In this updated Elliott Wave analysis for McDonald's Corp. (MCD), we will analyze the trend structure across both the daily and 1-hour charts, evaluating the current wave progression and identifying potential price targets.

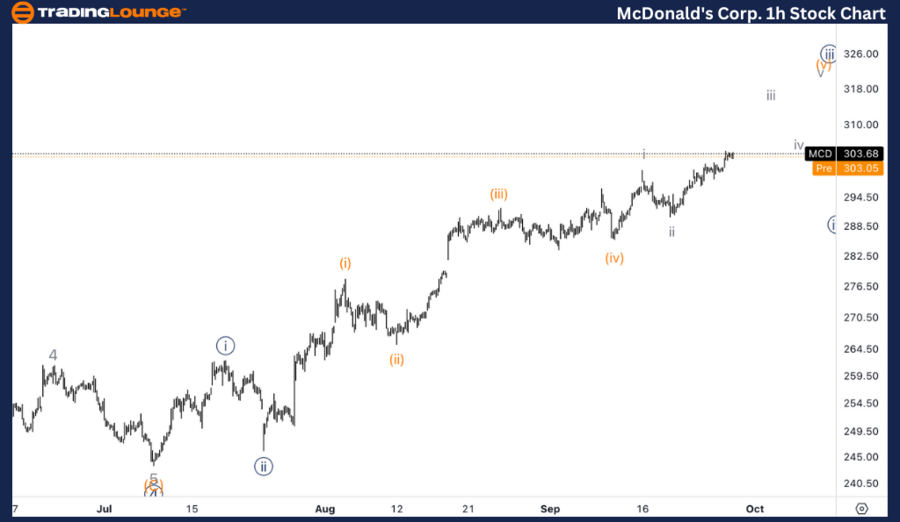

MCD Elliott Wave Analysis - TradingLounge Daily Chart

McDonald’s Corp. (MCD) Daily Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1

Direction: Completion in Wave 1

Details: We are targeting the Minor Group 1 (MG1) level at $300 as the primary upside goal, where a potential top for Wave 1 could form.

MCD Stock Technical Analysis – Daily Chart

On the daily chart, McDonald’s is advancing through Wave 1 of a new impulsive move. The focus remains on the completion of this wave, with the $300 target (MG1) serving as a key psychological and technical resistance level.

Traders should closely monitor price action as it approaches $300, as signs of exhaustion may signal the beginning of a corrective phase once Wave 1 concludes.

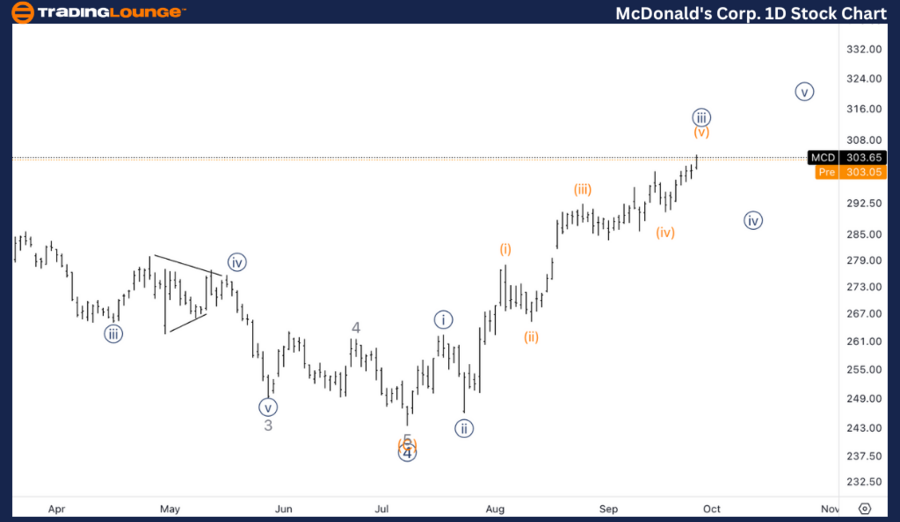

MCD Elliott Wave Analysis - TradingLounge 1H Chart

McDonald’s Corp. (MCD) 1-Hour Chart Analysis

MCD Stock Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {v} of 1

Direction: Upside within Wave {v}

Details: We expect further upside within Wave (v) of {v}, slightly differing from the daily chart but aligning with the broader trend.

MCD Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, McDonald’s is progressing within Wave {v} of 1, and the structure indicates we are in the final leg, specifically Wave (v) of {v}. While slightly different from the daily chart, this aligns with the broader trend, suggesting more upside potential before Wave 1 completes.

The shorter-term analysis supports the bullish trend, with price moving toward the $300 target. Once Wave (v) completes, traders should anticipate a possible correction, marking the end of Wave 1.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Dell Technologies Inc. (DELL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support