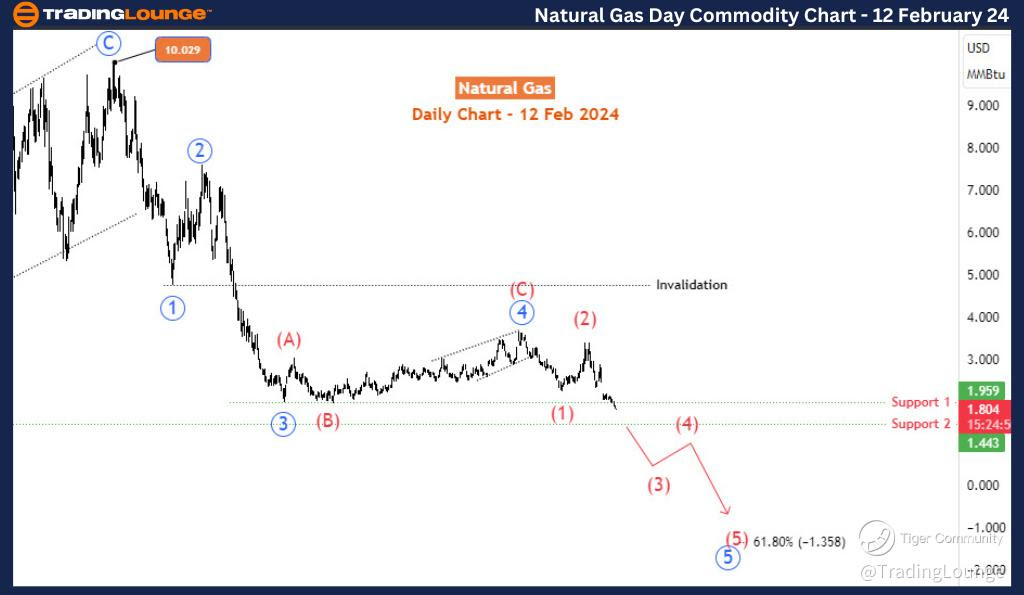

Natural Gas Elliott Wave Technical Analysis 12 February 24

Welcome to Tradinglounge detailed Natural Gas Elliott Wave Technical Analysis for February 12. In this comprehensive analysis, we will delve into the intricate details of the current market trends, focusing on the 4-hour and daily charts. Our analysis revolves around the Elliott Wave Theory, a powerful tool for understanding market movements.

Elliott Wave Analysis Overview:

Function - Trend

Our analysis identifies the prevailing market trend for Natural Gas, crucial for making informed trading decisions. By understanding the market's primary direction, we can anticipate potential profit opportunities.

Mode - Impulsive

The market is currently exhibiting an impulsive mode, indicating a strong and decisive price movement. This characteristic is essential for traders seeking to capitalize on significant market shifts.

Structure - Impulse Wave

The structure of the market suggests an impulse wave, emphasizing the strong directional movement in play. Traders can use this information to align their strategies with the prevailing market dynamics.

Position - Black Wave 3 of Larger Degree Red Wave (3)

Our analysis pinpoints the current position of Natural Gas within the larger Elliott Wave framework. Specifically, we are observing the development of the Black Wave 3 within the higher-degree Red Wave (3), providing valuable insights into the ongoing market sentiment.

Direction - Black Wave 3 of Higher Degree Red Wave (3) Still in Play

The identified Black Wave 3 within the higher-degree Red Wave (3) is confirmed to be active. Traders should remain attentive to this directional movement, as it continues to influence market dynamics.

Detailed Analysis: Our analysis delves into the finer details of the current wave structure:

Details: Wave (3) evolving into a bearish impulse.

The ongoing evolution of Wave (3) indicates a bearish impulse, signaling a potential downturn in Natural Gas prices. Traders should closely monitor this development for strategic decision-making.

Sub-wave 3 (in Black) broke below 1.959 support and could extend toward 1.378-1.124 key Fib zone.

A critical aspect of our analysis is the identification of sub-wave 3 (in Black), which has breached the crucial 1.959 support level. This breach suggests a potential downward extension towards the 1.378-1.124 key Fibonacci zone, providing traders with specific levels to watch.

Technical Analyst: Sanmi

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Natural Gas, 4Hr Chart:

Natural Gas, Day Chart:

Conclusion: In conclusion, our Natural Gas Elliott Wave Technical Analysis on the 4-hour and daily charts for February 12 provides a comprehensive overview of the market trends. Traders can use this information to make informed decisions, capitalizing on the identified impulsive mode and bearish impulse wave. Stay tuned for further updates as we closely monitor the evolving market dynamics.