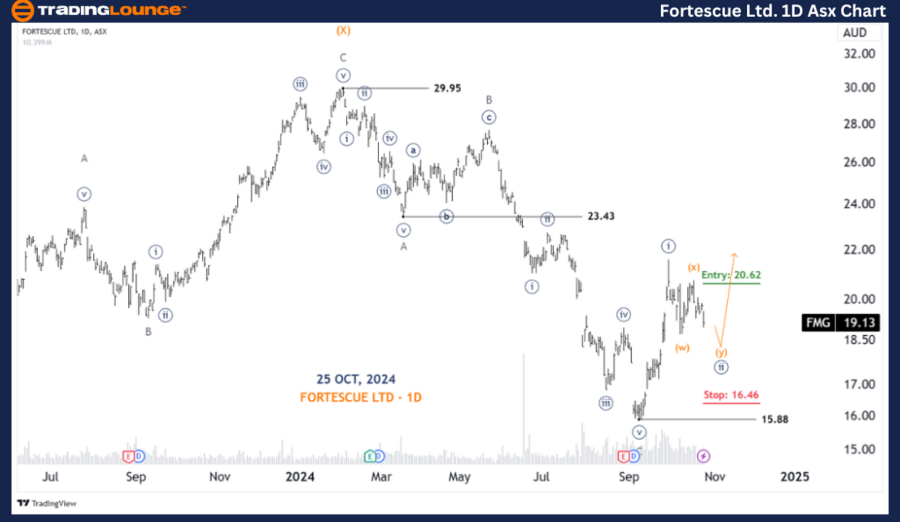

ASX: FORTESCUE LTD – FMG Elliott Wave Analysis | TradingLounge (1D Chart)

Welcome to our Elliott Wave analysis update for the Australian Stock Exchange (ASX), focusing on FORTESCUE LTD (FMG). Our assessment suggests FMG.ASX may be on the verge of entering a bullish wave ((iii))-navy.

ASX: FORTESCUE LTD – FMG 1D Chart (Semilog Scale) Analysis

FMG Elliott Wave Technical Analysis

Trend Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy

Wave Details: The current wave ((ii))-navy is extending longer and moving downward more than initially anticipated. A potential rebound in wave ((iii))-navy could increase the price. Our designated stop level remains secure for now.

Invalidation Point: 15.88

ASX: FORTESCUE LTD – FMG 4-Hour Chart Analysis

Trend Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave c-grey of Wave (y)-orange of Wave ((ii))-navy

Wave Details: Since reaching the low at 15.88, wave ((i))-navy completed as a five-wave pattern, while wave ((ii))-navy is moving downward, developing as a Double Zigzag. It appears that wave (w),(x)-orange has completed, and wave (y)-orange will likely continue to push lower. With the stop positioned at 16.46, we expect it to hold steady.

Invalidation Point: 15.88

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: LIGHT & WONDER INC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for ASX: FORTESCUE LTD – FMG highlights both the broader market context and short-term trends to assist readers in leveraging current patterns for informed decision-making. We have identified key price points serving as validation or invalidation markers, increasing the confidence in our market outlook. By combining these components, we aim to offer a balanced and professional view on the emerging market trends for FMG.