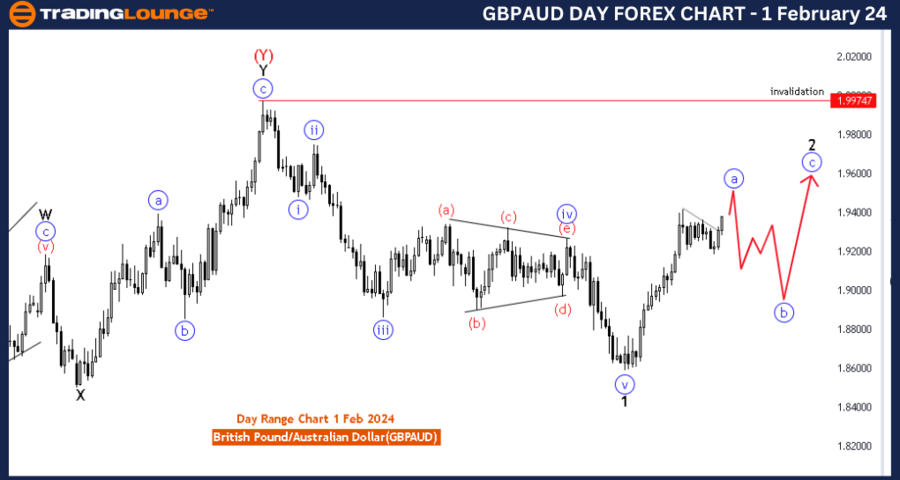

GBPAUD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 1 February 24

British Pound/ Australian Dollar(GBPAUD) 4 Hour Chart

GBPAUD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: impulsive as A

STRUCTURE: red wave 5 of A

POSITION: black wave 2

DIRECTION NEXT LOWER DEGREES: blue wave B of 2

DETAILS: red wave 4 of A completed , now red wave 5 of blue wave A is in play . Wave Cancel invalid level: 1.99748

The "GBPAUD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated February 1, 2024, provides a comprehensive analysis of the British Pound/Australian Dollar (GBPAUD) currency pair, focusing on the 4-hour chart and utilizing Elliott Wave Technical Analysis.

The identified "FUNCTION" is "Counter Trend," indicating that the analysis is geared towards identifying potential movements against the prevailing trend. This suggests a focus on counter trend trading opportunities, which can be crucial for traders looking to capitalize on corrective waves.

The specified "MODE" is "Impulsive as A," signifying that the current wave count is part of an impulsive movement within the context of a larger corrective structure. This information is valuable for understanding the character of the market movement.

The "STRUCTURE" is labeled as "Red wave 5 of A," providing insight into the specific wave count within the Elliott Wave framework. This indicates that the analysis is zooming into a particular degree of wave counts within the corrective structure labeled as "A."

The "POSITION" is defined as "Black wave 2," suggesting the current position within the broader wave count. This likely implies that the impulsive movement identified is part of a larger corrective structure labeled as "2."

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis points to "Blue wave B of 2," anticipating the movement in the next lower degree of wave count. This suggests an expected correction following the completion of the current impulsive wave.

Regarding "DETAILS," it mentions that "red wave 4 of A completed," indicating the completion of a corrective wave and the initiation of a new impulsive movement, specifically "red wave 5 of blue wave A."

The "Wave Cancel invalid level" is specified as "1.99748." This serves as a crucial reference point, and a breach of this level could potentially invalidate the current wave count, signaling a shift in the anticipated market movements.

In summary, the GBPAUD Elliott Wave Analysis for the 4-hour chart on 1 February 24, 2024, suggests an ongoing impulsive movement (red wave 5 of A) following the completion of a corrective wave (red wave 4 of A). Traders are advised to closely monitor the market, particularly the invalidation level at 1.99748.

Technical Analyst: Malik Awais

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

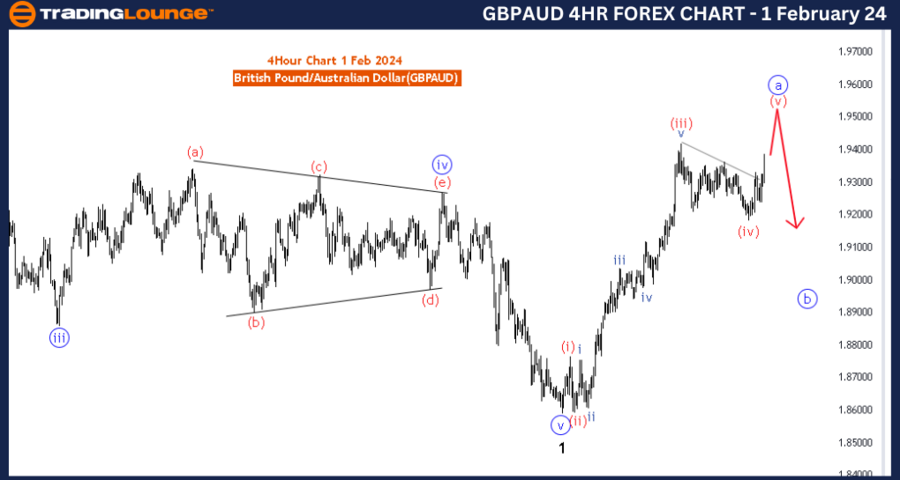

GBPAUD Elliott Wave Analysis Trading Lounge Day Chart, 1 February 24

British Pound/ Australian Dollar(GBPAUD) Day Chart

GBPAUD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: impulsive as A

STRUCTURE: blue wave A of 2

POSITION: black wave 2

DIRECTION NEXT LOWER DEGREES: blue wave B of 2

DETAILS: Blue wave A of 2 is in play and looking near to end . Wave Cancel invalid level: 1.99748

The "GBPAUD Elliott Wave Analysis Trading Lounge Day Chart" dated February 1, 2024, provides a detailed analysis of the British Pound/Australian Dollar (GBPAUD) currency pair on the daily chart, employing Elliott Wave Technical Analysis.

The identified "FUNCTION" is "Counter Trend," indicating that the focus of the analysis is on potential movements against the prevailing trend. This is valuable for traders seeking opportunities in corrective waves within the broader market context.

The specified "MODE" is "Impulsive as A," suggesting that the current wave count is part of an impulsive movement, particularly within the context of a larger corrective structure. This information is crucial for understanding the nature of the market movement.

The "STRUCTURE" is labeled as "Blue wave A of 2," providing insight into the specific wave count within the Elliott Wave framework. This suggests that the analysis is zooming into a particular degree of wave counts within the corrective structure labeled as "2."

The "POSITION" is defined as "Black wave 2," indicating the current position within the broader wave count. This likely implies that the impulsive movement identified is part of a larger corrective structure labeled as "2."

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis points to "Blue wave B of 2," anticipating the movement in the next lower degree of wave count. This suggests an expected correction following the completion of the current impulsive wave.

The "DETAILS" section mentions that "Blue wave A of 2 is in play and looking near to end." This suggests that the current impulsive wave is in progress and might be approaching completion.

The "Wave Cancel invalid level" is specified as "1.99748." This level serves as a critical reference point, and a breach of this level could potentially invalidate the current wave count, signaling a shift in the anticipated market movements.

In summary, the GBPAUD Elliott Wave Analysis for the daily chart on 1 February 24, suggests an ongoing impulsive movement (Blue wave A of 2) within the context of a larger corrective structure. Traders are advised to closely monitor the market, especially the invalidation level at 1.99748.

Technical Analyst: Malik Awais

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

See Previous: Australian Dollar/Japanese Yen(AUDJPY)