ServiceNow Inc. (NOW) Elliott Wave Forecast - Trading Lounge (Daily Chart)

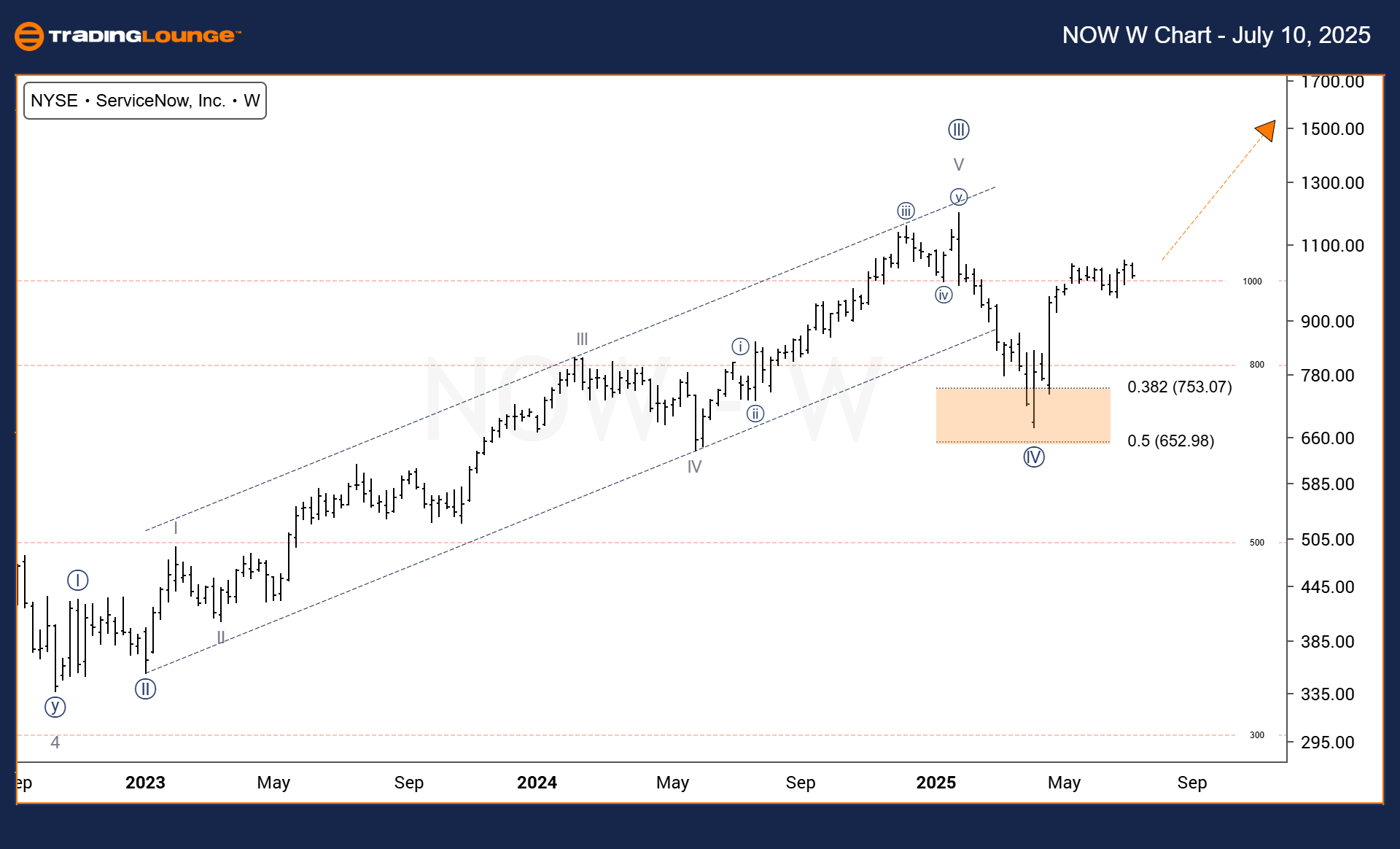

ServiceNow Inc. (NOW) US Stock Daily Chart Forecast

ServiceNow Inc. (NOW) Elliott Wave Technical Analysis

- Function: Trend

- Mode: Motive

- Structure: Impulsive

- Position: Wave (v)

- Direction: Uptrend

- Details: Following the end of Wave (iv), ServiceNow (NOW) is expected to advance into Wave (v), potentially reaching a level equal to Wave (i).

Daily Chart Overview

ServiceNow Inc. (NYSE: NOW) is displaying continued strength on the daily chart as it progresses into Wave (v) of the Elliott Wave sequence. Wave (iv) appears to be in a corrective stage, with probable completion in the 38.2%–50% Fibonacci retracement range. Once this retracement finalizes, Wave (v) is projected to follow, potentially matching the scale of Wave (i). This setup creates a favorable scenario for bullish traders, highlighting short-term upside potential. The current impulsive wave formation reflects a continuation of the upward trend.

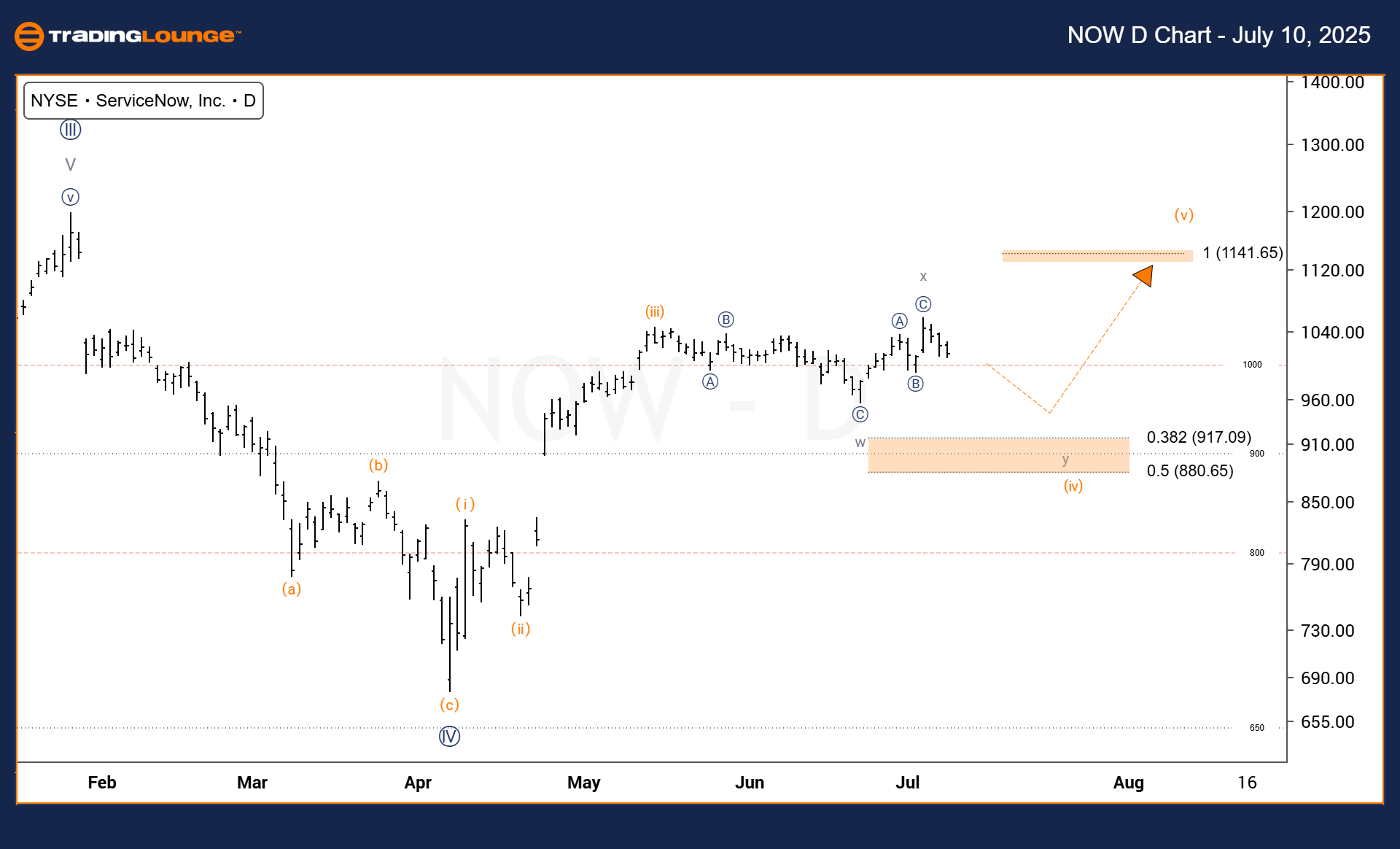

ServiceNow Inc. (NOW) – Elliott Wave Forecast (Weekly Chart)

ServiceNow Inc. (NOW) Technical Analysis – Trading Lounge

- Function: Trend

- Mode: Motive

- Structure: Impulsive

- Position: Wave {V}

- Direction: Uptrend

- Details: The bullish path toward Wave {V} remains intact after a rebound from the 50% Fibonacci retracement zone in April.

Weekly Chart Insight

On the weekly chart, ServiceNow (NOW) preserves its bullish Elliott Wave structure, aiming for the completion of Wave {V}. After Wave {IV} ended around April, near the 50% Fibonacci retracement, the stock gained momentum. This ongoing impulsive movement supports a positive long-term outlook. Traders should monitor key resistance levels and watch for consolidation signals as Wave {V} evolves.

Technical Analyst: Dhiren Pahuja

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: Carvana Co. (CVNA) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support