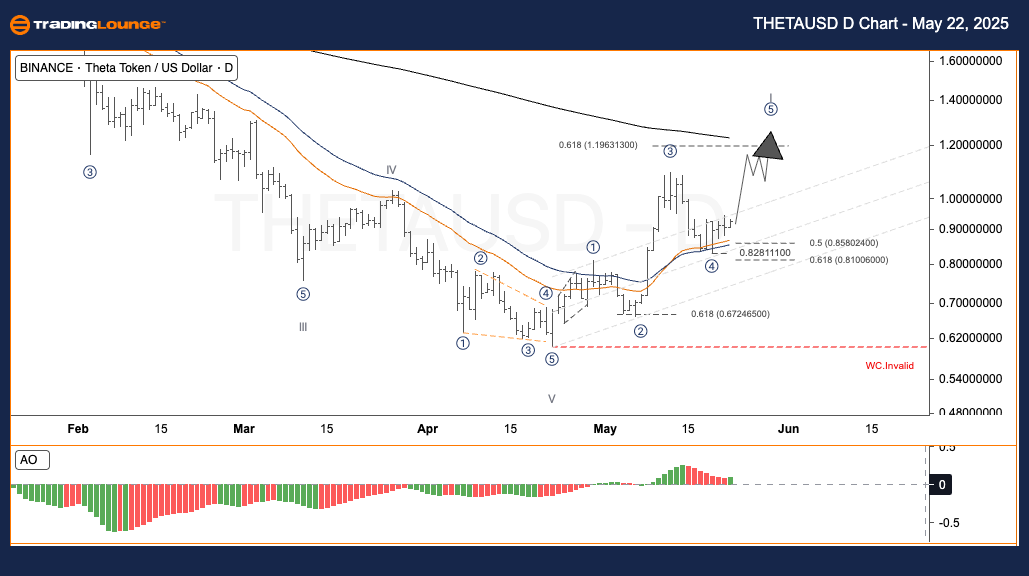

THETAUSD Elliott Wave Analysis – TradingLounge Daily Chart

Theta Token / U.S. Dollar (THETAUSD) Daily Chart Analysis

THETAUSD Elliott Wave Technical Overview

Function: Trend-following

Mode: Motive

Structure: Impulse

Current Position: Wave 4

Next Direction at Higher Degrees: Pending confirmation

Invalidation Level: Move below $0.620 invalidates the current wave setup

Theta Token (THETAUSD) – Daily Trading Strategy

After concluding its downward fifth wave in April, Theta Token began a notable recovery. This rebound follows a motive wave structure, progressing into wave (5), which will complete the broader wave I of the bullish trend. Waves ① through ④ are already in place, while wave ⑤ has initiated, targeting the 0.618 Fibonacci extension of waves 1–3 near $1.196. A decline beneath $0.620 would invalidate this wave count and call for reevaluation.

Trading Strategies

Strategy Type

✅ Swing Trade Strategy for Short-Term Crypto Traders

- Traders focused on short-term momentum can watch for a brief retracement to enter long positions.

- Wave ⑤ Target Zone: $1.19 to $1.25

Risk Management

🟥 Stop-Loss Recommendation: Below $0.82 or anchored at $0.72 support zone

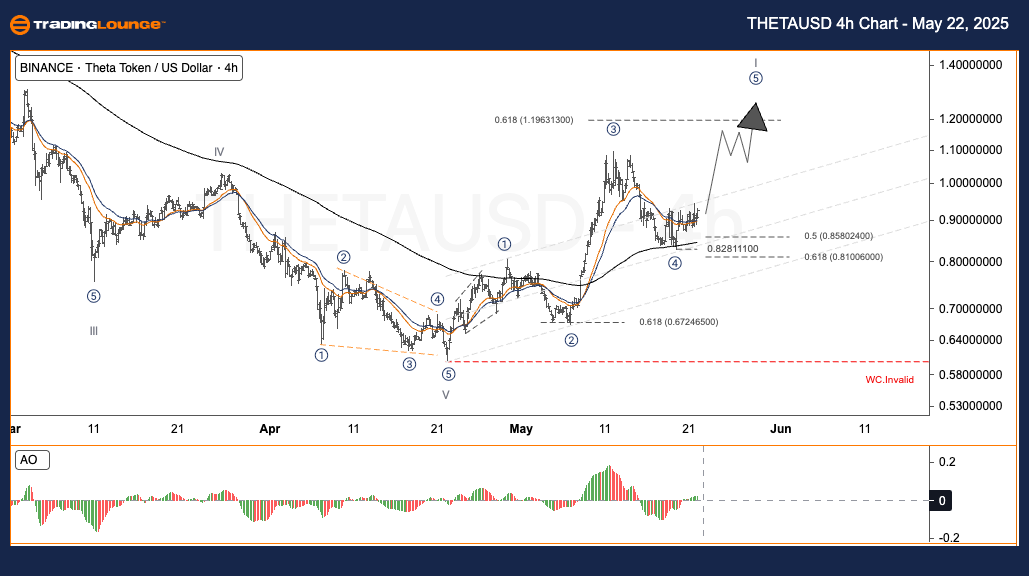

THETAUSD Elliott Wave Analysis – TradingLounge H4 Chart

Theta Token / U.S. Dollar (THETAUSD) 4-hour Chart Analysis

THETAUSD Elliott Wave Technical Analysis

Function: Trend-following

Mode: Motive

Structure: Impulse

Current Position: Wave 4

Next Direction at Higher Degrees: To be determined

Invalidation Level: A breach below $0.620 nullifies the wave count

Theta Token (THETAUSD) – H4 Trading Strategy

Following the conclusion of the fifth wave down in April, Theta has transitioned into a motive wave setup on the 4-hour chart. The market now works through wave (5), which is expected to complete the larger degree wave I in this bullish phase. Waves ① through ④ have finalized, with wave ⑤ currently unfolding. The price aim is aligned with the 0.618 Fibonacci extension from waves 1–3, estimated near $1.196. If price action breaks below $0.620, the structure will be considered invalid.

THETAUSD Trading Strategies

Strategy Type

✅ Short-Term Swing Trade Strategy for THETAUSD

- Momentum traders might seek a pullback entry point for long setups.

- Projected Wave ⑤ Range: $1.19 – $1.25

Risk Management

🟥 Stop-Loss Guidance: Set below $0.82 or secure at the $0.72 support level

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support