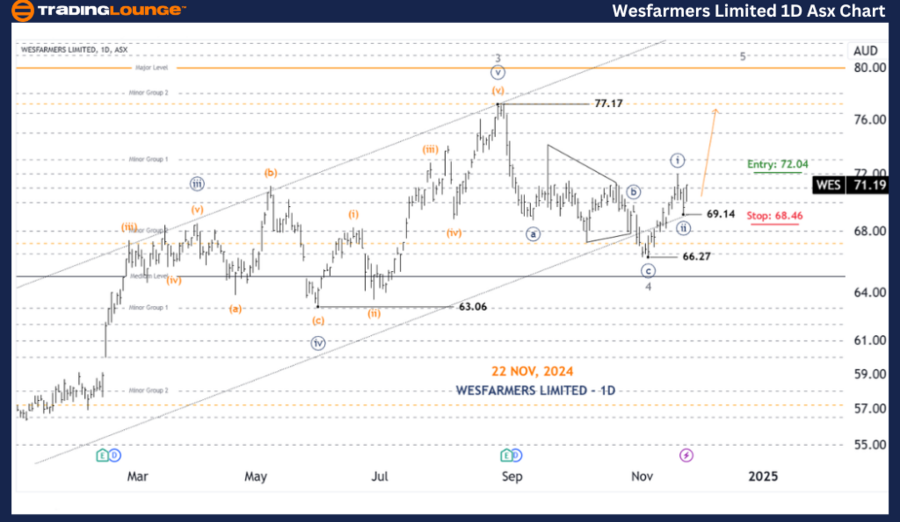

Wesfarmers Limited – WES Elliott Wave Analysis TradingLounge 1D Chart

ASX: WES Elliott Wave Analysis Update

Our Elliott Wave analysis for WESFARMERS LIMITED (ASX: WES) highlights the potential for a continued upward push in a ((iii))-navy wave. Below is a detailed breakdown of the technical analysis.

ASX: WESFARMERS LIMITED – WES 1D Chart Analysis (Semilog Scale)

WES Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave 5-grey of Wave (3)-orange

Key Details: Wave 4-grey concluded at 66.27, with Wave 5-grey now unfolding to move significantly higher.

Target Zone: 77.17 - 80.00

Invalidation Point: 69.14

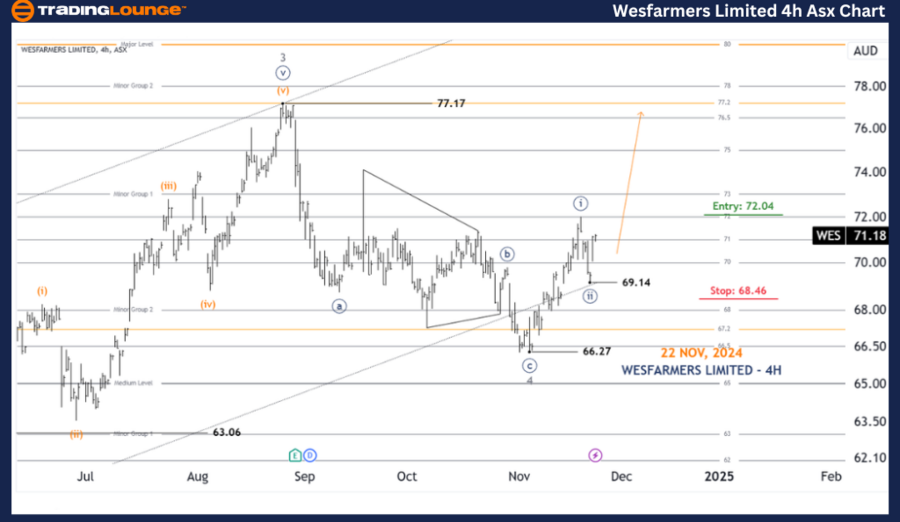

ASX: WESFARMERS LIMITED – WES 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 5-grey

Key Details:

- Following the low at 66.27, Wave 5-grey is advancing and subdividing further.

- Subdivisions of Wave 5-grey include Wave ((i)) and ((ii))-navy, which have likely concluded.

- Wave ((iii))-navy is now in progress and heading toward the targets identified in the 1D chart analysis.

Critical Support: Price must remain above 69.14 to sustain this wave structure and bullish outlook.

Invalidation Point: 69.14

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis provides a comprehensive forecast and identifies critical levels for ASX: WESFARMERS LIMITED – WES.

- Key Targets: Our projections for Wave 5-grey point to 77.17 - 80.00, contingent on the price holding above the invalidation level at 69.14.

- Trading Strategy: By focusing on the Elliott Wave structure and key price points, traders can enhance decision-making with clear validation and invalidation signals.

Through this approach, our goal is to empower traders with professional and actionable insights into market trends and price movements.