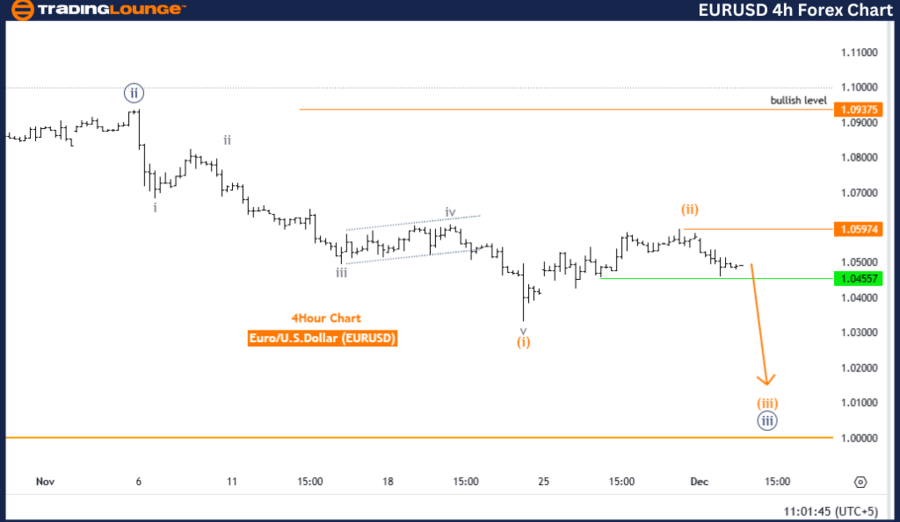

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis Trading Lounge Day Chart

EURUSD Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction Next Higher Degrees: Orange Wave 4

Details

The EURUSD daily chart highlights a detailed Elliott Wave analysis, showcasing a bearish trend currently in progress. This wave structure is identified as orange wave 3, which forms a segment of the larger impulsive pattern within navy blue wave 3.

According to the analysis, orange wave 2 has likely been completed, paving the way for the continuation of orange wave 3 within the broader framework of navy blue wave 3. This projection adheres to Elliott Wave Theory, a methodology used to detect recurring wave patterns and anticipate market movements.

The wave sequence indicates sustained bearish momentum. Once orange wave 3 concludes, the next expected move is a transition into orange wave 4.

Key Levels

- Wave Cancel Invalidation Level: 1.93575

Should the price rise above this invalidation level, the wave count would require revision, as it would signify a deviation from the anticipated pattern.

Trading Insights

This analysis offers critical insights into the market's behavior, focusing on the impulsive nature of the ongoing wave structure. The bearish outlook signals continued downward price movement, providing traders with a structured framework to monitor and predict market trends.

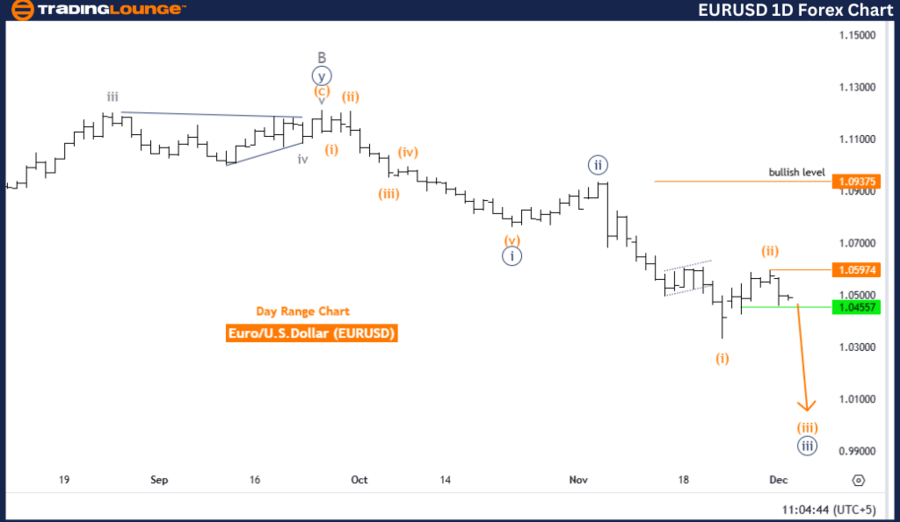

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis Trading Lounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction Next Higher Degrees: Orange Wave 4

Details

The EURUSD 4-hour chart offers an Elliott Wave analysis indicating a sustained bearish trend. The wave structure is categorized as orange wave 3, which is part of a larger impulsive wave within navy blue wave 3.

As per the analysis, orange wave 2 appears to have concluded, allowing the market to advance into orange wave 3 within the navy blue wave 3 framework. This projection aligns with the principles of Elliott Wave Theory, which identifies recurring wave structures to forecast market trends effectively.

Currently, orange wave 3 is actively developing. Upon its completion, the analysis anticipates a transition to orange wave 4, reflecting the next movement in the higher-degree wave sequence.

Key Levels

- Wave Cancel Invalidation Level: 1.05974

Any price movement surpassing this invalidation level would necessitate a reevaluation of the wave count, potentially modifying the expected trend and structure.

Trading Insights

This Elliott Wave analysis reinforces the outlook of continued bearish momentum, emphasizing the impulsive characteristics of the current wave pattern. It provides traders with valuable guidance to anticipate potential market shifts and highlights critical levels for confirming or invalidating the current wave projections.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support