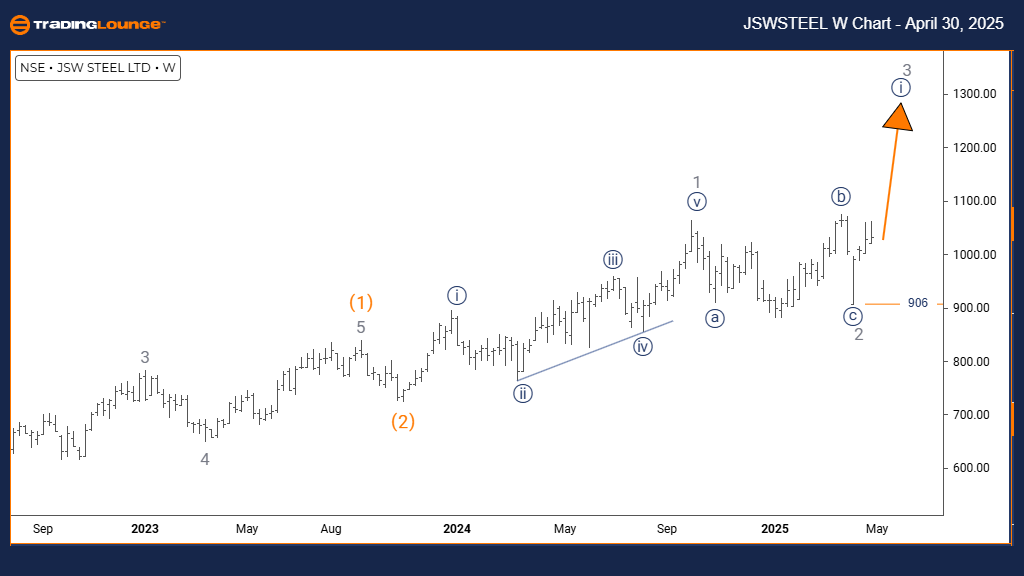

JSW STEEL – Elliott Wave Analysis – TradingLounge Daily Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange wave 1 appears complete; orange wave 2 is currently forming.

Wave Cancel/Invalid Level: 906

JSW STEEL Daily Elliott Wave Forecast:

JSW STEEL's daily Elliott Wave analysis suggests a counter-trend correction within a larger bullish structure. Orange wave 1 has likely completed, and the stock is currently forming orange wave 2 within the broader navy blue wave 1 uptrend. This represents a short-term pullback within a medium-term upward trend.

Wave 2 generally retraces 38% to 61% of wave 1 and is often seen as a zigzag or flat corrective pattern. Given wave 1’s strong bullish impulse, wave 2 is expected to unfold with slower momentum and overlapping structure, signaling a classic corrective phase. This aligns with a temporary consolidation before a bullish continuation.

Once orange wave 2 concludes, an impulsive orange wave 3 is expected. Historically, wave 3 delivers the strongest price action, potentially breaking above the wave 1 peak. The key invalidation level is at 906—a breach here negates the current bullish wave setup.

Trading Strategy Insight:

Watch for reversal signals indicating wave 2 is ending—bullish candlesticks, momentum indicators, or oversold conditions may point to a turning point. This corrective wave presents potential entry opportunities ahead of the forecasted orange wave 3 rally. Use Fibonacci retracement zones and momentum analysis to fine-tune entries during this setup phase.

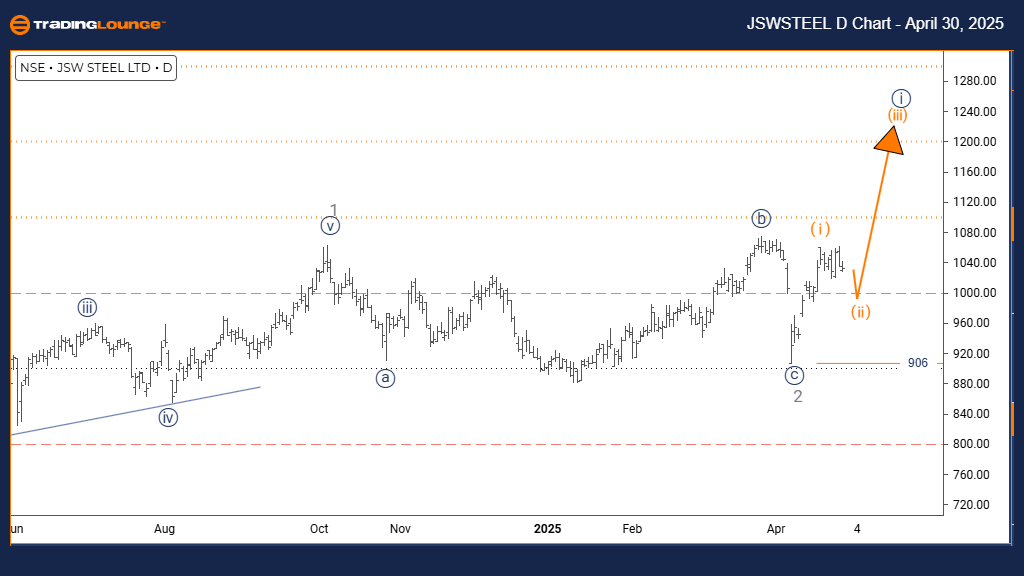

JSW STEEL – Elliott Wave Analysis – TradingLounge Weekly Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray wave 2 is likely complete; navy blue wave 1 within gray wave 3 is developing.

Wave Cancel/Invalid Level: 906

JSW STEEL Weekly Elliott Wave Forecast:

The weekly Elliott Wave outlook for JSW STEEL supports a bullish impulsive structure. With gray wave 2 likely complete, the stock has entered navy blue wave 1, the early segment of a larger gray wave 3. This implies a renewed uptrend with stronger momentum likely building in the coming weeks.

Wave 1 often begins with moderate bullish activity, marking the foundation of a new trend. While not explosive, this phase is crucial for establishing market confidence. The structure signals a gradual but firm advance, laying the groundwork for future impulsive waves.

As gray wave 3 unfolds, the bullish case strengthens. The support/invalidation level at 906 remains critical—any move below this level would invalidate the current count and require reevaluation.

Trading Strategy Insight:

Track wave 1’s development through volume increases and sustained upward price action. This phase presents early trade setup opportunities for positioning before wave 2 correction and eventual wave 3 strength. Use weekly trend confirmation tools to reinforce analysis and capture momentum shifts.

Wave 2 will follow upon completion of wave 1, offering a pullback and re-entry window. The weekly timeframe is ideal for planning medium-term positions aligned with the upcoming bullish cycle.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ADANI PORTS & SEZ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support