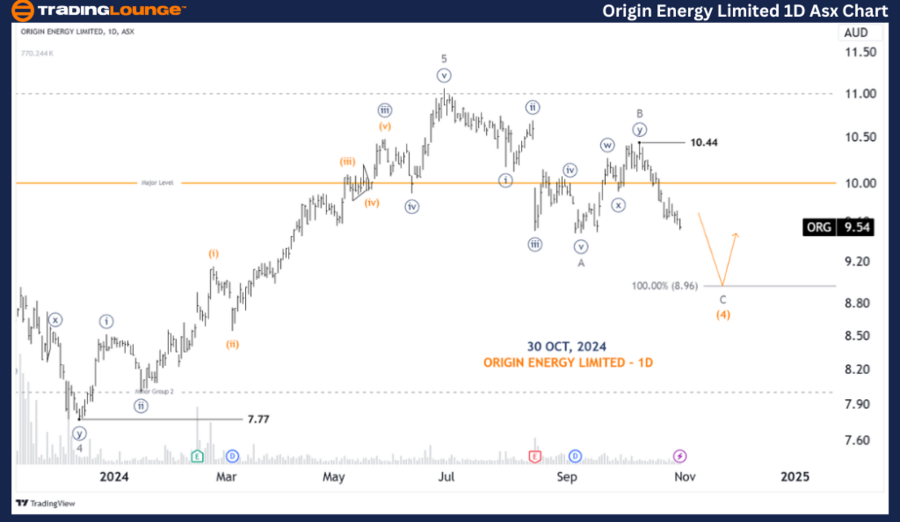

ASX: Origin Energy Limited – ORG Elliott Wave Analysis (1D Chart)

Welcome to today's Elliott Wave analysis for Origin Energy Limited (ASX: ORG). Based on our technical review, ORG.ASX is showing continued downward movement. Upon completing the current corrective wave, we anticipate wave (5)-orange may drive an upward reversal.

ASX: Origin Energy Limited – ORG 1D Chart (Semilog Scale) Analysis

ORG Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave C-grey of Wave (4)-orange

Analysis Details:

Wave 4-grey is progressing in a pronounced Zigzag pattern, identified by its A, B, and C-grey labels. Both wave A-grey and wave B-grey are complete, leaving wave C-grey to extend downward, targeting a projected low of approximately 8.96.

Invalidation Point: 10.44

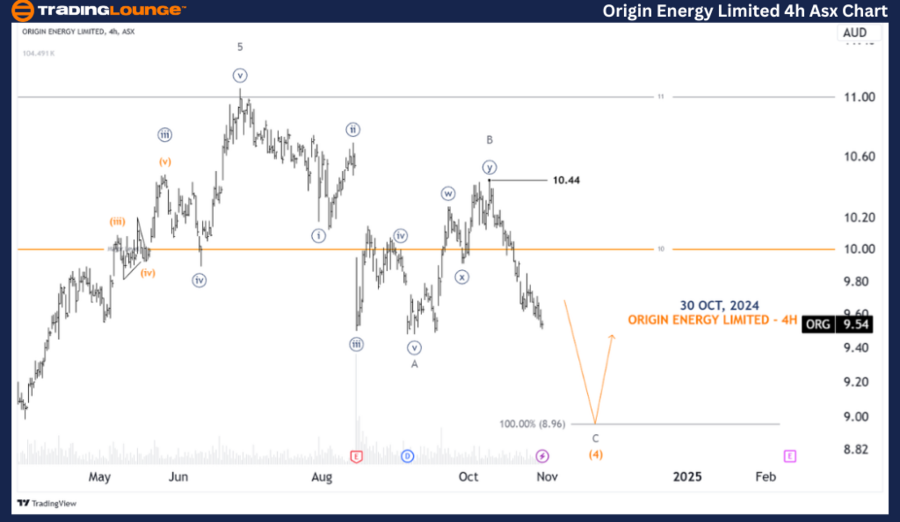

ASX: Origin Energy Limited – ORG 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave C-grey of Wave (4)-orange

Detailed Analysis:

Wave 4-grey remains in a steep Zigzag pattern, marked by the sequence A, B, and C-grey. With the completion of waves A-grey and B-grey, wave C-grey is anticipated to push lower towards 8.96, signaling the final phase for wave (4)-orange around this price zone. Following this, wave (5)-orange may emerge with upward momentum. Once support establishes around the Major Level at 100.00, we anticipate a quality long trade opportunity.

Invalidation Point: 10.44

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JAMES HARDIE INDUSTRIES PLC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis of ASX: Origin Energy Limited – ORG provides a strategic overview, indicating the current corrective wave’s influence on ORG’s price movements. We highlight specific price levels as validation and invalidation points, helping traders align with potential market shifts confidently. This approach aims to deliver an objective perspective on Origin Energy’s short-term and long-term market trends for effective trading strategies.