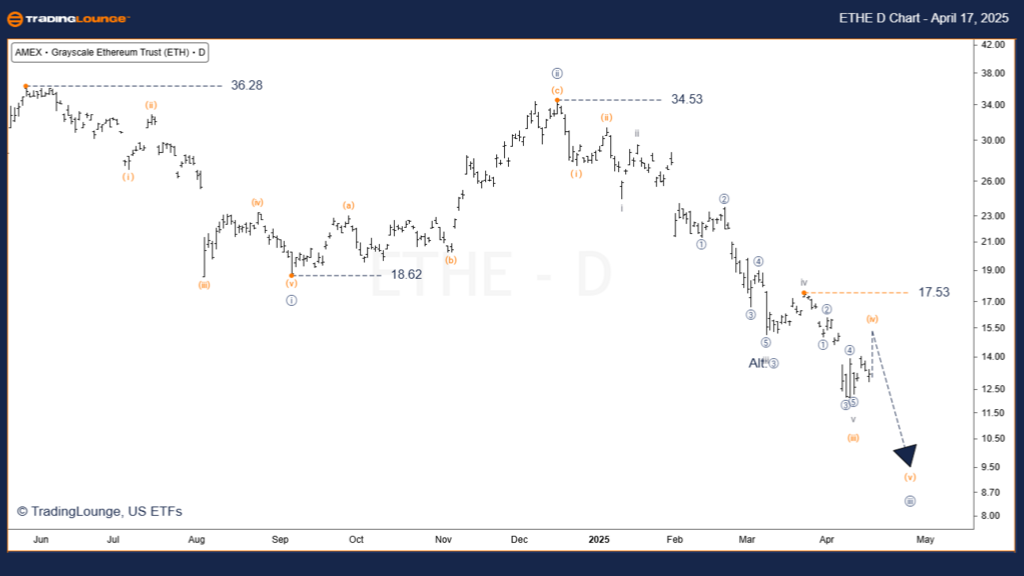

Grayscale Ethereum Trust ETF – ETHE Elliott Wave Analysis - TradingLounge Daily Chart

Grayscale Ethereum Trust ETF Daily Chart Analysis

ETHE ETF Elliott Wave Technical Analysis

Function: Identifying the major trend

Mode: Motive

Structure: Impulse

Position: Wave [iii]

Direction: Downtrend

Details:

The Grayscale Ethereum Trust (ETHE) is in a clear downtrend, progressing through wave [iii] of a motive impulse. Fibonacci targets for wave (iii) of [iii] have now been reached, confirming the structure's strength.

Wave [iii] is currently unfolding in its final leg, as wave (iv) correction develops. This wave (iv) is expected to conclude within the next week, setting the stage for wave (v) to resume the downward impulse.

Invalidation Level: $22.00

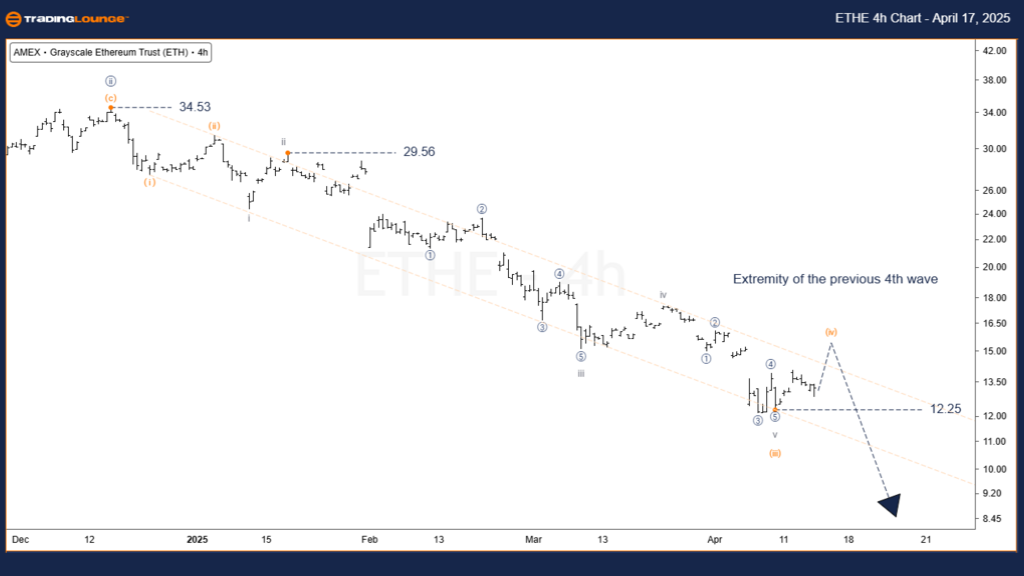

Grayscale Ethereum Trust ETF – ETHE (4H) Elliott Wave Technical Analysis Hourly Chart

Function: Tracking minor trends

Mode: Motive

Structure: Impulse

Position: Wave (iii) in orange

Direction: Downtrend

Details:

On the 4-hour chart, ETHE has begun a wave (iv) correction. Price is expected to consolidate near the previous wave 4 area of a lower degree, consistent with typical Elliott Wave guidelines.

Given the shallow nature of wave (ii), wave (iv) is also expected to be limited in depth. A price move above $14.97 would invalidate the current wave structure, suggesting that wave (iv) could already be underway or wave (v) is delayed.

Invalidation Level: $22.00

Technical Analyst: Simon Brooks

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: VanEck Rare Earth & Strategic Metals ETF – REMX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ETHE has entered wave (iv), offering a potential short trade opportunity as wave (v) approaches.

The next decline could extend by at least $5 from current levels. While the Elliott Wave count remains intact up to $22.00, alternate scenarios will be reassessed if this level is breached.

Traders should remain alert and ready, using wave theory and key invalidation points to manage risk and time their entries effectively.