ASX: Fisher & Paykel Healthcare Corporation Limited – FPH Elliott Wave Technical Analysis

Introduction

Welcome to our Elliott Wave analysis for the Australian Stock Exchange (ASX) Fisher & Paykel Healthcare Corporation Limited – FPH. Our latest insights suggest ASX:FPH is nearing the completion of a wave 4 Triangle pattern, setting the stage for a potential rally with wave 5. This technical analysis highlights key price levels and market movements to help you navigate the upcoming trends effectively.

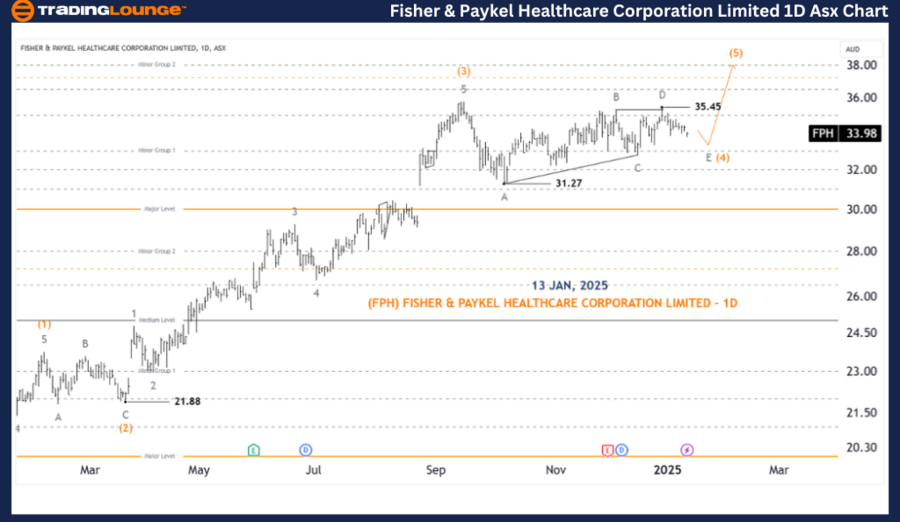

ASX: Fisher & Paykel Healthcare Corporation Limited – FPH 1D Chart Analysis(Semilog Scale)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (4)-orange

Analysis Details:

- The wave count has been adjusted for higher probability.

- Wave (4)-orange is likely forming a Triangle, requiring additional time to complete.

- Upon completion, wave (5)-orange is expected to push higher.

- A breakout above 35.45 would signal the beginning of the wave (5)-orange move.

Key Price Levels:

- Invalidation Point: The end of wave A-grey

- Confirmation Point: 35.45

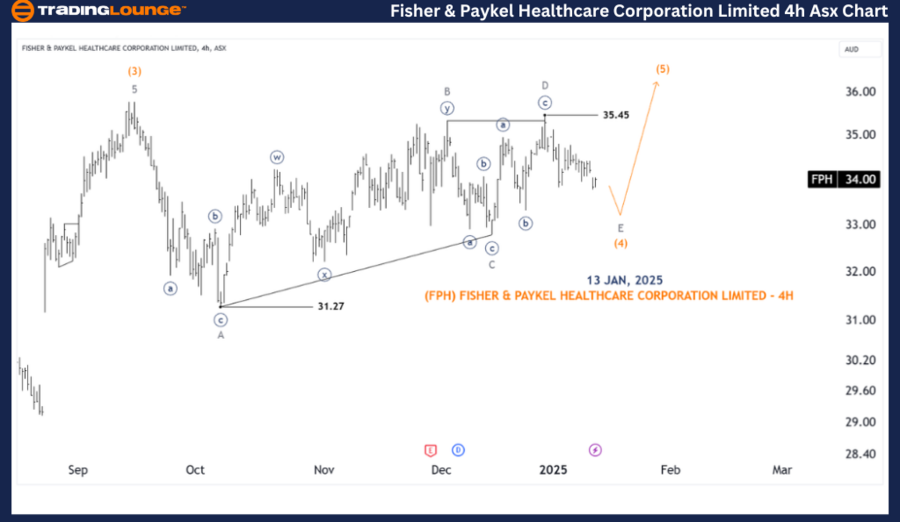

ASX: Fisher & Paykel Healthcare Corporation Limited – FPH 4-Hour Chart Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave E-grey of Wave (4)-orange

Analysis Details:

- The 4-hour chart provides a detailed look at the wave (4)-orange Triangle.

- This phase is nearing completion, signaling a likely transition to wave (5)-orange.

- A confirmed push above 35.45 would strengthen this bullish view.

- Conversely, failure to breach 35.45 and a breakdown below wave C-grey would invalidate the bullish scenario.

Key Price Levels:

- Invalidation Point: The end of wave C-grey

- Confirmation Point: 35.45

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Northern Star Resources Ltd – NST Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for ASX: FPH provides insights into both the short-term and long-term trends. By identifying specific price points as validation or invalidation signals, we enhance the reliability of our wave count. Investors and traders can utilize this professional analysis to better anticipate market movements and capitalize on potential opportunities.