XRPUSD Elliott Wave Analysis | TradingLounge Daily Chart

XRP / U.S. Dollar (XRPUSD) Daily Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: —

Wave Cancel Invalid Level: —

XRP / U.S. Dollar (XRPUSD) Forecast & Trading Strategy

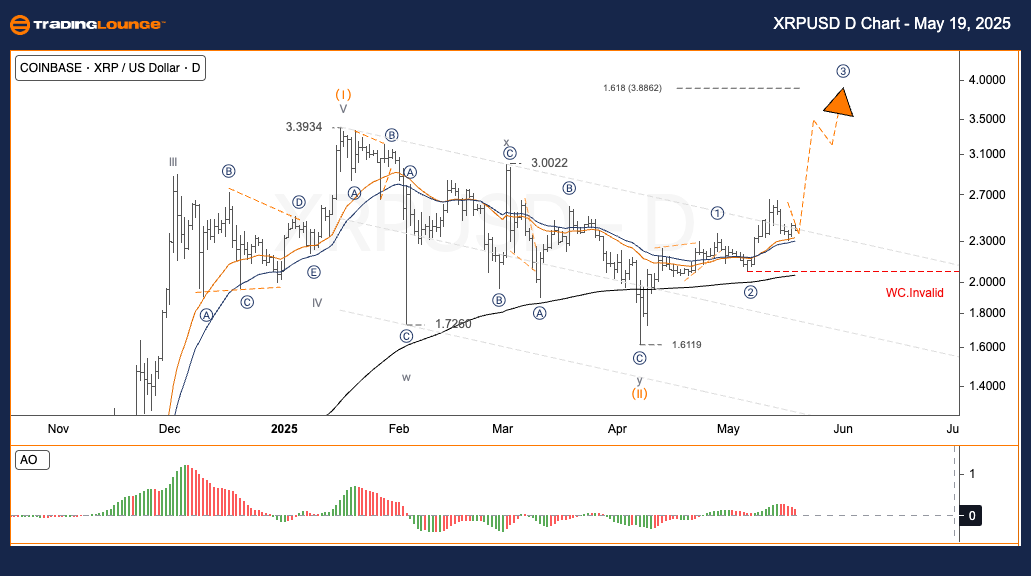

After completing the significant corrective wave (II) near the $1.88 level, XRP/USD initiated a new bullish Elliott wave cycle. The formation of wave III is progressing within the guidelines of the Elliott Wave theory. Wave (1) of wave ③ concluded near $2.80, while wave (2) is currently correcting within the standard 50%–61.8% Fibonacci retracement zone, between $2.36 and $2.29. Price has started bouncing off the Base Channel support, maintaining the integrity of the current wave setup.

Trading Strategy for XRPUSD

✅ Swing Trade Opportunity

A confirmed breakout above the $2.65 resistance would mark the start of wave (3) inside wave ③, signalling a potential rapid bullish continuation.

Risk Control

🟥 Invalidation Point

A drop below $2.07 would invalidate the current Elliott Wave count, necessitating a revised outlook.

XRPUSD Elliott Wave Analysis | TradingLounge H4 Chart

XRP / U.S. Dollar (XRPUSD) Pair 4-Hour Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: —

Wave Cancel Invalid Level: —

XRP / U.S. Dollar (XRPUSD) Short-Term Forecast

Following the termination of corrective wave (II) near $1.88, XRP/USD entered a pronounced uptrend. Within this bullish sequence, wave (1) of wave III ended close to $2.80. The current wave (2) pullback has reached the typical Fibonacci retracement zone of $2.36 to $2.29. Market activity is signaling a rebound from the Base Channel, maintaining structural compliance with the Elliott Wave framework.

Trading Strategy for XRPUSD (4-Hour Chart)

✅ Swing Trading Setup

A surge above $2.65 would validate the formation of wave (3) inside wave ③, which could drive a swift upward movement.

Risk Control

🟥 Wave Count Review Trigger

A price move below $2.07 would challenge the current count, requiring reassessment.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support