TradingLounge 1D Chart – CIPLA Elliott Wave Technical Analysis

CIPLA India Day Chart Analysis

CIPLA Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Impulse within larger degree Corrective Structure

Position: Minor Wave 1 Grey

Details:

Invalidation point: 1705

CIPLA Daily Chart Technical Analysis and Potential Elliott Wave Counts:

-

CIPLA’s daily chart suggests a potential end to its larger degree uptrend near the 1705 mark, as prices reversed lower after breaking below 1470, the previous Wave 4 of a lesser degree.

-

Wave 2 rally peaked at 1615, indicating completion, as bearish momentum drags prices lower.

-

Earlier, the stock ended Intermediate Wave (4) near 850 in March 2023. A subsequent impulse rally through 1705 marked a completed trend, transferring control to the bears.

-

Alternatively, the recent dip to 1400 could indicate Minor Wave 4, with bulls possibly working toward a Wave 5 rally.

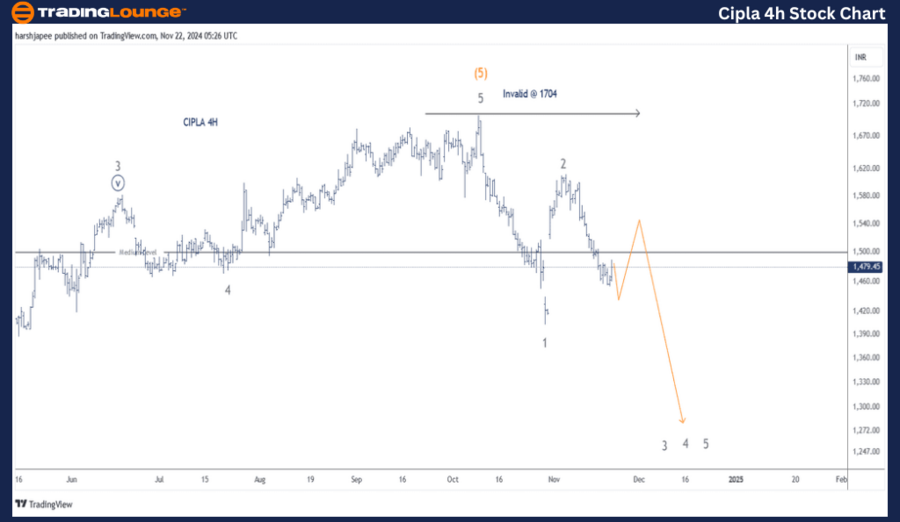

CIPLA – CIPLA (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Impulse within larger degree Corrective Structure

Position: Minor Wave 1 Grey

Details:

Invalidation point: 1705

CIPLA 4H Chart Technical Analysis and Potential Elliott Wave Counts:

- The 4H chart highlights key wave counts since Minor Wave 4 ended near 1470 in August 2024.

- Minor Wave 5, appearing complete at 1704, preceded a sharp reversal below 1470.

- Minor Wave 1 ended at 1400, followed by a Wave 2 rally to 1615. The ongoing Minor Wave 3 targets a potential drop toward 1250 or lower.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: SUN PHARMACEUTICALS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

CIPLA is moving downward within Minor Wave 3, with the 1705 level acting as a significant invalidation point for bearish scenarios.