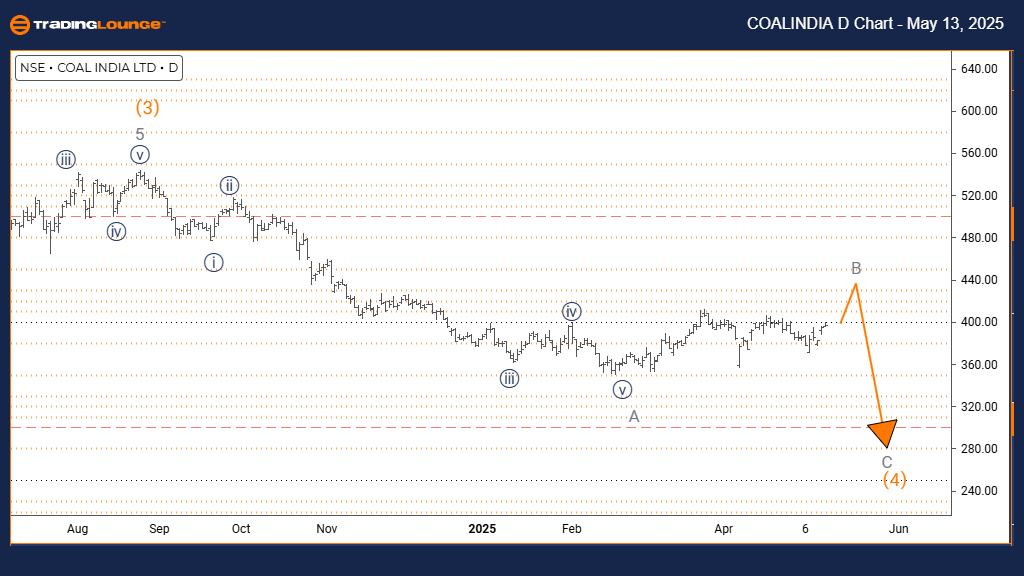

COAL INDIA Elliott Wave Analysis | Trading Lounge Daily Chart

COAL INDIA Elliott Wave Technical Outlook

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Gray Wave B

POSITION: Orange Wave 4

DIRECTION NEXT LOWER DEGREES: Gray Wave C

DETAILS: Completion of gray wave A; gray wave B of wave 4 now unfolding.

The daily Elliott Wave analysis for Coal India stock indicates a counter-trend corrective formation. The pattern currently reveals gray wave B forming within orange wave 4, confirming that gray wave A has ended. This transition introduces a short-term bullish correction.

The ongoing retracement, defined as gray wave B, suggests a corrective rally that may precede a decline toward gray wave C. The chart structure supports the notion that gray wave A is complete and gray wave B is progressing. This implies a likely bearish move in gray wave C after the corrective bounce finalizes. Since wave B movements often have constrained upside potential, traders should be cautious unless key resistance zones are breached.

This setup provides key insights into Coal India's corrective cycle, emphasizing heightened volatility during gray wave B’s development. Monitoring this phase is crucial, as its end could trigger the start of gray wave C. The analysis identifies a short-term bullish phase within a broader downward correction, supporting a bearish continuation once the current correction ends.

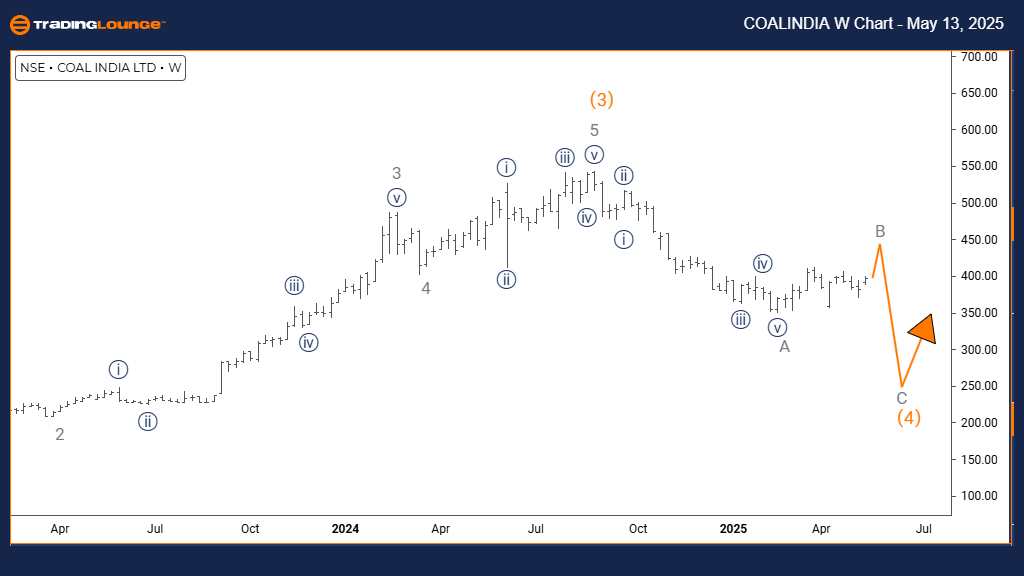

COAL INDIA Elliott Wave Analysis | Trading Lounge Weekly Chart

COAL INDIA Elliott Wave Technical Outlook

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 4

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5

DETAILS: Completion of orange wave 3; orange wave 4 in progress.

The weekly Elliott Wave analysis for Coal India Limited points to a corrective phase developing as part of a long-term bullish trend. After the confirmed completion of orange wave 3, the market has entered orange wave 4, currently forming within navy blue wave 1. This configuration represents a short-term correction rather than a full trend reversal.

Corrections in wave 4 often involve sideways or slightly declining price movements before a resumption of upward momentum through orange wave 5. The analysis underlines that orange wave 3 has finalized, transitioning into the current pullback. Traders should focus on Fibonacci retracement levels to gauge the correction’s boundary before anticipating another bullish push.

This broader technical view suggests that the current pullback could offer a strategic entry for long positions ahead of wave 5. The limited downside risk during wave 4 enhances the bullish outlook, assuming the corrective phase aligns with typical wave behavior. Close observation will help traders position ahead of the potential rally, aligning with the prevailing uptrend in Coal India’s share price.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ADANI ENTERPRISES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support