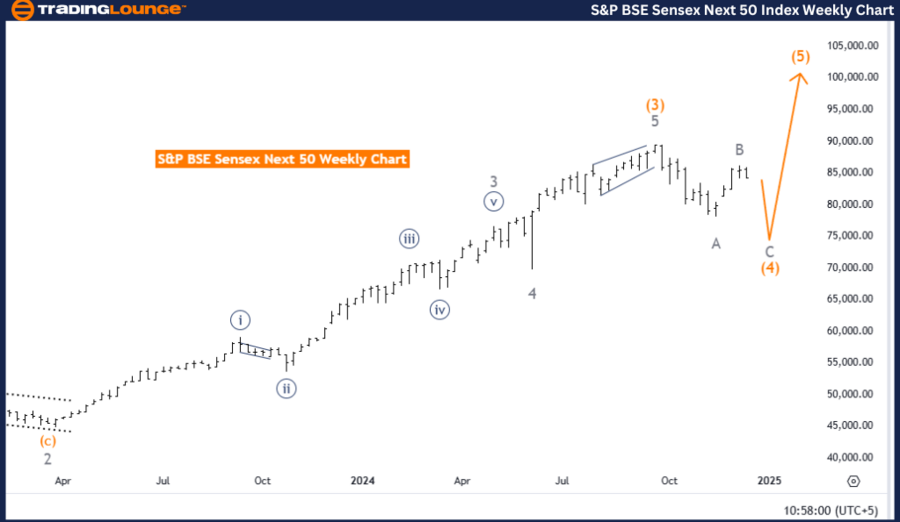

S&P BSE Sensex (INDIA) Elliott Wave Analysis - Trading Lounge Day Chart

S&P BSE Sensex (INDIA) Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 4

Direction Next Higher Degrees: Orange Wave 5

Details: Gray wave B of orange wave 4 is considered complete. Currently, gray wave C of orange wave 4 is in progress.

Wave Cancel Invalid Level: 89,555.31

The daily Elliott Wave analysis for the S&P BSE Sensex highlights a counter-trend phase following the Elliott Wave theory. The ongoing wave structure is impulsive, with gray wave C currently unfolding as part of orange wave 4. This progression signals the continuation of a corrective trend phase.

- Gray Wave B: Completed, marking the end of the previous corrective phase.

- Gray Wave C: Actively developing, signaling the market's progression within orange wave 4.

Once gray wave C concludes, the market is expected to transition into orange wave 5, resuming the dominant trend. This phase is integral to the cyclical progression typical of Elliott Wave patterns.

The wave cancel invalid level, set at 89,555.31, is a critical benchmark. A breach above this level would invalidate the current Elliott Wave count for gray wave C of orange wave 4, prompting a reassessment of the analysis. This invalidation point is essential for monitoring risk and maintaining analytical accuracy.

Summary

The S&P BSE Sensex daily chart analysis reveals the following key points:

- Gray wave B has been completed.

- Gray wave C is actively developing within orange wave 4.

This counter-trend phase temporarily diverges from the dominant trend but sets the stage for a return to the primary wave structure with orange wave 5. The invalidation level of 89,555.31 serves as a vital reference for evaluating market dynamics.

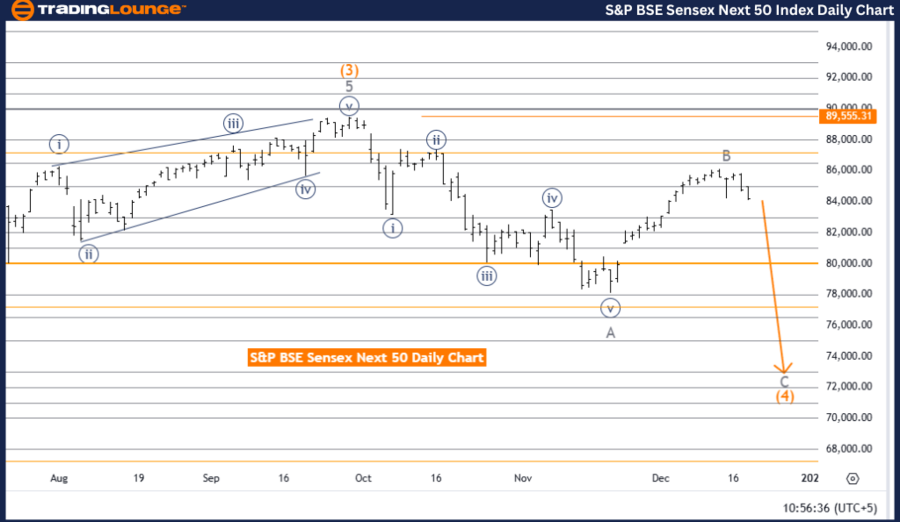

S&P BSE Sensex (INDIA) Elliott Wave Analysis - Trading Lounge Weekly Chart

S&P BSE Sensex (INDIA) Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 4

Direction Next Higher Degrees: Orange Wave 5

Details: Gray wave B of orange wave 4 is complete. Currently, gray wave C of orange wave 4 is in progress.

The weekly analysis of the S&P BSE Sensex focuses on a counter-trend movement within the Elliott Wave framework. The ongoing structure is impulsive, with gray wave C progressing as part of the corrective wave in orange wave 4.

- Gray Wave B: Completed, marking the end of the prior corrective phase.

- Gray Wave C: Developing further within orange wave 4 and nearing completion.

Upon the conclusion of gray wave C, the market is expected to transition into orange wave 5, aligning with the broader trend. This phase reflects the cyclical nature of market behavior, where corrective waves are followed by a resumption of the dominant trend.

Summary

The S&P BSE Sensex weekly chart analysis highlights:

- Completion of gray wave B.

- Active development of gray wave C within orange wave 4.

This corrective phase, while diverging from the dominant trend, is expected to finalize before transitioning into orange wave 5. This transition will mark the resumption of the broader trend and align with the primary Elliott Wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NIKKEI 225 (N225) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support