Analysis of Berkshire Hathaway Inc. (BRK.B) Using Elliott Wave Theory: Daily and 1-Hour Chart Insights

This article provides an in-depth analysis of Berkshire Hathaway Inc. (BRK.B) by applying the Elliott Wave Theory to evaluate current trends and predict future price action. We focus on the daily and 1-hour charts to offer a comprehensive overview.

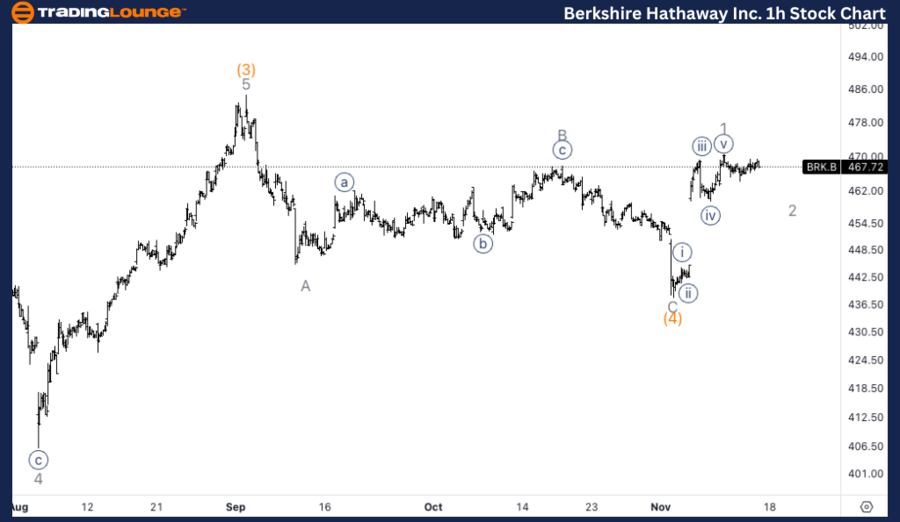

BRK.B Elliott Wave Analysis - TradingLOunge Daily Chart

Berkshire Hathaway Inc. (BRK.B) Daily Chart Analysis

BRK.B Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (5)

Direction: Upside in wave (5)

Details:

Berkshire Hathaway (BRK.B) appears to have concluded a corrective wave (4), which was likely a three-wave move. The price is now targeting an upward progression in wave (5) and is currently positioned just below the critical TradingLevel5 at $500. A break above this resistance level is expected to confirm continued upward momentum.

BRK.B Stock Technical Analysis – Daily Chart

On the daily chart, BRK.B is preparing to continue its ascent as part of wave (5) following the likely completion of a three-wave corrective structure in wave (4). The price currently faces resistance at the key psychological level of $500 (TradingLevel5). A successful breach of this level would provide further confirmation of the anticipated upside, signaling the continuation of the bullish trend in wave (5).

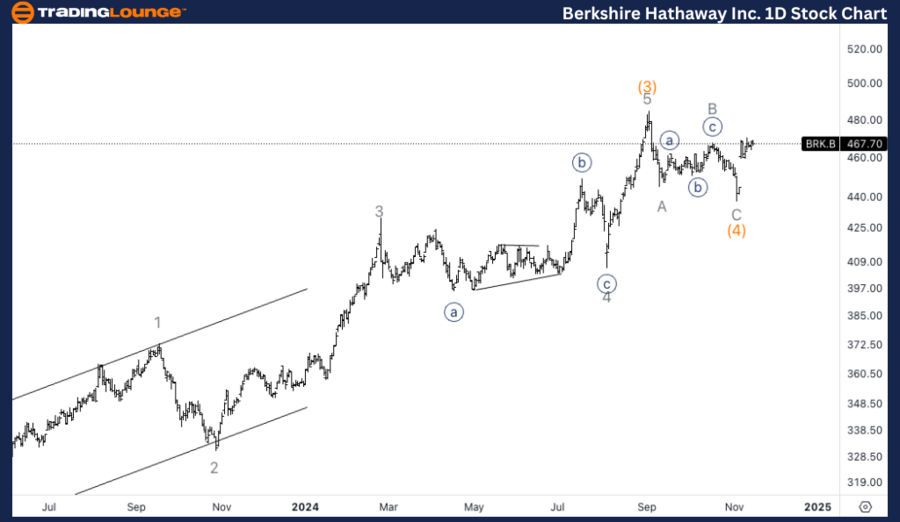

Berkshire Hathaway Inc. (BRK.B) TradingLounge 1-Hour Chart

BRK.B Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (5)

Direction: Pullback in wave 2

Details:

BRK.B is likely in the process of completing wave 2 within wave (5). There is evidence that another downward leg may be missing, indicating that wave 2 has yet to fully unfold. The stock could find support around $465, which may act as a turning point before resuming the upward movement in wave 3 of (5).

Berkshire Hathaway Inc. Technical Analysis – 1-Hour Chart

The 1-hour chart suggests that BRK.B is still in wave 2 of the larger wave (5). The analysis points to at least one more downward leg before the corrective structure is complete. Support near $465 could mark the end of wave 2, setting the stage for the stock to bottom out and begin the next upward leg in wave 3 of (5).

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: QUALCOMM Inc. (QCOM) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support