CSX Corp. (CSX) – Summary Elliott Wave Outlook

This updated Elliott Wave analysis of CSX Corp. examines price structure on the daily and 1-hour timeframes:

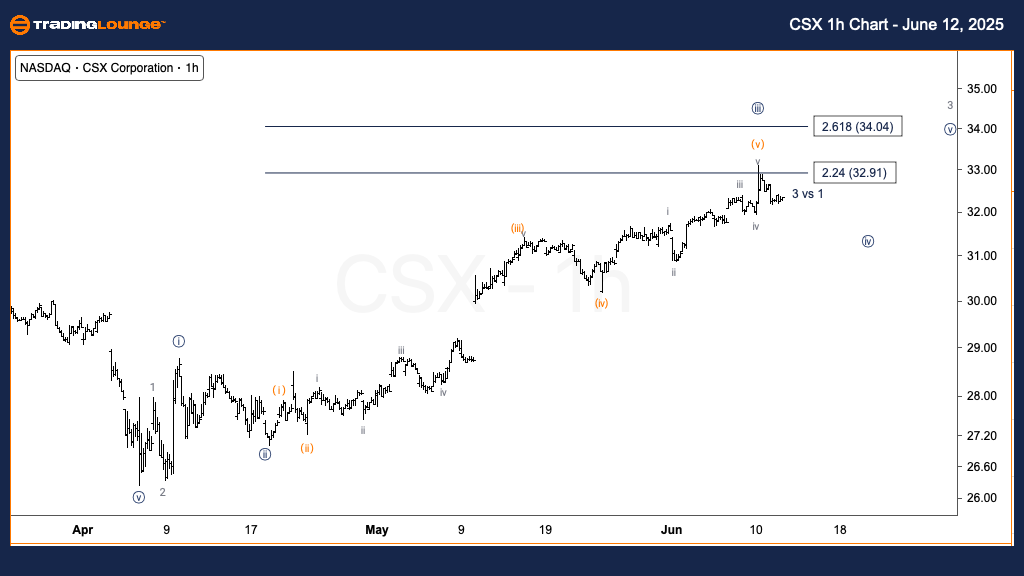

CSX Elliott Wave Analysis – Trading Lounge Daily Chart

CSX Corp. (CSX) – Daily Chart Outlook

CSX Elliott Wave Technical Review

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 3 of (1)

DIRECTION: Bullish Continuation in Wave 3

DETAILS: The stock is forming an impulsive wave pattern from its April bottom, reinforcing the bullish outlook for Minor Wave 3. Wave {iii} may be nearing completion, with an upcoming correction in wave {iv} likely to reach the $30 support zone.

CSX Daily Chart Outlook

CSX stock is trending higher within Minor Wave 3 of Primary Wave (1), beginning from the April low. The ongoing Elliott Wave structure is clearly impulsive. A short-term top in wave {iii} appears imminent, followed by a retracement in wave {iv}. This correction is expected to test the $30 area, creating a possible long entry aligned with the dominant uptrend.

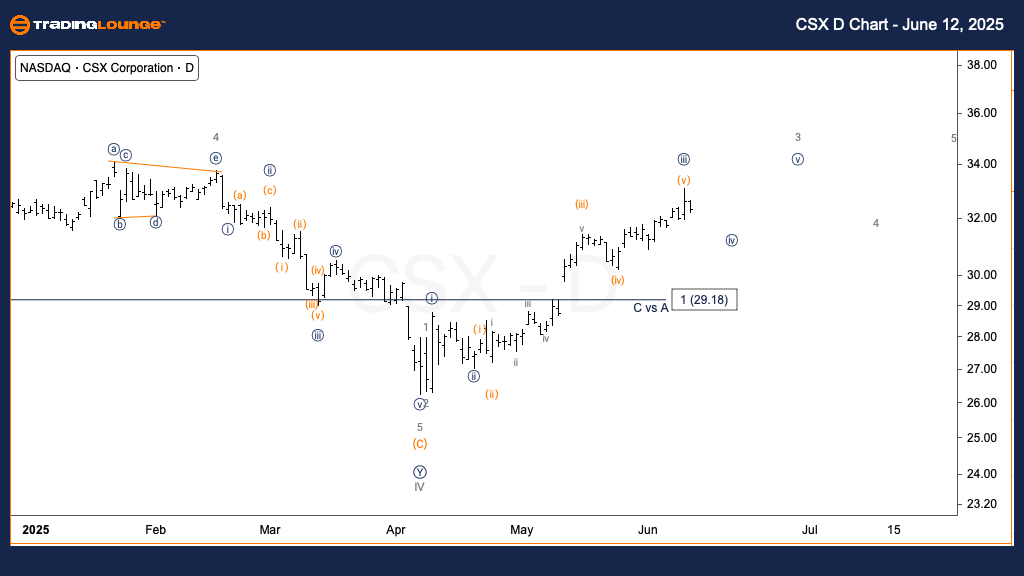

CSX Corp. (CSX) Elliott Wave Outlook – Tradinglounge 1H Chart

CSX Elliott Wave Technical Review

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (v) of {iii}

DIRECTION: Near-Term Top in Wave (v)

DETAILS: Price has reached $33, the top of Minor Group 1 (MG1), suggesting wave (v) of {iii} may be finalized. A downward correction in wave {iv} is now probable, with the $30 level acting as the next support target.

CSX Corp 1-Hour Chart Outlook

In the short-term view, CSX completed a full five-wave advance, peaking at $33 in line with MG1 resistance. This confirms a potential top in wave (v) of {iii}. Attention now shifts to a corrective movement in wave {iv}, with support anticipated around the $30 area, matching typical Fibonacci retracement zones.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Palo Alto Networks Inc. (PANW) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support