COST Elliott Wave Analysis – Trading Lounge Daily Chart

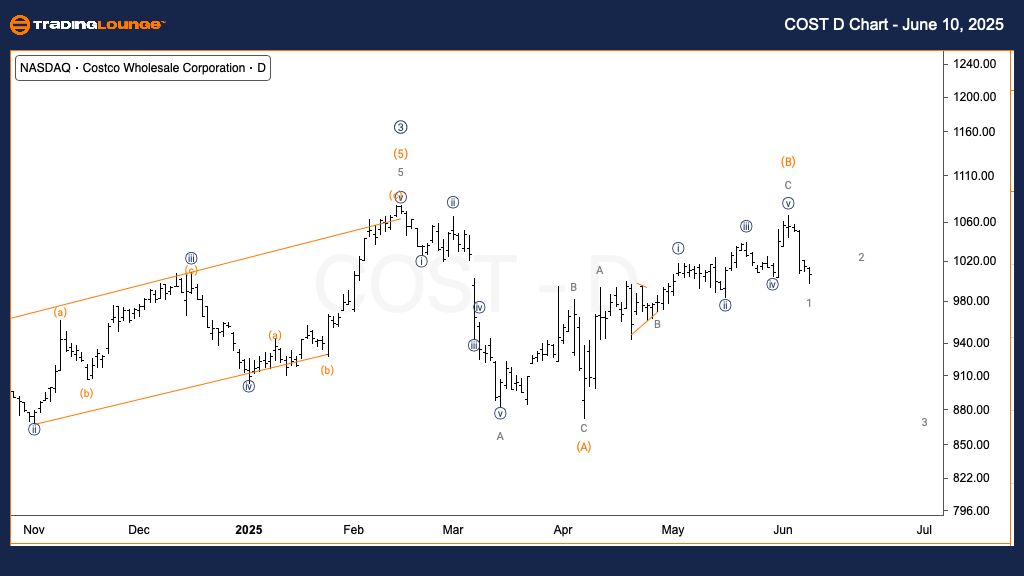

Costco Wholesale Corp. (COST) – Daily Chart Analysis

COST Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave 2 of (C)

DIRECTION: Downside in Wave 2

DETAILS: The Elliott Wave setup for Costco (COST) on the daily chart shows a likely retracement in Wave 2 of (C), following a bounce off the significant $1000 support level. Bearish momentum remains inconclusive unless $1000 flips to resistance after a confirmed retest. A deeper correction in Wave 2 remains probable before initiating any move into Wave 3 of (C).

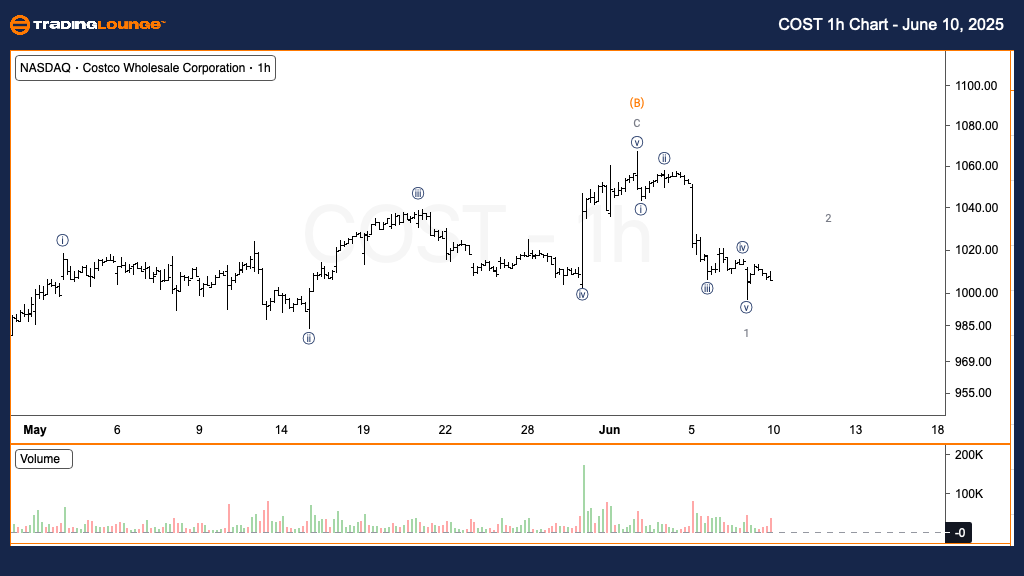

Costco Wholesale Corp. (COST) – 1H Chart

COST Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave {a} of 2

DIRECTION: Upside in Wave 2

DETAILS: The 1-hour COST chart reveals a completed five-wave decline ending Minor Wave 1, signaling the onset of a corrective phase. The current upward move marks the progression of Wave {a} within Wave 2. Once Wave 2 concludes, anticipate the start of another downward five-wave impulsive leg.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Amazon.com Inc. (AMZN) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Combined Technical Summary:

This Elliott Wave analysis combines insights from both the daily and intraday charts of Costco Wholesale Corp. (COST) to provide a clearer market perspective:

Daily Chart: Indicates a corrective Wave 2 of (C) retracement following a bounce at the key $1000 level.

1H Chart: Highlights the formation of a corrective rally in Wave {a} of 2 after a completed five-wave decline into Minor Wave 1.