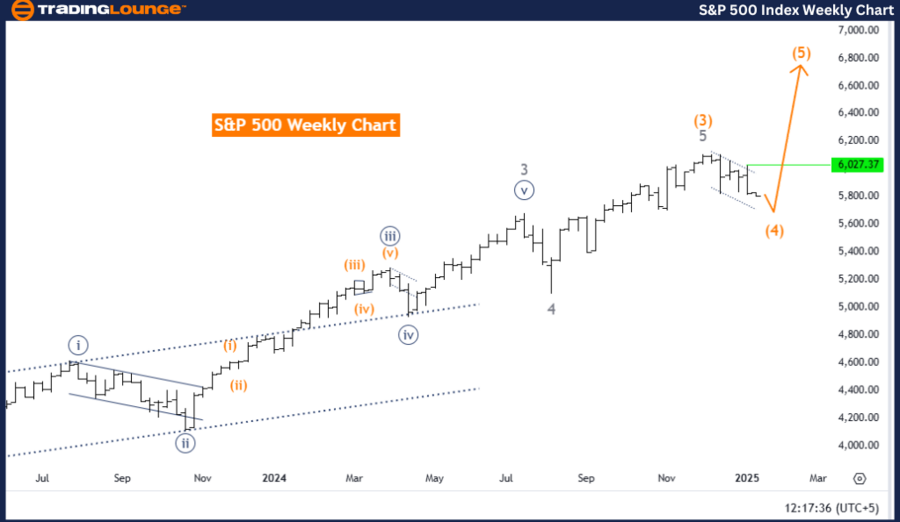

S&P 500 Elliott Wave Analysis – Trading Lounge Day Chart

S&P 500 Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Impulsive as Wave C

Structure: Gray Wave C

Position: Orange Wave 4

Next Higher Degree Direction: Orange Wave 5

Details:

The S&P 500 Index is currently in a counter-trend phase, as indicated by Elliott Wave Analysis on the daily chart. The market is displaying an impulsive behavior, represented by gray Wave C, which is a part of the larger corrective structure known as orange Wave 4. This development follows the completion of gray Wave B, signaling that gray Wave C is actively unfolding within orange Wave 4.

Gray Wave C represents the final impulsive wave of this correction phase, marking the completion of orange Wave 4. This stage is crucial as it sets the groundwork for the market's transition to orange Wave 5, which aligns with the broader bullish trend expected to follow.

Once orange Wave 4 and gray Wave C are finalized, the market will confirm the conclusion of the current corrective cycle, paving the way for the anticipated orange Wave 5. This upward wave is forecasted to continue the broader impulsive structure, reaffirming bullish momentum in the S&P 500 Index.

Summary:

- The S&P 500 is in the midst of a counter-trend phase with gray Wave C unfolding within orange Wave 4.

- This phase serves as the final stage of the ongoing correction, signaling preparation for the next upward move, orange Wave 5.

- The development of gray Wave C provides essential insights into future price trends and confirms the broader bullish direction.

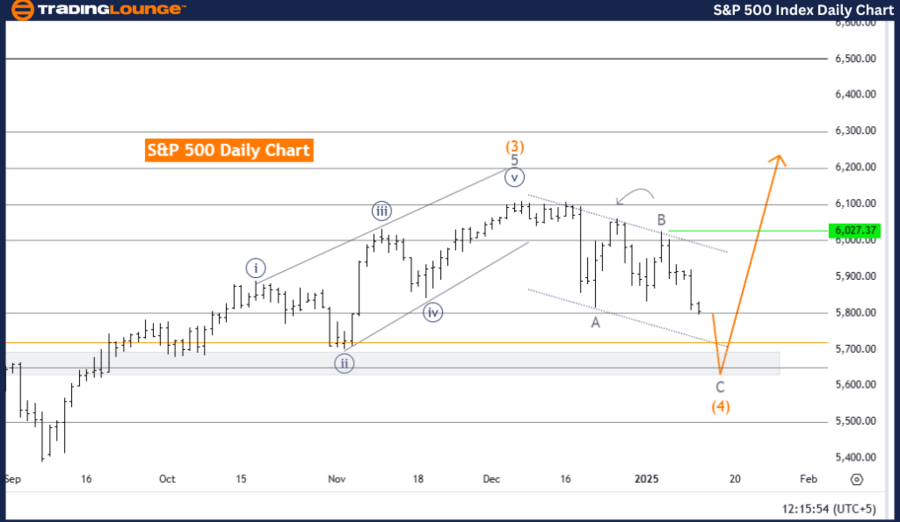

S&P 500 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P 500 Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Likely Zigzag

Position: Orange Wave 4

Next Higher Degree Direction: Orange Wave 5

Details:

On the weekly chart, the S&P 500 Index is undergoing a counter-trend corrective phase, likely forming a zigzag pattern within orange Wave 4. This phase comes after the completion of orange Wave 3, acting as a temporary retracement in the broader bullish trajectory.

The orange Wave 4 correction features a well-defined three-part structure, characteristic of a zigzag formation. This wave serves as a necessary consolidation phase before the market transitions into orange Wave 5, resuming the upward momentum consistent with the higher-degree bullish trend.

The conclusion of orange Wave 3 underscores the market's readiness for a corrective pullback, with orange Wave 4 providing a structured pause in the broader impulsive cycle. This stage allows the market to consolidate and realign before advancing into the final bullish phase.

Summary:

- The S&P 500 Index is in a corrective orange Wave 4 on the weekly chart, likely forming a zigzag pattern.

- This phase follows the completion of orange Wave 3 and prepares the market for the next upward leg, orange Wave 5.

- The completion of orange Wave 4 will maintain the structural integrity of the Elliott Wave pattern, offering critical insights into future trends and the overall bullish direction.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: S&P/TSX 60 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support