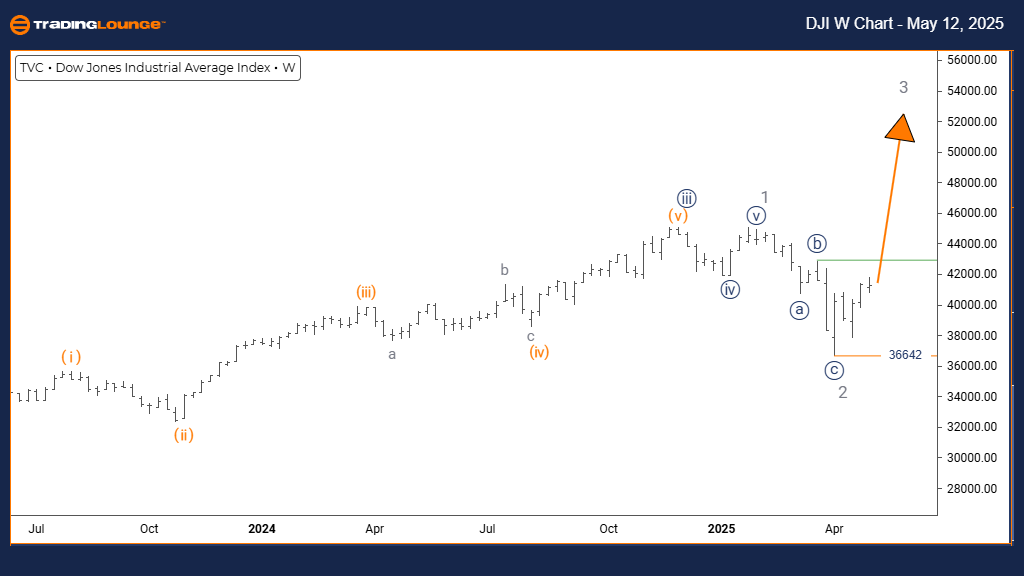

DOW JONES – DJI Elliott Wave Analysis – Trading Lounge Day Chart

DOW JONES – DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 looks complete; Navy Blue Wave 1 of 3 is developing.

Wave Cancel/Invalidation Level: 36,642

The daily Elliott Wave analysis of the Dow Jones Industrial Average (DJI) indicates a strong bullish trend driven by impulsive wave activity. The market is currently advancing through navy blue wave 1, a sub-wave of the broader gray wave 3. The recent completion of gray wave 2 has opened the path for the next bullish impulse. This setup suggests that the index is entering a significant growth phase, with navy blue wave 1 confirming early momentum.

Looking ahead, navy blue wave 2 is anticipated as the following corrective move once wave 1 concludes. The current wave count remains valid above the key invalidation point of 36,642. A decline below this level could suggest a possible trend reversal or a more intricate corrective pattern.

The presence of impulsive wave action reflects solid bullish market sentiment and increased buying pressure. Traders should monitor the progress of navy blue wave 1 for signs that wave 2 is beginning. This analysis supports the view of a sustained uptrend within the broader Elliott Wave cycle. Staying alert to changes in structure or a break below the invalidation point is crucial for effective market positioning.

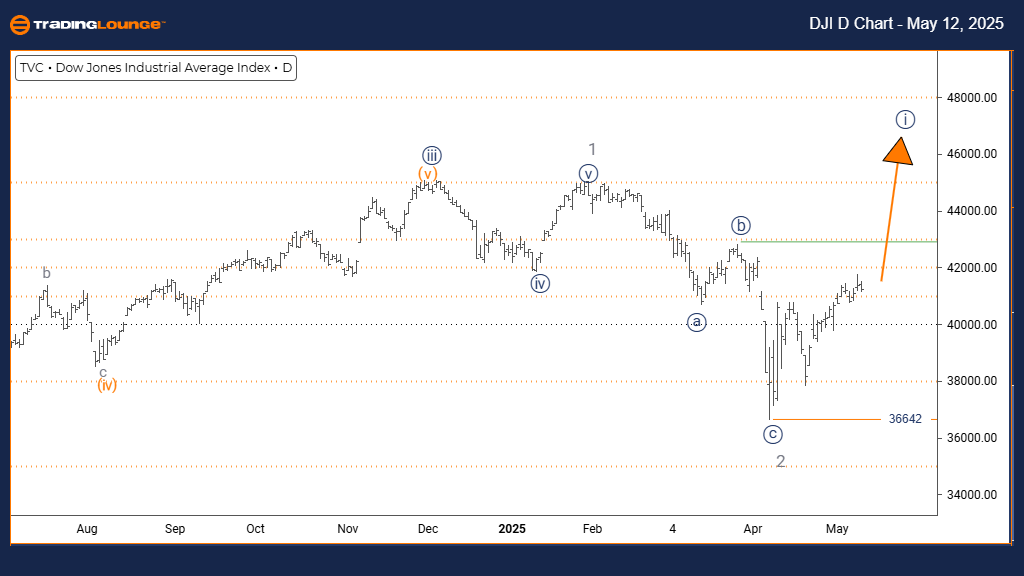

DOW JONES – DJI Elliott Wave Analysis – Trading Lounge Weekly Chart

DOW JONES – DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3 (active)

DETAILS: Gray Wave 2 seems complete; Gray Wave 3 has likely started.

Wave Cancel/Invalidation Level: 36,642

The weekly Elliott Wave forecast for the Dow Jones Index reinforces a strong bullish trajectory aligned with impulsive wave behavior. The index is positioned within gray wave 3, forming part of the larger orange wave 3 advance. The likely end of gray wave 2 signals a new wave of upward price action, often regarded as a powerful stage in the Elliott Wave sequence.

The next expected movement is the continuation of gray wave 3 within the broader orange wave 3 structure. The wave count remains valid above 36,642, which serves as the invalidation benchmark. A breach below this point could redefine the current outlook toward a more corrective or bearish scenario.

This impulsive phase suggests strong institutional interest and market momentum. Traders should watch for sub-wave formations inside gray wave 3 to verify the ongoing bullish trend. As long as the price stays above the invalidation level, the long-term uptrend outlook remains intact. This analysis provides valuable insight into the Dow's larger bullish pattern, supporting informed trade decisions and trend confirmation strategies.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support