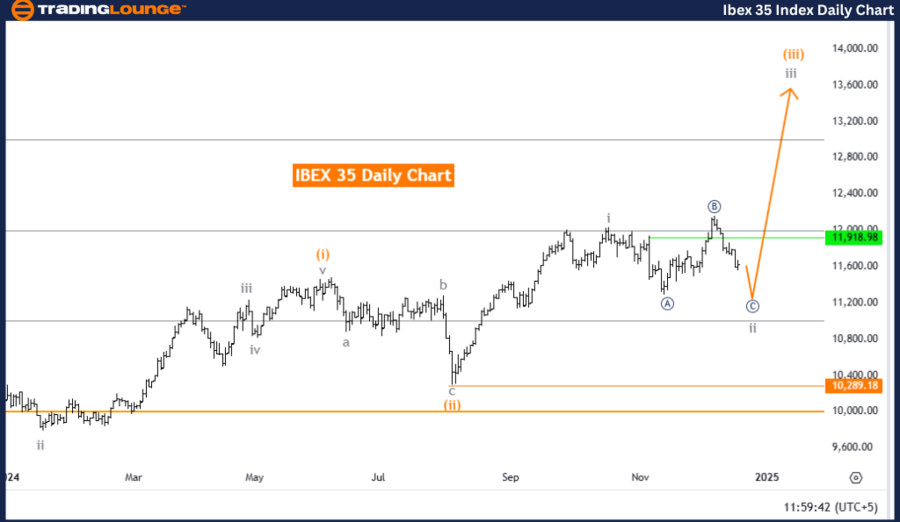

IBEX 35 (Spain) Elliott Wave Analysis - Trading Lounge Daily Chart

IBEX 35 (Spain) Elliott Wave Technical Analysis

IBEX 35 Daily Chart Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray wave 2

Position: Orange wave 3

Next Higher Degree Direction: Gray wave 3

Details: Gray wave 1 completed; gray wave 2 of orange wave 3 in progress.

Wave Cancel Invalidation Level: 10,289.18

Analysis Overview

The IBEX 35 daily chart showcases a counter-trend movement within the framework of Elliott Wave theory. The focus is on gray wave 2, which operates as a corrective structure nested within the larger orange wave 3. This phase represents a temporary consolidation, setting the stage for the broader market trend.

Wave Dynamics

Higher Degree Wave Outlook

The imminent completion of gray wave 2 signals the market’s preparation for a bullish resurgence in gray wave 3. This phase aligns with the Elliott Wave principle of consolidation preceding trend continuation, emphasizing the market's transition back into upward momentum.

Critical Threshold

The wave cancel invalidation level is set at 10,289.18. A breach below this benchmark would invalidate the current wave count, requiring the reevaluation of the Elliott Wave structure and associated projections.

Conclusion

The IBEX 35 daily analysis reflects a counter-trend corrective phase defined by gray wave 2 following the completion of gray wave 1. This period of consolidation serves as a stepping stone for the anticipated bullish continuation in gray wave 3. The defined invalidation level at 10,289.18 remains pivotal for validating this wave structure and ensuring alignment with Elliott Wave principles.

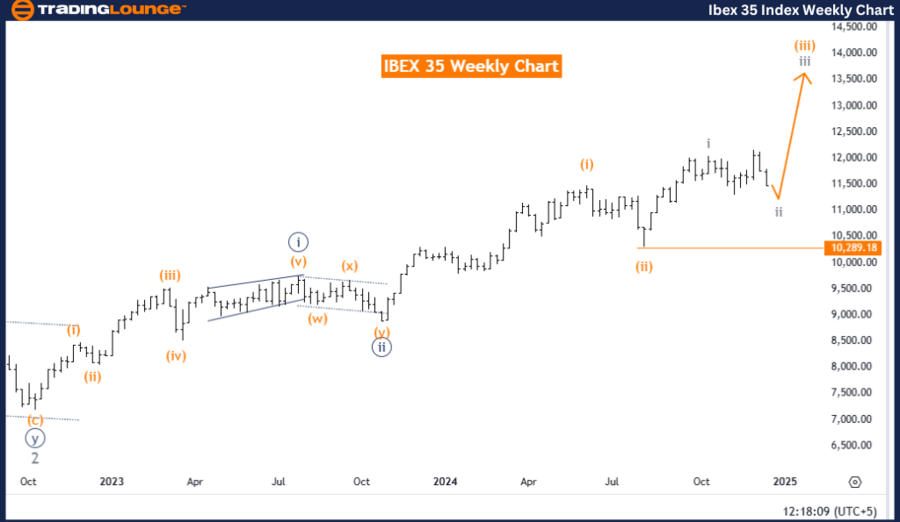

IBEX 35 (Spain) Elliott Wave Analysis - TradingLounge Weekly Chart

IBEX 35 (Spain) Elliott Wave Technical Analysis

IBEX 35 Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray wave 2

Position: Orange wave 3

Next Higher Degree Direction: Gray wave 3

Details: Gray wave 1 completed; gray wave 2 of orange wave 3 in progress.

Wave Cancel Invalidation Level: 10,289.18

Analysis Overview

The weekly chart for IBEX 35 reiterates a corrective counter-trend phase defined by gray wave 2, part of the larger orange wave 3. This temporary pause signals a market retracement as part of the broader Elliott Wave impulsive structure.

Wave Dynamics

Higher Degree Wave Outlook

The next phase, gray wave 3, is projected to reestablish bullish momentum upon the conclusion of gray wave 2. This progression underscores the inherent cyclicality of market trends per Elliott Wave principles.

Critical Threshold

The invalidation level remains pivotal at 10,289.18, serving as a benchmark for reassessing the wave count. Any price movement below this point would necessitate a revised analysis of the current wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: S&P BSE Sensex Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The weekly chart analysis of IBEX 35 outlines a corrective wave (gray wave 2) following the completion of gray wave 1. This phase within the orange wave 3 structure is pivotal for the market's eventual upward movement into gray wave 3. The 10,289.18 invalidation level acts as a critical point for maintaining the integrity of the Elliott Wave analysis and ensuring accuracy in projections.