CRM Elliott Wave Analysis: Salesforce Inc. (CRM) Trends and Projections

This analysis delves into the trend structure of Salesforce Inc. (CRM) using the Elliott Wave Theory, evaluating both the daily and 1-hour charts. Below is a detailed breakdown of CRM’s current position and potential price movements.

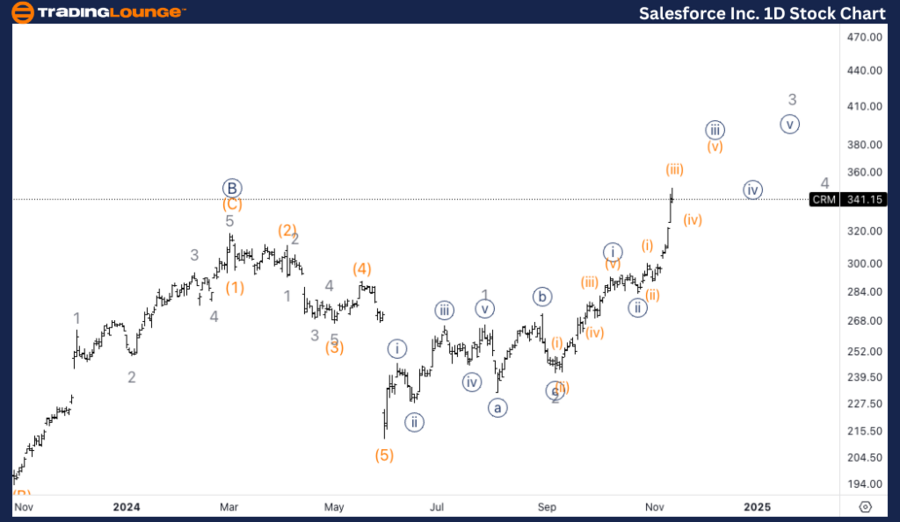

CRM Elliott Wave Analysis: TradingLounge Daily Chart

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 3

Direction: Upside within wave 3

Details:

Salesforce has entered a strong bullish phase, as evident in the impulsive structure heading towards all-time highs (ATH). Having surpassed the critical Trading Level 3 at $300, CRM has regained momentum and is pushing toward new peaks.

Key Observations on the Daily Chart:

CRM Elliott Wave Technical Analysis – Daily Chart On the daily chart, Salesforce appears to be in Minor wave 3, with a bullish impulsive structure developing. Having broken through the significant TradingLevel 3 at $300, the stock is now approaching all-time highs (ATH). This suggests that wave 3 has more room to the upside, and the structure is expected to continue unfolding towards new highs.

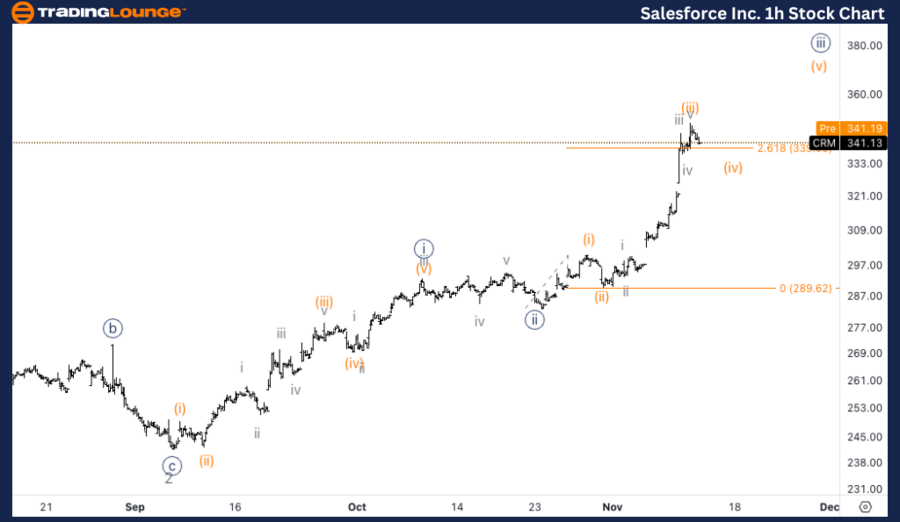

CRM Elliott Wave Analysis: TradingLounge 1-Hour Chart

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iv) of {iii}

Direction: Bottom in wave (iv)

Details:

On the 1-hour chart, CRM is currently consolidating in wave (iv) of {iii}, following a strong rally in wave (iii). The price is near the 2.618 Fibonacci extension of wave (i), which may indicate that wave (iii) has reached a temporary peak.

Key Observations on the 1-Hour Chart:

CRM Elliott Wave Technical Analysis – 1H Chart On the 1-hour chart, CRM seems to be in wave (iv) of {iii}. There is a possibility that wave (iii) may have topped out, as the price is trading near the 2.618 Fibonacci extension of wave (i) vs. (iii). After wave (iv) completes, the focus will shift towards a potential move higher in wave (v), with $350 being a key resistance target for the completion of wave (v).

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Walt Disney Co. Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support