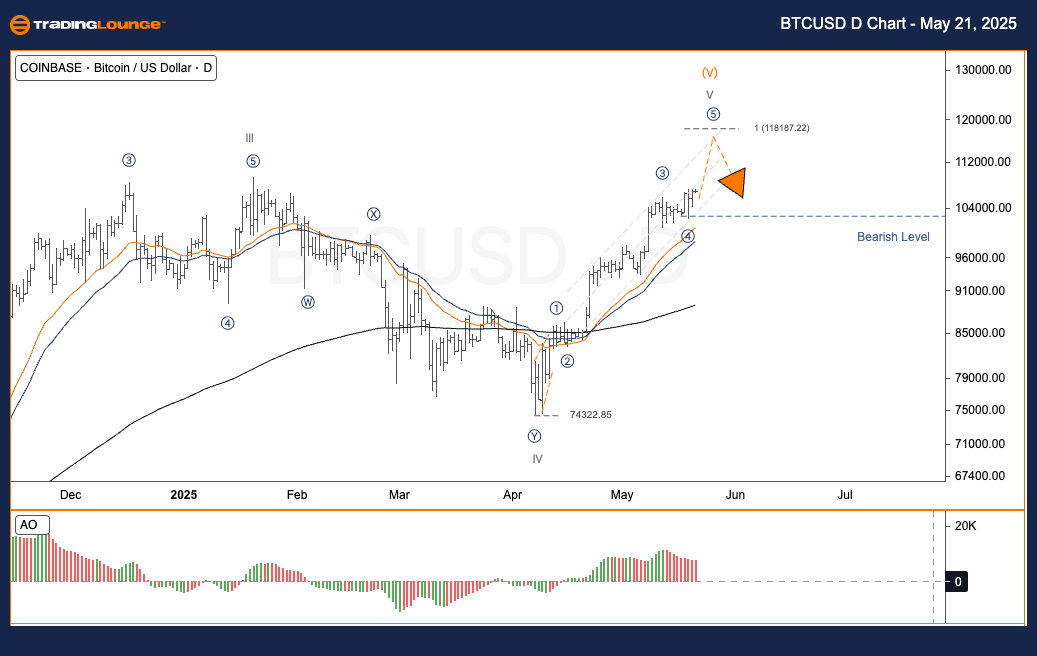

BTCUSD Elliott Wave Analysis – TradingLounge Daily Chart

Bitcoin / U.S. Dollar (BTCUSD) Daily Chart Analysis

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C

Next Higher Degree Direction: Wave (b)

Wave Cancellation Level: Not Applicable

Analysis Summary:

Bitcoin (BTCUSD) is moving toward finalising wave ⑤, which would conclude the broader wave V cycle. This signals a potential turning point in the mid-term trend direction for BTC.

BTCUSD Trading Strategy – Daily Chart

After rebounding from $74,322.85 in April, Bitcoin formed a strong upward momentum consistent with an impulsive wave structure. It is now entering the final leg of wave ⑤, pointing to the potential end of the primary wave V. The previous wave (4) displayed a classic A-B-C corrective form, and current price behavior suggests that sub-wave (5) is unfolding upward.

Key Fibonacci Price Target:

- Target: $118,187.22 – This aligns with a 100% Fibonacci extension of wave 1.

Trading Strategies

Approach:

Short-Term Strategy (Swing Trading):

- Long traders are recommended to gradually take profits as Bitcoin approaches the $117,000–$118,000 resistance zone.

- Traders anticipating a reversal can prepare for short entries on wave A, post-completion of wave ⑤. Watch for bearish reversal indicators such as RSI divergence or Bearish Engulfing candlestick patterns.

Risk Management:

Status: Data Not Provided

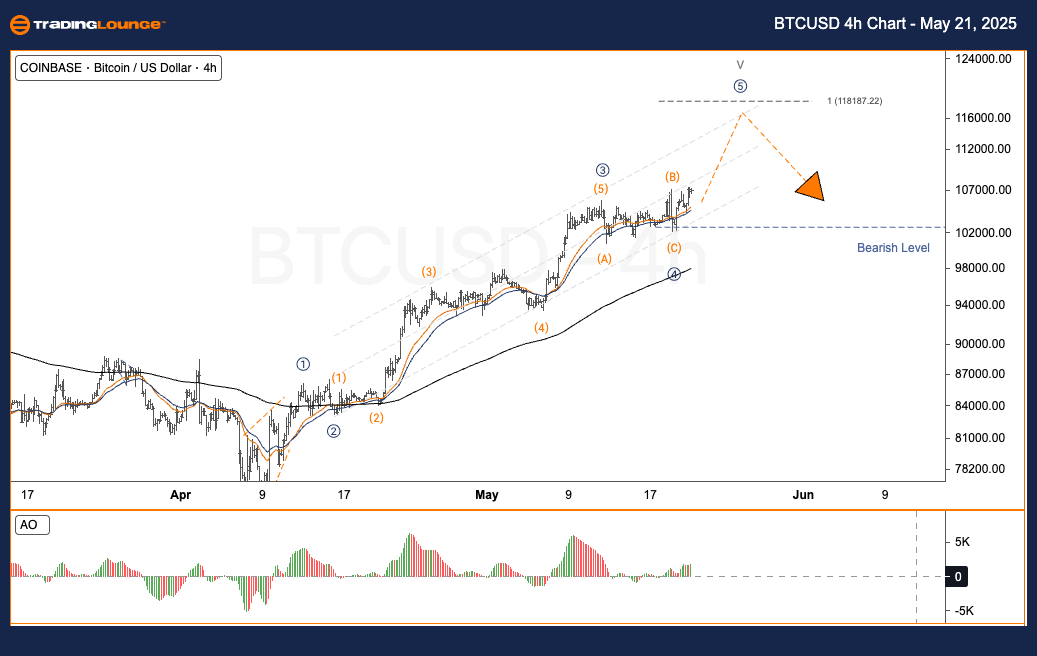

BTCUSD Elliott Wave Analysis – TradingLounge H4 Chart

Bitcoin / U.S. Dollar (BTCUSD) 4-hour Chart Analysis

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C

Next Higher Degree Direction: Wave (b)

Wave Cancellation Level: Not Applicable

Analysis Summary:

BTCUSD is nearing the completion of wave ⑤, indicating that the broader wave V cycle is close to finishing. This could mark a significant inflection point in Bitcoin's price action.

BTCUSD Trading Strategy – H4 Chart

Since the April rebound at $74,322.85, Bitcoin has steadily advanced in a textbook impulse wave. Currently, BTC is navigating through the final sub-wave (5) of wave ⑤, which is a crucial part of the wave V cycle.

Targeted Fibonacci Level:

🎯 Target: $118,187.22 – Represents a full 100% extension from wave 1.

Trading Strategies

Approach:

Short-Term Strategy (Swing Trading):

- Profit-taking should be staged near the $117,000–$118,000 range.

- Reversal-oriented traders should be vigilant for technical bearish signals like RSI divergence or reversal candlestick formations to initiate short positions on wave A.

Risk Management:

Status: Data Not Provided

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: XRPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support