TreadingLounge Corn Commodity Elliott Wave Analysis

Corn Elliott Wave Technical Analysis

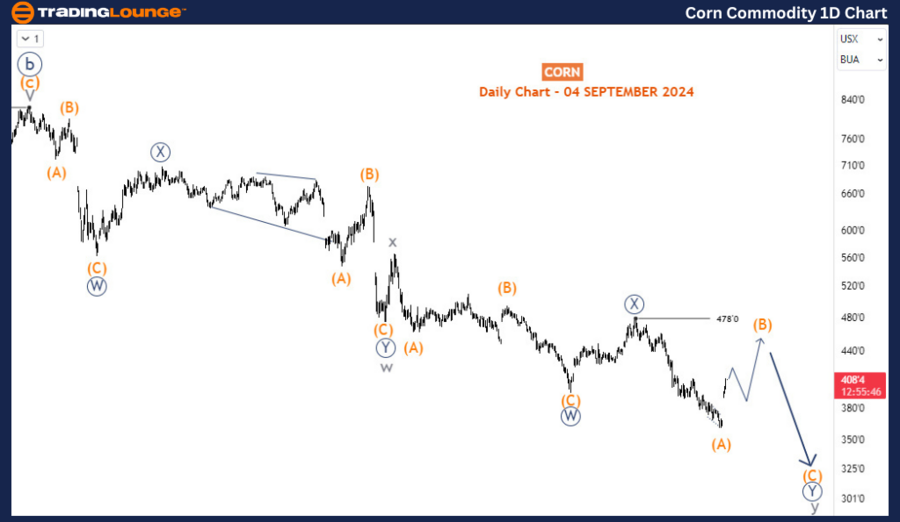

Corn prices have surged over 13% since the low on August 26th, following a correction after the August 28th contract shift. Despite this recent rise, the long-term outlook remains bearish, especially if the recovery fails to breach the key $478 resistance level.

Corn Daily Chart Analysis:

The ongoing bearish trend in corn prices began in April 2022. However, the downward movement appears to be corrective rather than impulsive. Unless an impulsive recovery develops, the current bounce is expected to be temporary, with a likely continuation of the decline. The structure from the April 2022 high resembles a double zigzag pattern at the cycle degree. The drop from the $478 level seems to be an impulse wave, likely forming wave (A) of Y (circled) within the cycle degree wave y. The current recovery is labeled as wave (B) of Y (circled), and it is expected to conclude below $478 to maintain the present Elliott Wave count. In any case, the bounce is anticipated to extend higher in the short term, supported by H4 chart analysis.

Corn H4 Chart Analysis:

On the H4 chart, the recent rally in corn prices is forming an impulse wave sequence, likely representing wave A of (B). After this wave, a pullback for wave B is expected, followed by another rally to complete wave C of (B). While the short-term outlook favors a corrective bounce, the broader bearish corrective sequence remains incomplete, suggesting the long-term downward trend can resume from the top of (B).

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support