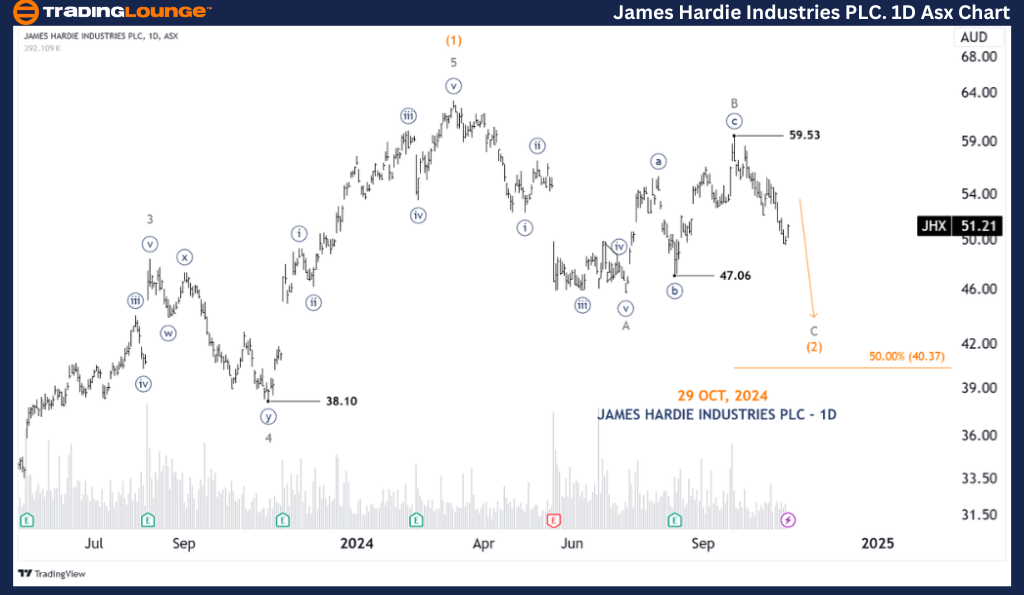

ASX: JAMES HARDIE INDUSTRIES PLC - JHX Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings! Our updated Elliott Wave analysis on JAMES HARDIE INDUSTRIES PLC (JHX) for the Australian Stock Exchange (ASX) suggests a continued potential for downward movement. We anticipate the ((3))-navy wave may resume with momentum to the upside in the future.

ASX: JAMES HARDIE INDUSTRIES PLC - JHX 1D Chart (Semilog Scale) Analysis

JHX Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave c-grey of Wave (2)-orange

Details: With the completion of the B-grey wave, the unfolding C-grey wave indicates a push downward. We target a potential move down to around 40.37.

Invalidation Point: 59.53

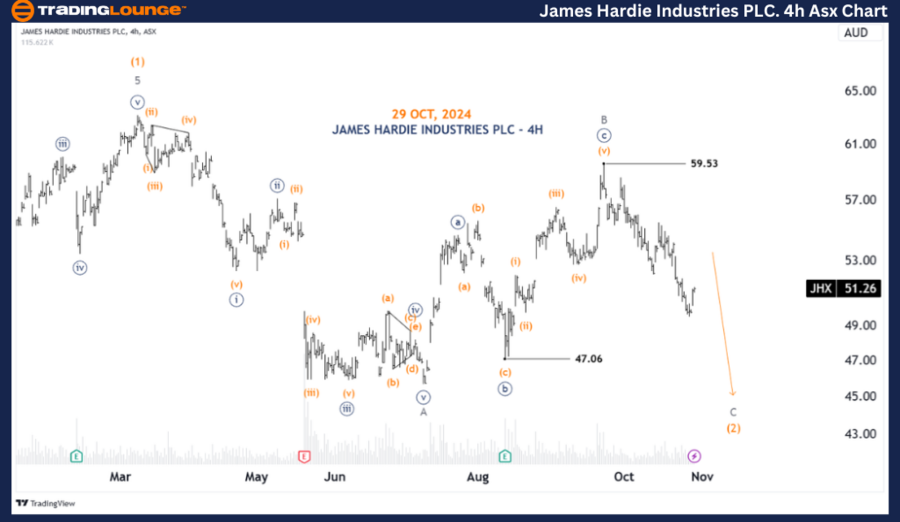

ASX: JAMES HARDIE INDUSTRIES PLC - JHX 4-Hour Chart Analysis

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C-grey of Wave (2)-orange

Details: Since reaching the high near 59.53, the C-grey wave continues to show potential for further downward movement, targeting levels like 47.06 or below. To maintain this wave count, price must remain below 59.53. A movement above this level would suggest that the (3)-orange wave could regain momentum to the upside.

Invalidation Point: 59.53

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: RIO TINTO LIMITED – RIO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis of ASX: JAMES HARDIE INDUSTRIES PLC - JHX provides a technical perspective on current market trends and potential investment opportunities. We highlight key validation and invalidation levels to help build confidence in our wave count. By integrating these insights, we aim to provide readers with a clear and professional approach to identifying market trends and navigating potential price movements effectively.