Johnson & Johnson, Elliott Wave Technical Analysis

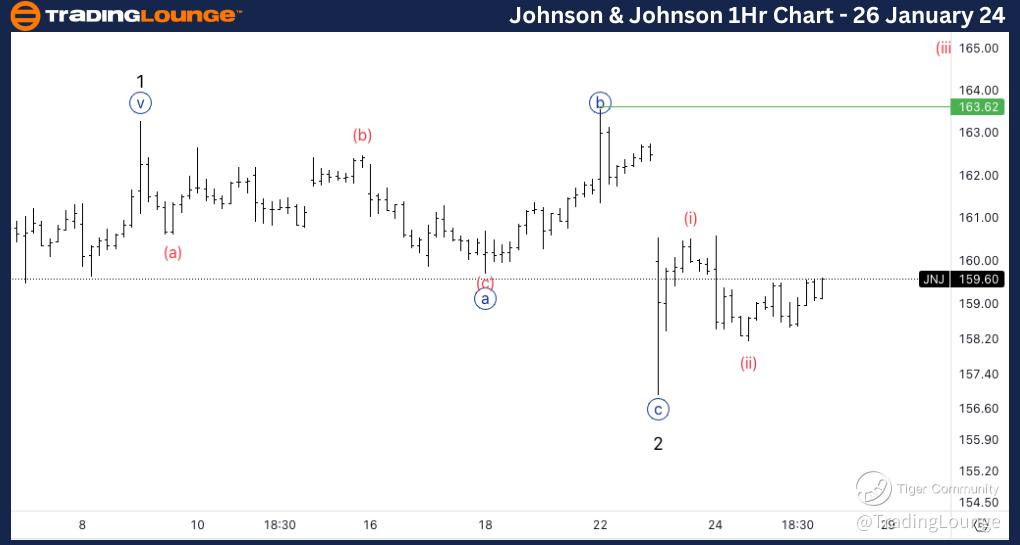

Johnson & Johnson, (JNJ:NYSE): 4h Chart, 26 January 24

JNJ Stock Market Analysis: Looking for upside into wave 3 as we seem to have a three wave move into wave 2. Looking for a break of wave {b} to have additional confirmation.

JNJ Elliott Wave Count: Wave {c} of 2.

JNJ Technical Indicators: Between 20EMA and 200EMA, volume increases while price moves higher.

JNJ Trading Strategy: Looking for a break of {b} of 2 to enter long.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

Previous: McDonald’s Corp.

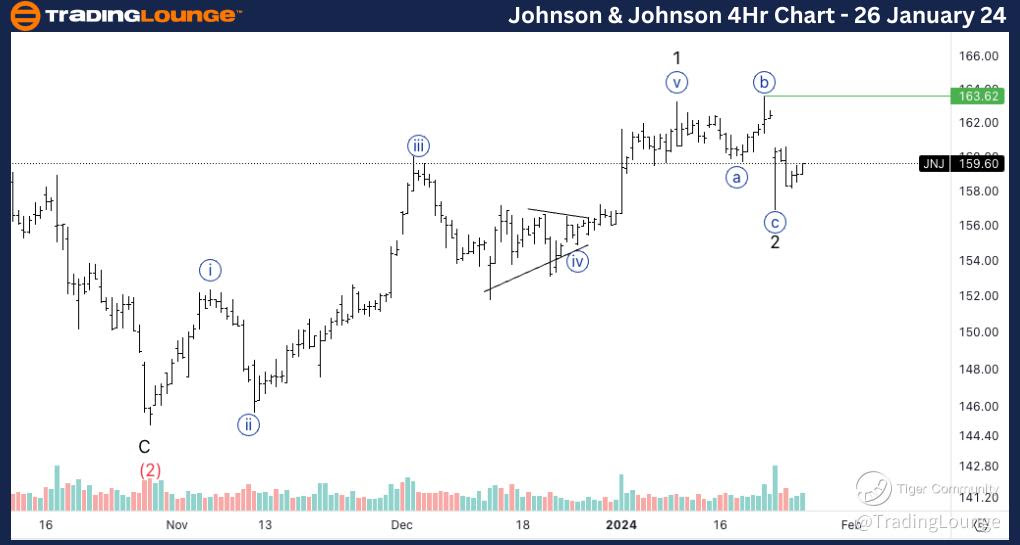

Johnson & Johnson, JNJ: 1-hour Chart, 26 January 24

Johnson & Johnson, Elliott Wave Technical Analysis

JNJ Stock Market Analysis: Looking for additional upside into wave (iii) of {i}, there is a possibility we are in some sort of wave iv of (c).

JNJ Elliott Wave count: Wave {c} of 2.

JNJ Technical Indicators: 200EMA as support.

JNJ Trading Strategy: Looking for a break of {b} of 2 to enter long.