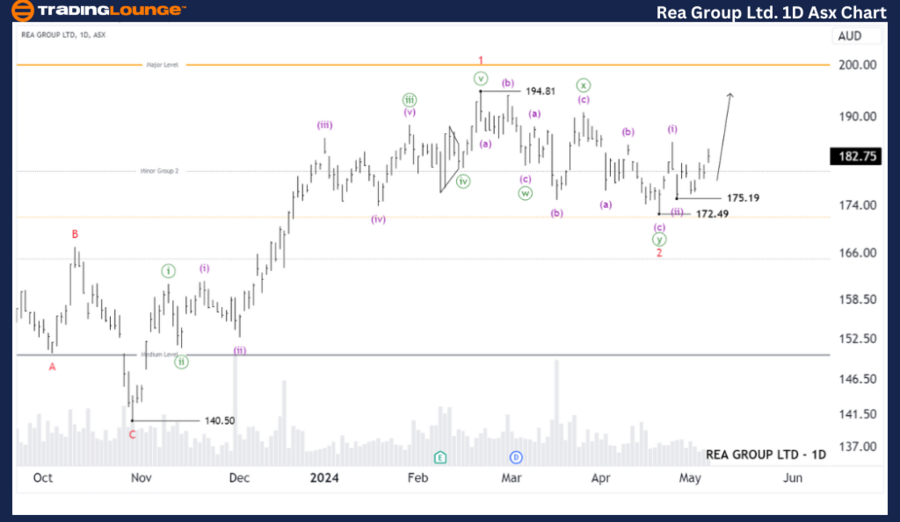

ASX: REA Group Ltd – REA Elliott Wave Technical Analysis (1D Chart)

In our latest Elliott Wave analysis, we explore the price movements of REA Group Ltd, listed on the Australian Stock Exchange under the ticker ASX: REA. Recent developments suggest significant potential for upward movement in the stock price following the completion of wave 2-red.

REA Elliott Wave Technical Analysis

ASX: REA Group Ltd – REA 1D Chart (Semilog Scale) Overview:

- Function: Tracks the major trend with a focus on minor degrees marked in red.

- Mode: Motive, indicating directional movements.

- Structure: Impulse, typical of strong trend movements.

- Position: Currently in wave (iii)-purple, a component of the broader wave 3-red.

Detailed Analysis: The trading pattern for REA Group Ltd indicates that the recent conclusion of wave 2-red has set the stage for an aggressive upward trend in wave 3-red. This major wave is now subdividing into smaller segments, specifically waves (i) and (ii)-purple, both of which have completed. We are now witnessing the emergence of wave (iii)-purple, which promises to drive prices higher.

Key Point of Invalidation: The bullish outlook remains valid as long as the price does not fall below 175.19.

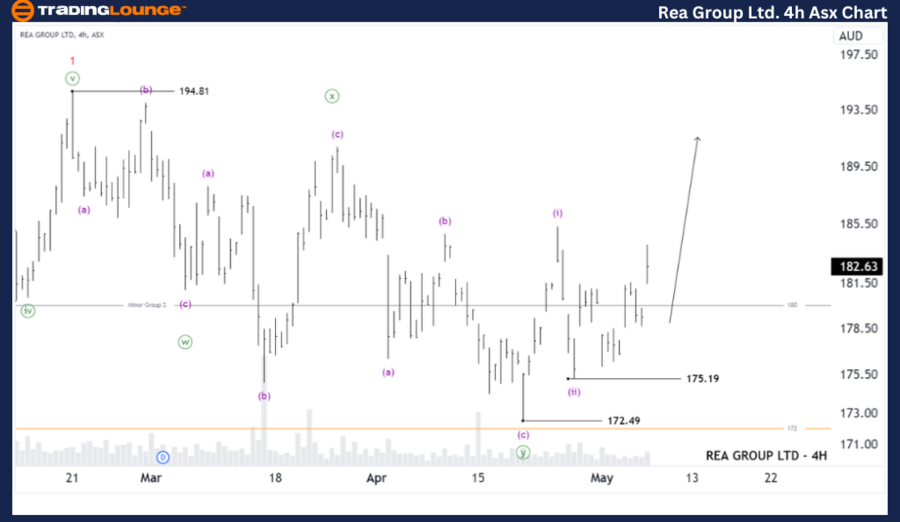

ASX: REA Group Ltd – REA Elliott Wave Technical Analysis (4-Hour Chart)

The shorter-term 4-hour chart analysis for REA Group Ltd mirrors the bullish sentiment observed on the daily chart. This detailed examination focuses on the minuette degree movements within the major wave patterns.

ASX: REA Group Ltd – REA 4-Hour Chart Overview:

- Function: Emphasizes the major trend with detailed observation at the minuette degree, marked in purple.

- Mode: Motive, as the pattern suggests a continuation of the current trend.

- Structure: Impulse, indicative of robust directional trends.

- Position: Wave (iii)-purple of wave 3-red is currently in progress.

Detailed Analysis: The short-term analysis confirms the ongoing development of wave 3-red, breaking down into initial waves (i) and (ii)-purple, both of which have concluded. The focus now shifts to wave (iii)-purple, expected to propel the stock toward a new target near $200. This advance relies on the critical support level maintaining above 175.19.

Key Point of Invalidation: The bullish scenario will be negated if the price drops below 175.19.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: WiseTech Global Limited (WTC) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion: Both the daily and 4-hour charts for REA Group Ltd indicate a robust bullish phase aligned with the principles of Elliott Wave analysis. The completion of wave 2-red has paved the way for a vigorous ascent in wave 3-red, subdividing further into dynamic sub-waves. Investors and traders should monitor the support level at 175.19 closely, as staying above this threshold is crucial for the continuation of the upward momentum towards the $200 mark.