AMCOR PLC – AMC Elliott Wave Technical Analysis | TradingLounge Review

Greetings,

Today's Elliott Wave analysis of AMCOR PLC (ASX:AMC) highlights a strong bullish trend. Our technical review identifies the initiation of a potential third impulse wave, signaling further upside potential. This report outlines key target price levels and the crucial invalidation point to assess the reliability of this forecast.

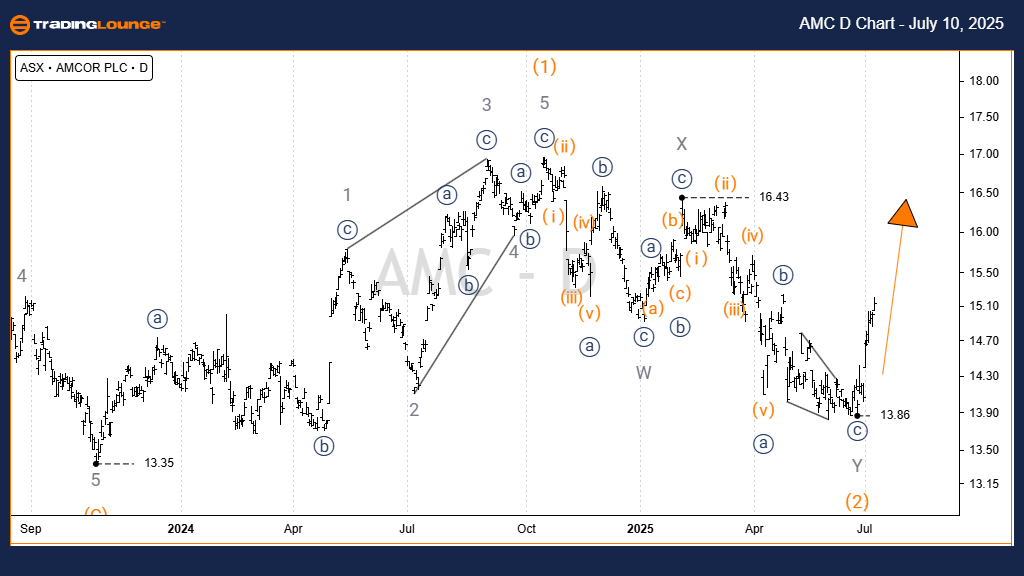

AMCOR PLC – AMC Daily Chart (1D) – Semilogarithmic Analysis

Function: Intermediate Trend Direction (Orange Degree)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave 3) – Orange

Key Insights:

- Wave 3) – orange appears to be developing from the 13.35 support level.

- Within this wave, sub-wave 3)) – navy is extending with completed wave 1),2) – orange components.

- The rally from 13.82 low supports an upward trajectory toward the 17.56–20.37 target range.

- Sustaining above 13.82 is critical to confirm momentum toward wave 5)) – navy.

Invalidation Level: 13.86

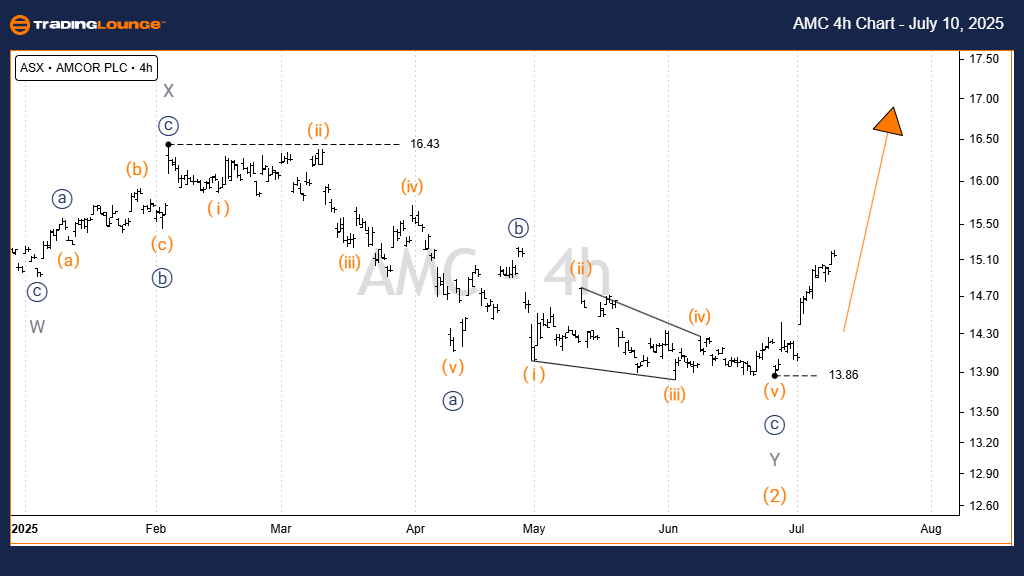

AMCOR PLC – AMC 4-Hour Chart Technical Analysis

Function: Intermediate Trend Confirmation (Orange Degree)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave 3) – Orange

Technical Observations:

- The uptrend remains active as AMC approaches the 16.43 resistance zone.

- Price continuation above 13.86 is essential to validate this bullish structure.

Invalidation Level: 13.86

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED – MIN Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for AMCOR PLC (AMC) presents a technically grounded outlook for both long-term and short-term price action. Critical validation levels and price targets enhance confidence in this wave count. Our structured analysis supports traders with an informed and professional assessment of AMC stock's technical positioning.