PANW Elliott Wave Analysis – TradingLounge Daily Chart

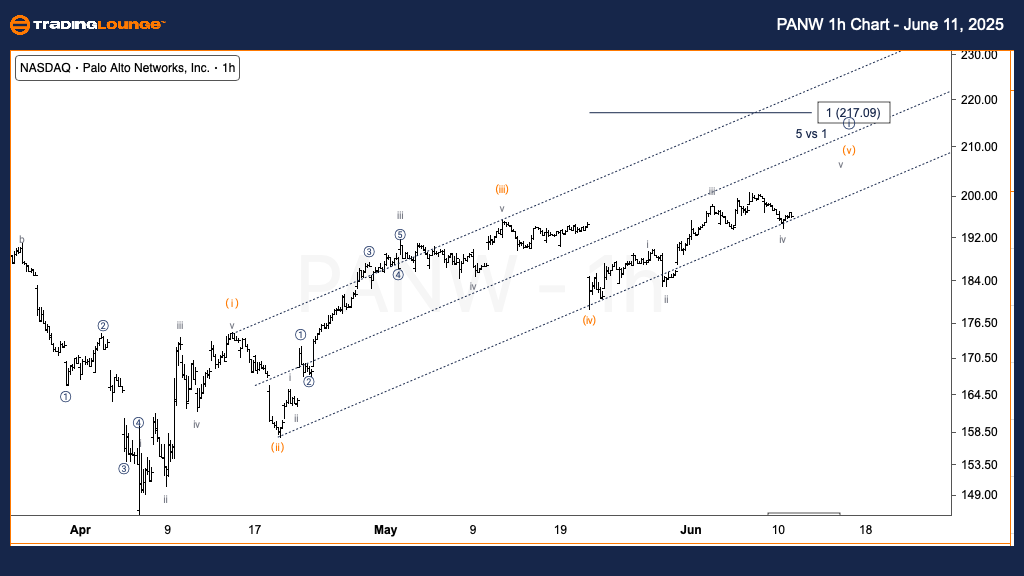

Palo Alto Networks Inc. (PANW) – Daily Chart Analysis

PANW Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave (v) of {i}

DIRECTION: Upward movement toward Wave (v)

DETAILS: PANW stock continues to move higher, progressing into Wave (v) within a larger impulsive structure. The price is approaching a significant resistance zone near the $200 mark, aligned with Trading Level 2. This level is considered a key decision point for potential bullish continuation.

The daily Elliott Wave chart for Palo Alto Networks Inc. (PANW) illustrates a strong upward trend within an impulsive formation, with Wave (v) nearing completion under Minor Wave {i}. The $200 resistance level is technically crucial. A confirmed breakout above this resistance could open the path for extended bullish momentum.

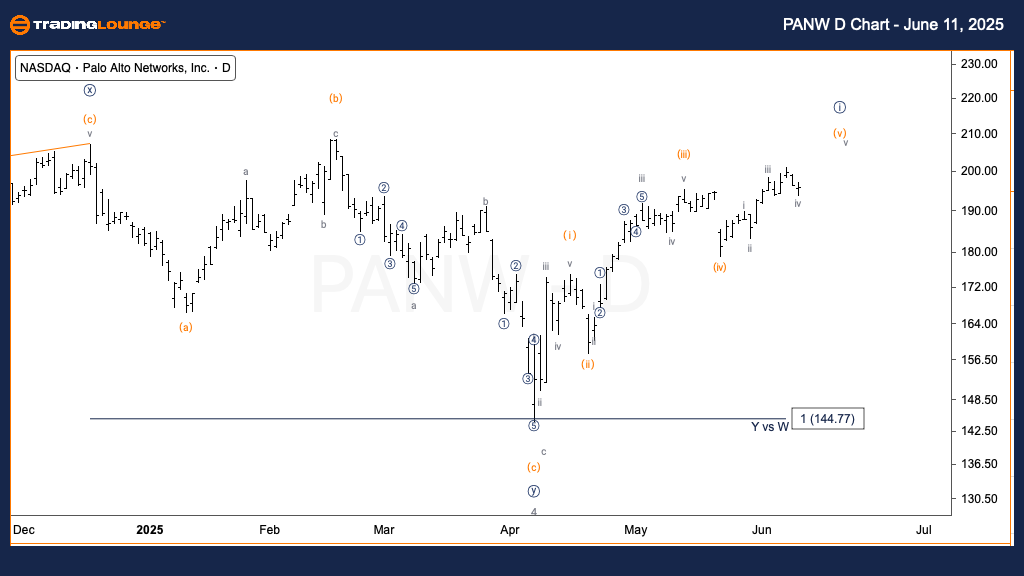

Palo Alto Networks Inc. (PANW) – 1 Hour Chart

PANW Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave v of (v)

DIRECTION: Continuing upward in Wave v

DETAILS: The price has rebounded from the support line of the parallel channel formed by Wave (iv). Currently, PANW is advancing in Wave v, with the immediate target set at $200. If Wave (v) mirrors the length of Wave (i), the next projected resistance lies at $217.

The 1-hour Elliott Wave analysis confirms the bullish trend, supported by a successful retest of channel support. With Wave (v) unfolding, the price action suggests a short-term bullish outlook toward $200. A further extension toward $217 remains a viable scenario if wave symmetry holds, reinforcing the current bullish momentum.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Costco Wholesale Corp. (COST) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support