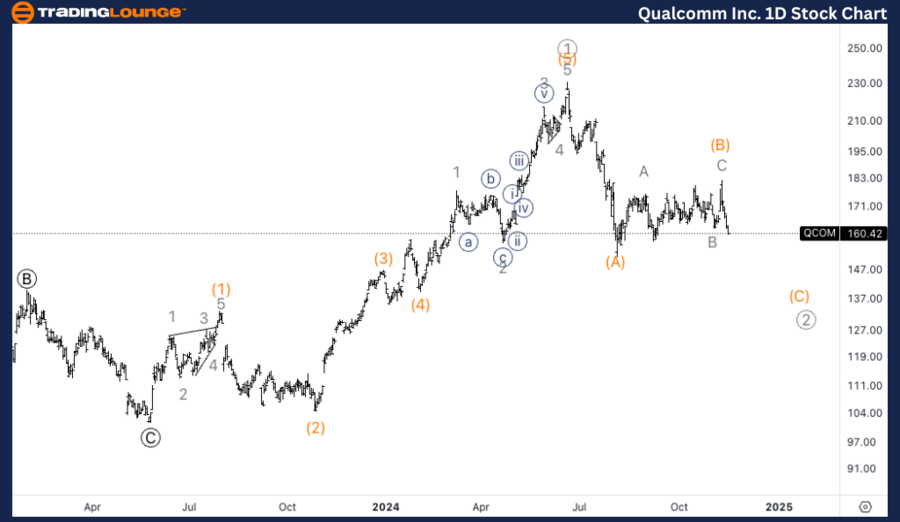

QUALCOMM Inc. (QCOM) Elliott Wave Analysis – Trading Lounge Daily Chart

QCOM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave (C) of 2

Direction: Downside in wave (C)

Details:

QUALCOMM Inc. (QCOM) is currently in a corrective phase within Primary degree wave 2, specifically progressing through wave (C) of a ZigZag structure. There is a possibility that the stock has formed a larger top at $230, suggesting that QCOM may be undergoing a higher-degree correction. Further downside is anticipated as this correction unfolds.

QCOM Daily Chart Overview:

QCOM is in wave (C) of Primary degree wave 2, a corrective ZigZag structure. A deeper correction is expected as the price moves downward, with the previous top near $230 indicating the start of this phase.

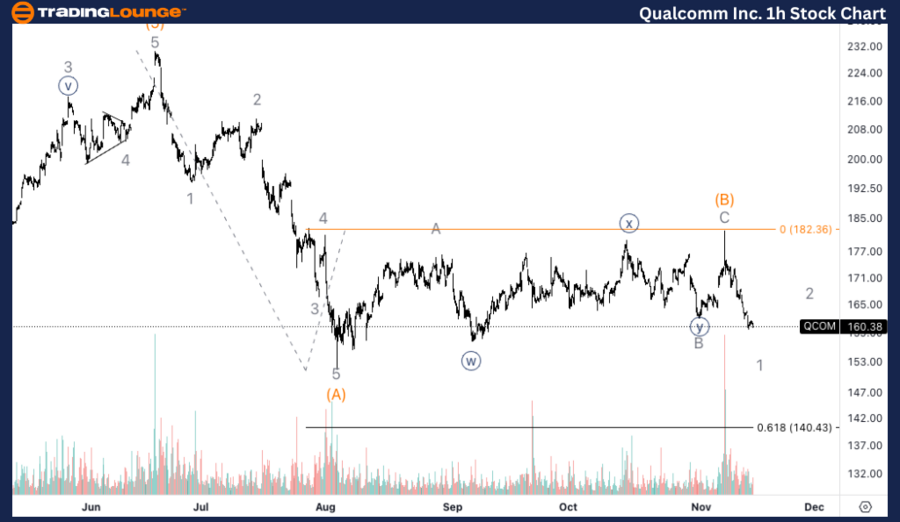

QUALCOMM Inc. (QCOM) Elliott Wave Analysis – Trading Lounge 1-Hour Chart

QCOM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave 1 of (C)

Direction: Bottom in wave 1

Details:

On the 1-hour chart, QCOM appears to be concluding wave 1 of (C) within the corrective structure. After wave 1 is complete, a pullback in wave 2 is likely, offering a potential shorting opportunity. The 0.618 Fibonacci retracement of wave (C) vs. wave (A) stands around $140, which could act as a target level for the larger corrective move.

QCOM 1-Hour Chart Overview:

1-Hour Chart: A bottom in wave 1 of (C) is anticipated, followed by a pullback into wave 2, which could present shorting opportunities. The Fibonacci 0.618 level around $140 acts as a key downside target.

By closely monitoring these levels and corrective phases, traders can align strategies with QCOM's Elliott Wave structure.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: CRM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support