WTI Crude Oil Commodity Elliott Wave Analysis

WTI Elliott Wave Technical Analysis

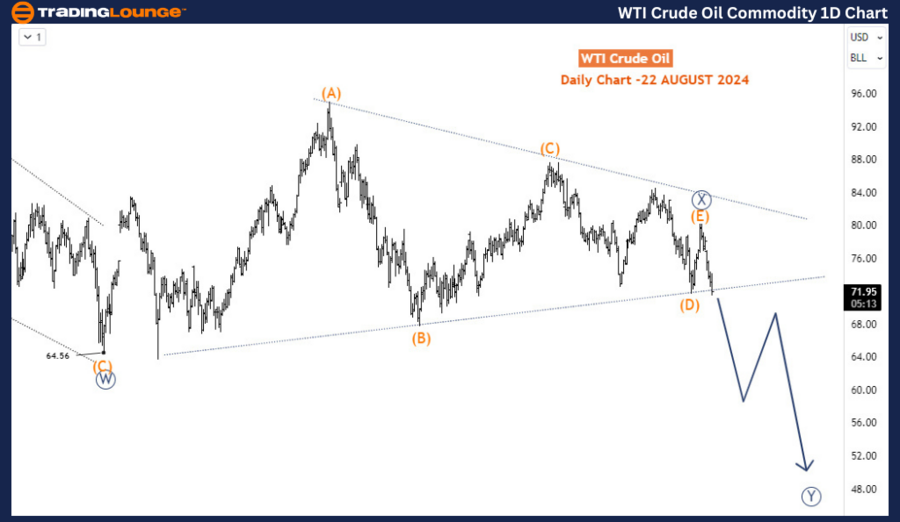

WTI Crude Oil is breaking out of a long-standing range that has persisted for over a year, indicating potential further declines in the upcoming weeks. After a swift recovery between August 5th and 13th, the commodity quickly lost those gains within a single week. Although currently trading above the $70 level, bearish momentum suggests a move into the $60 range may be imminent.

WTI Crude Oil Commodity Daily Chart Analysis

On the daily chart, WTI Crude remains in a corrective phase, retracing the significant bullish move observed between April 2020 and March 2022. This correction is taking shape as a complex double zigzag pattern, identified as waves W-X-Y of the primary degree. The initial leg of the correction, wave W (circled), concluded in March 2023, displaying a classic zigzag structure. This was followed by a sideways consolidation, characterized by a triangle pattern, forming wave X (circled) of the primary degree.

With the recent breakdown below the triangle boundary, the market appears to be initiating wave A of (W) within the final leg of the Y wave (circled). This suggests that the bearish trend is strengthening, with further declines likely as the market moves deeper into this corrective phase.

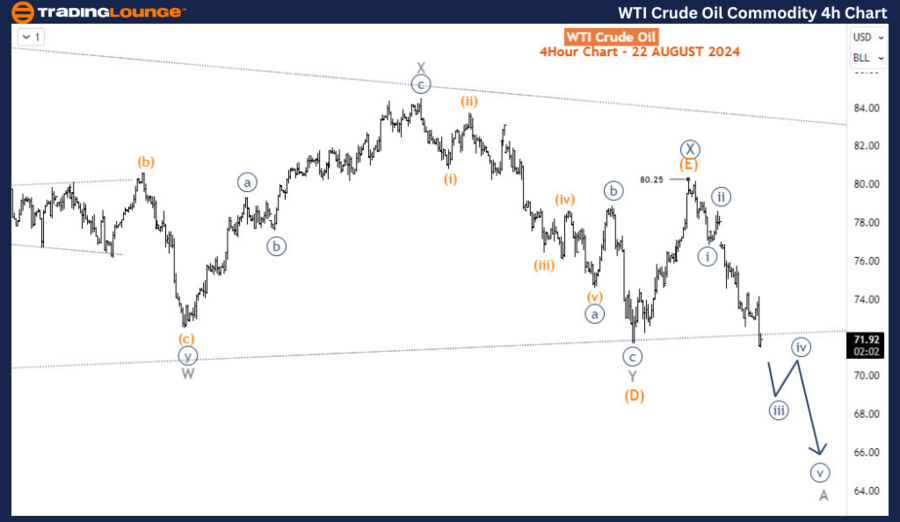

Commodity WTI Crude Oil H4 Chart Analysis

Zooming into the 4-hour chart, the current downtrend is unfolding as an impulse wave, particularly in the third wave of the sequence, labeled as wave iii (circled) of A. This indicates that the decline is not yet complete, and prices are likely to drop below $70 before wave A finalizes. Once this leg concludes, a corrective wave B bounce is anticipated, which should be capped below the resistance at $80.25. This will pave the way for a final decline in wave C, completing the current bearish cycle.

Overall, WTI Crude remains aligned with the broader downtrend that began in March 2022, with the technical structure supporting a bearish outlook. As the market completes the corrective double zigzag pattern, lower prices remain the primary expectation in the medium term, especially if wave iii (circled) continues its downward trajectory. Traders should stay cautious of potential bearish setups, as any corrective bounces are likely to be short-lived and capped by key resistance levels.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Coffee Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support