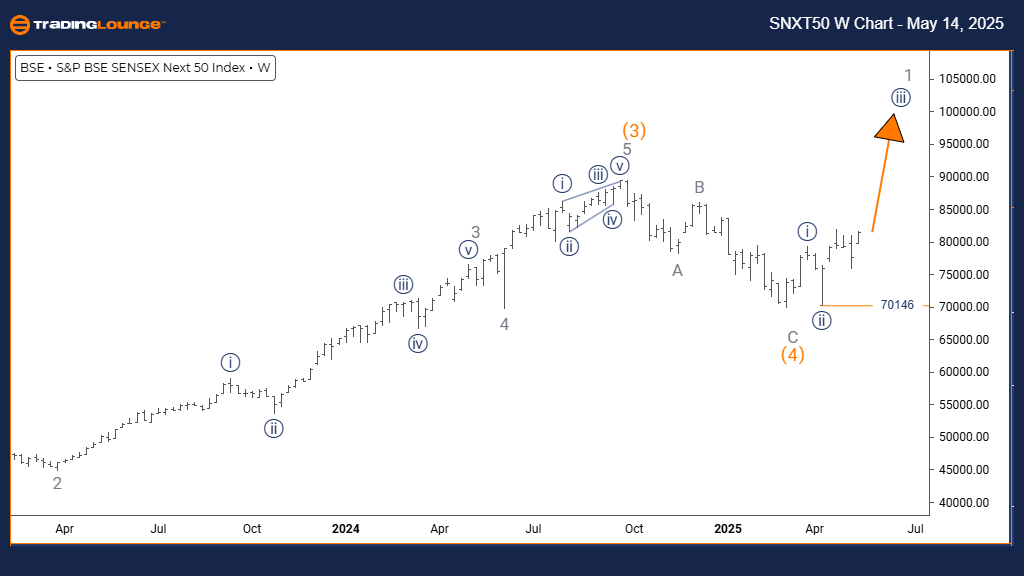

S&P BSE SENSEX NEXT 50 Elliott Wave Analysis – Trading Lounge Day Chart

S&P BSE SENSEX NEXT 50 Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (initiated)

DETAILS: Orange wave 2 appears finalized, with orange wave 3 actively progressing.

Wave Cancel Invalid Level: 75640

The daily chart of the S&P BSE SENSEX NEXT 50 reflects a clearly bullish trend, driven by an impulsive wave structure. Current Elliott Wave counts suggest the emergence of orange wave 3, unfolding within the upward phase of navy blue wave 3. This indicates that orange wave 2 has completed, initiating a new phase of upward momentum. Orange wave 3 typically exhibits the strongest thrust in an Elliott Wave cycle, indicating high market participation.

This wave analysis confirms the transition from orange wave 2 to 3, highlighting increased buying momentum. The invalidation level at 75640 serves as a key risk marker; any drop below this point would negate the current bullish structure and may imply a deeper market correction. The impulsive nature of the wave indicates robust market demand, likely supported by institutional investors, with ongoing potential for upside movement in navy blue wave 3.

Key Takeaways:

- Focus remains on the advancement of orange wave 3.

- Monitor closely for price action near the 75640 invalidation level.

- Structure suggests early phases of a strong rally with more upside likely.

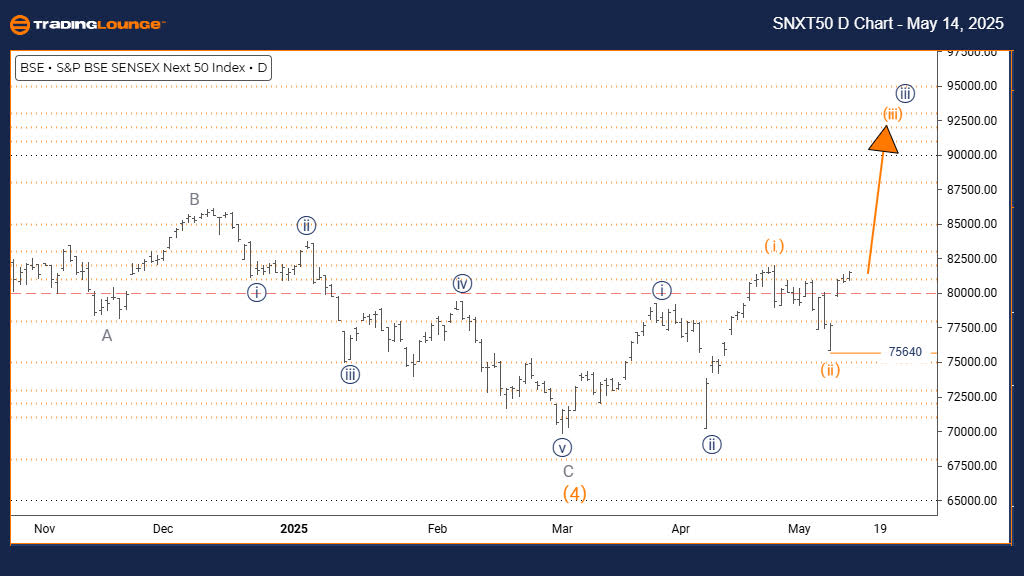

S&P BSE SENSEX NEXT 50 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P BSE SENSEX NEXT 50 Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 1

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 3 (active)

DETAILS: Navy blue wave 2 looks completed; navy blue wave 3 of gray wave 1 is now unfolding.

Wave Cancel Invalid Level: 70176

The weekly chart of the S&P BSE SENSEX NEXT 50 index reinforces a strong bullish sentiment, confirmed by a clear impulsive wave formation. The wave structure identifies the start of navy blue wave 3, forming as part of gray wave 1, following the conclusion of navy blue wave 2. This phase generally reflects strong upward price movement and signals a continuation of the broader bullish trend.

Analysis points to a completed navy blue wave 2, with wave 3 gaining traction. A critical invalidation level at 70176 is in place; any breach below this could undermine the current bullish count and indicate a potential shift in market direction. Price movement at this scale usually corresponds to longer-term institutional positioning. The structure of gray wave 1, in combination with navy blue wave 3, suggests the potential for prolonged upward progression.

Key Takeaways:

- Gray wave 1 offers long-term bullish positioning.

- Navy blue wave 3 is in focus for extended upward potential.

- Watch for support near 70176 as a validation point for trend strength.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIKKEI 225 (N225) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support