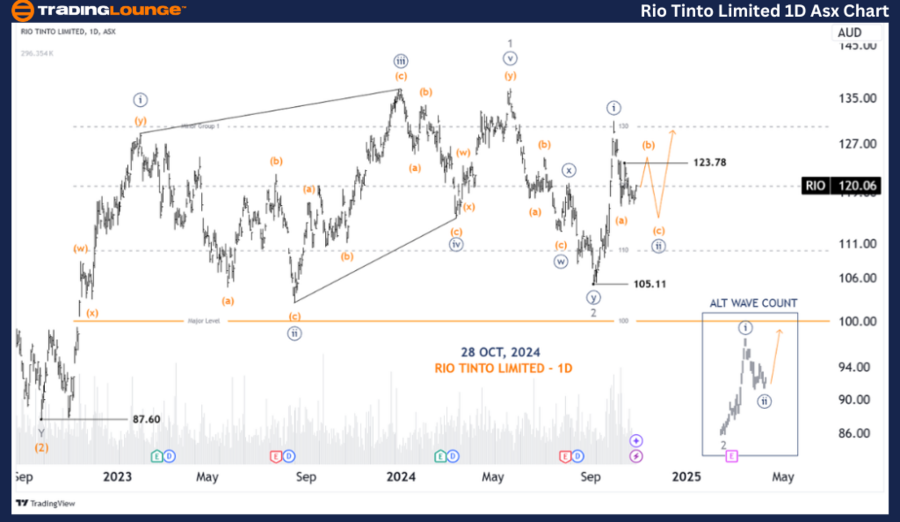

ASX: RIO TINTO LIMITED - RIO Elliott Wave Analysis - TradingLounge (1D Chart)

Our latest Elliott Wave analysis covers RIO TINTO LIMITED (ASX: RIO) on the Australian Stock Exchange. Currently, we anticipate a potential rally for RIO, likely within wave ((iii))-navy, though not immediately. We expect wave ((ii))-navy to push slightly lower before any upward move.

ASX: RIO TINTO LIMITED - RIO 1D Chart (Semilog Scale) Analysis

RIO Elliott Wave Technical Analysis

Trend Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy of Wave 3-grey

Analysis: We expect wave ((ii))-navy to complete a final leg down, finalizing its Zigzag pattern. Following this, wave ((iii))-navy may see an upward movement. Alternatively, if wave ((ii))-navy has ended, then wave ((iii))-navy could already be underway. For this alternative to confirm, prices must surpass the 123.78 level significantly and swiftly.

Invalidation Point: 105.11

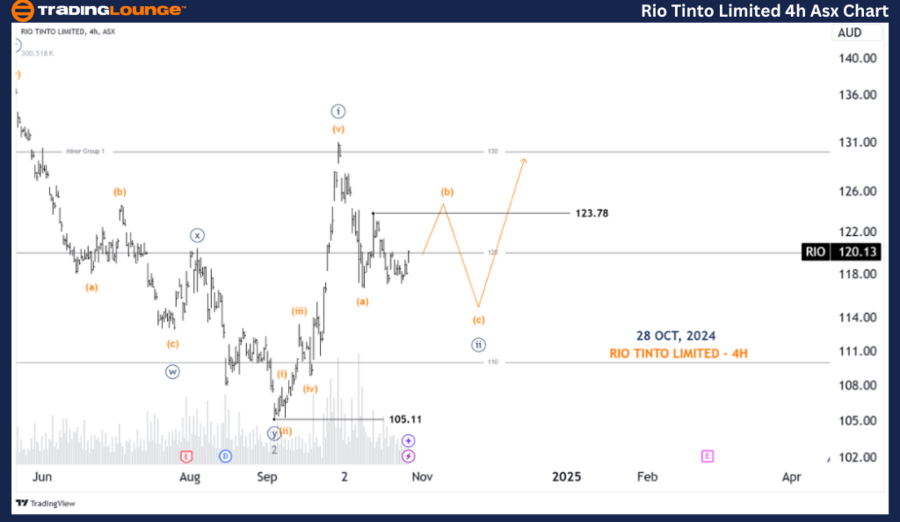

ASX: RIO TINTO LIMITED - RIO 4-Hour Chart Analysis

Trend Function: Major trend (Minuette degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (b)-orange of Wave ((ii))-navy

Analysis: Wave ((ii))-navy appears to be continuing downward in a Zigzag pattern (a), (b), (c)-orange. We expect a small upward push to finalize wave (b)-orange before wave (c)-orange resumes the downward trend, completing the entire wave ((ii))-navy.

Invalidation Point: 105.11

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: FORTESCUE LTD – FMG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis and forecast provide an informed perspective on ASX: RIO TINTO LIMITED (RIO), detailing current trends and price targets that may validate or invalidate our Elliott Wave count. These strategic price levels aim to empower readers with an objective, professional outlook on market movements.