McDonald’s Corp., Elliott Wave Technical Analysis

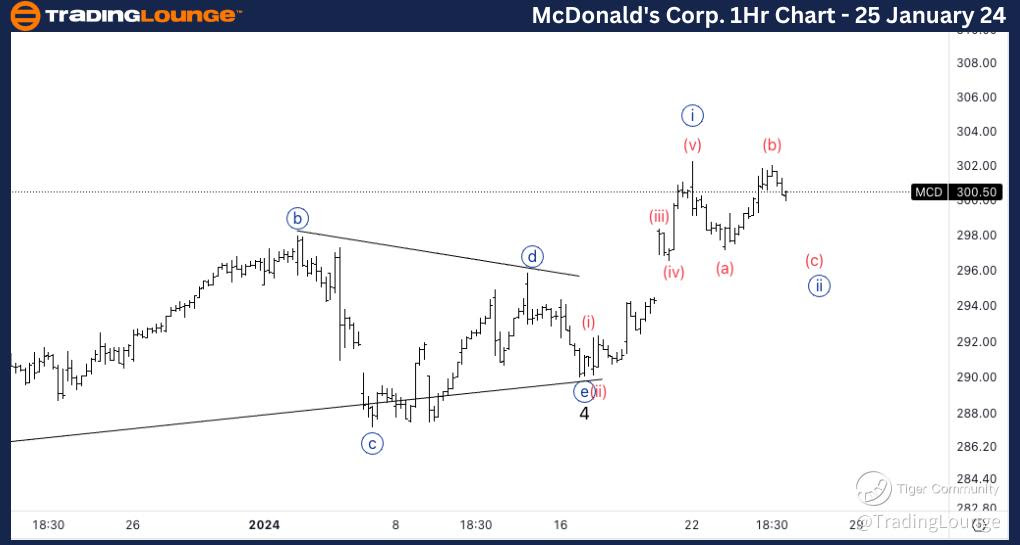

McDonald’s Corp., (MCD:NYSE): 4h Chart, 25 January 24

MCD Stock Market Analysis: In the previous McDonald’s update we were looking for further upside into Minor wave 5. As of today, as we are trading at ATH, we could either had a short wave 5 and have topped at 300$, or else we are making a wave {ii} of 5 to then continue higher.

MCD Elliott Wave Count: Wave {ii} of 5.

MCD Technical Indicators: Above all averages.

MCD Trading Strategy: Looking for longs after a break of (b) of {ii}.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get a trial here!

Previous: Eli Lilly & Co.

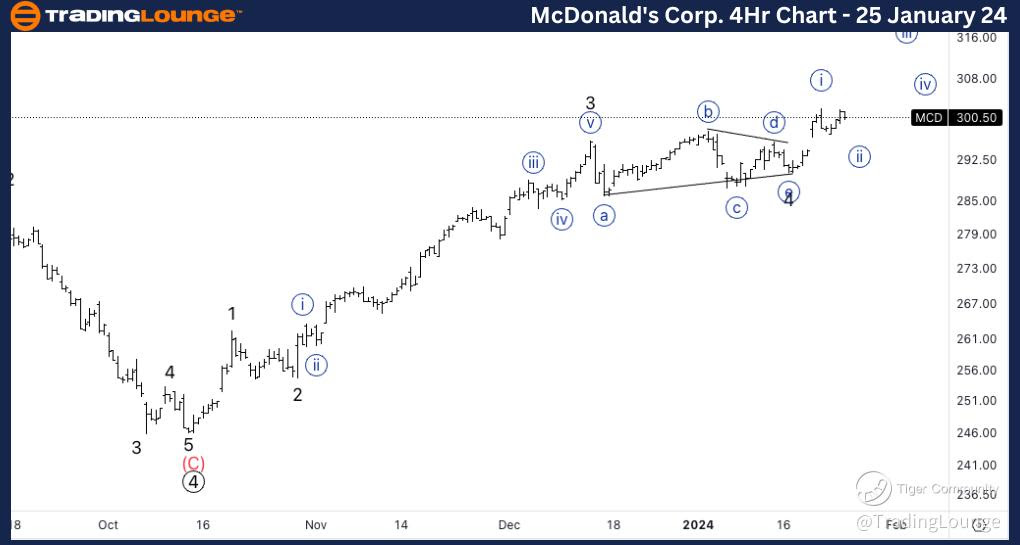

McDonald’s Corp., MCD: 1-hour Chart, 25 January 24

McDonald’s Corp., Elliott Wave Technical Analysis

MCD Stock Market Analysis: Here a closer look at the possibility of having a three wave move in wave {ii}. We would need to look for downside in wave (c) and then a CTLP on top of 300$. We are aware that we are trading at ATHs, however if we manage to see a CTL pattern we will have some level of safety.

MCD Elliott Wave count: Wave (c) of {ii}.

MCD Technical Indicators: Above all averages.

MCD Trading Strategy: Looking for longs after a break of (b) of {ii}.