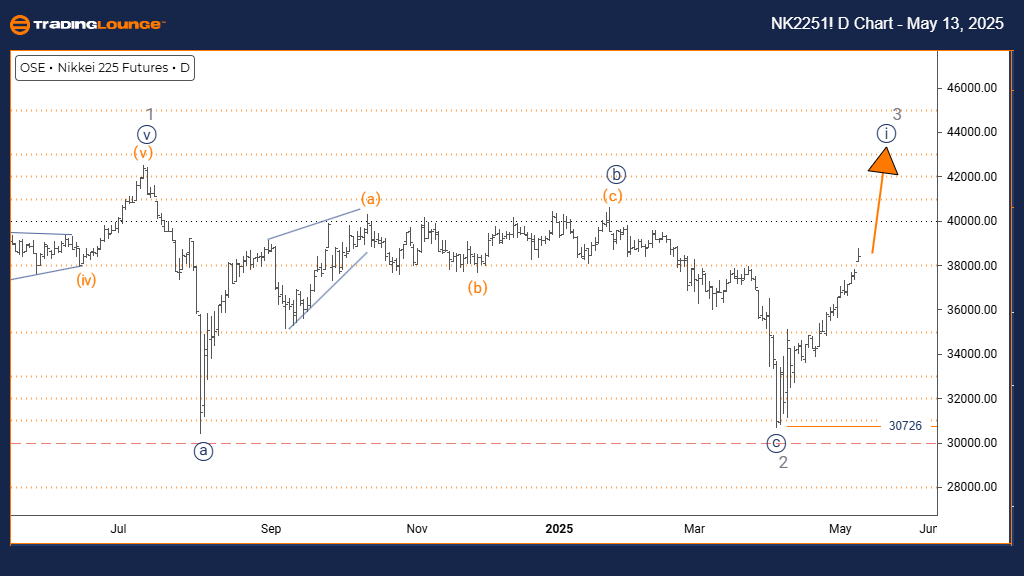

NIKKEI 225 (N225) Elliott Wave Analysis – Trading Lounge Daily Chart

NIKKEI 225 (N225) Elliott Wave Forecast – Daily Timeframe

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

NEXT LOWER DEGREE DIRECTION: Navy Blue Wave 2

DETAILS: Gray Wave 2 has likely ended; Navy Blue Wave 1 of 3 is developing.

INVALIDATION LEVEL: 30,726

The daily Elliott Wave analysis for the Nikkei 225 index highlights a clear bullish trend with impulsive characteristics. The formation of Navy Blue Wave 1 within Gray Wave 3 suggests the market has completed Gray Wave 2 and is moving into a fresh upward cycle. This structure indicates the start of a significant bullish phase, with the current wave acting as the lead wave in the larger move.

Technical evidence confirms Gray Wave 2's completion, leading to a new upward swing. The next expected development is Navy Blue Wave 2, likely presenting a corrective pullback after the current rally. The critical invalidation level of 30,726 must hold to maintain the bullish count. A break below this level could signal a more complex correction or a trend shift. As long as the current impulsive behavior persists, it reflects strong buying interest supporting the bullish momentum.

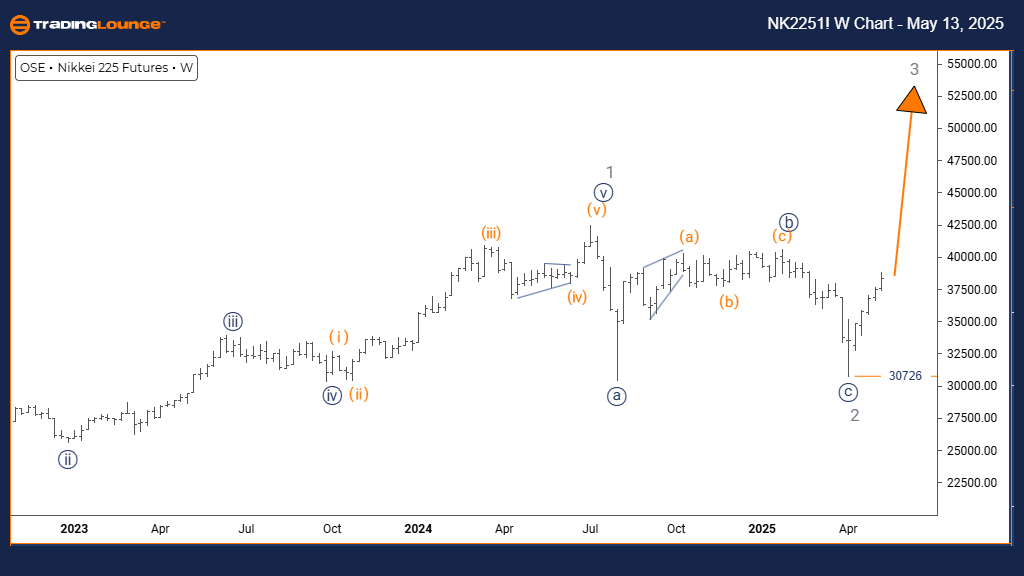

NIKKEI 225 (N225) Elliott Wave Analysis – Trading Lounge Weekly Chart

NIKKEI 225 (N225) Wave Forecast – Weekly Timeframe

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

NEXT HIGHER DEGREE DIRECTION: Gray Wave 3 in progress

DETAILS: Gray Wave 2 has likely ended; Gray Wave 3 of 3 is advancing.

INVALIDATION LEVEL: 30,726

The weekly Elliott Wave chart for the Nikkei 225 index reveals a strong bullish outlook supported by impulsive wave activity. The index is currently progressing within Gray Wave 3, nested inside Orange Wave 3, indicating a robust and sustained rally. The completion of Gray Wave 2 marks a shift into the most dynamic wave phase—Wave 3, known for strong price acceleration in Elliott Wave theory.

This bullish scenario remains intact as long as prices hold above 30,726, the wave count's invalidation level. A breakdown below this level would invalidate the current impulsive structure and suggest a potential trend change. However, the ongoing impulsive pattern implies continued upside potential, possibly driven by institutional buying and broader investor confidence in Japanese equities.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOW JONES – DJI Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support