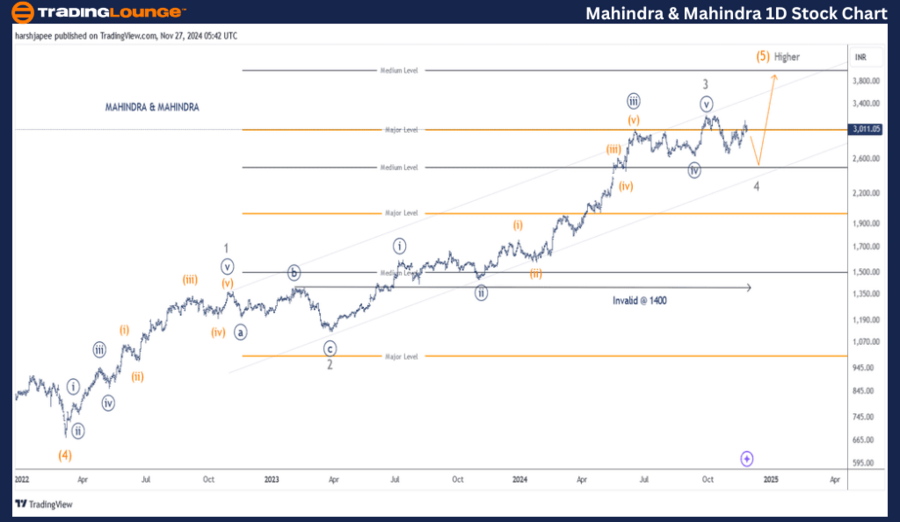

MAHINDRA & MAHINDRA – Elliott Wave Technical Analysis (1D Chart)

Mahindra & Mahindra Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, Wave (5) Orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4 Grey

Details: Minor Wave 4 Grey might be complete as an expanded flat around the 2700-20 range, or could drag to one more low (2500-50), within Intermediate Wave (5) Orange against 1400. If correct, Minor Wave 5 Grey should be underway soon.

Invalidation point: 1400

MAHINDRA & MAHINDRA Daily Chart Technical Analysis and potential Elliott Wave Counts:

MAHINDRA & MAHINDRA daily chart is indicating a religious uptrend, which has completed Minor Wave 4 around the 2700 mark or is near to completion around 2500-50 range. The stock could then turn higher again pushing through 3400 levels.

MAHINDRA & MAHINDRA stock prices had dropped through 675 lows in March 2022; carving Intermediate Wave (4) Orange. The subsequent rally thereafter suggests Minor Waves 1, 2 and 3 are complete and Wave 4 is potentially complete around 2700 mark.

If the above proposed structure holds well, the stock could first drop towards 2500-50 range then turn higher to complete Minor Wave 5 above 3400 levels.

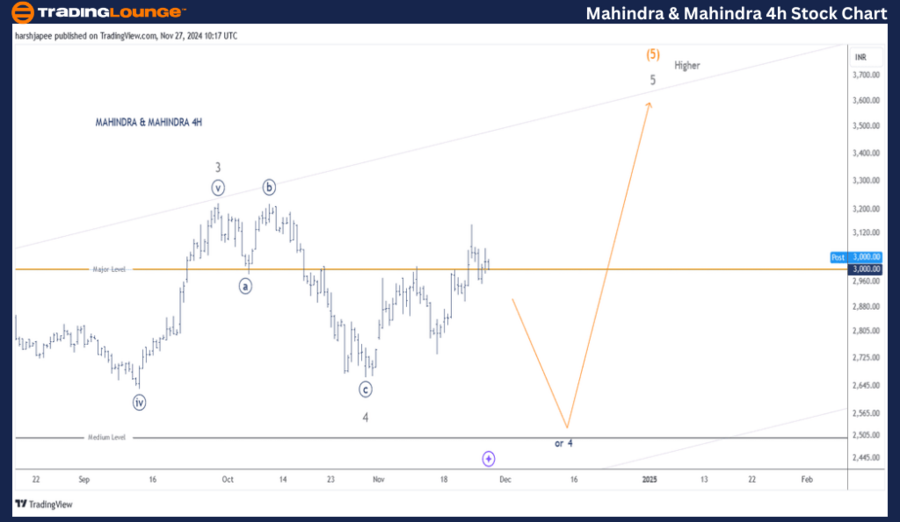

MAHINDRA & MAHINDRA – Elliott Wave Technical Analysis (4H Chart)

Function: Larger Degree Trend Higher (Intermediate degree, Wave (5) Orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4 Grey

Details: Minor Wave 4 Grey appears to have completed as an expanded flat within the 2700-2720 range but could extend into a complex combination pattern, dipping toward 2550. This pattern is part of Intermediate Wave (5) Orange, advancing against the invalidation level at 1400. If correct, Minor Wave 5 Grey should begin a strong upward move soon.

Invalidation Point: 1400

MAHINDRA & MAHINDRA 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart for MAHINDRA & MAHINDRA sheds light on the price structure between Minor Wave 3 Grey and the subsequent movements. Minor Wave 4 likely developed as an expanded flat pattern ((a))-((b))-((c)), potentially completing near the 2700 level. However, there remains a possibility for a complex correction toward 2550.

Following the completion of Wave 4, Minor Wave 5 is projected to begin, pushing the stock higher against the 1400 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HCL TECHNOLOGIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

MAHINDRA & MAHINDRA appears to be moving higher as it progresses within Intermediate Wave (5) Orange. A pullback to the 2500-2550 range might be followed by a sharp upward trend, targeting levels above 3400.