THETAUSD Elliott Wave Analysis – Daily Chart Overview | TradingLounge

Technical Summary: THETA Elliott Wave Analysis

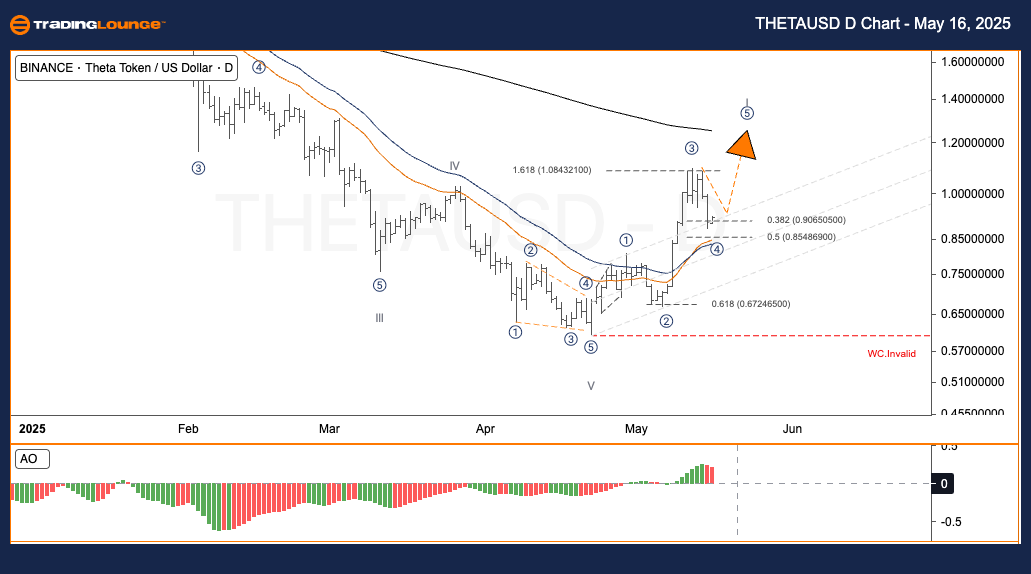

Function: Trend-Following

Mode: Motive

Wave Structure: Impulse

Current Position: Wave ④

Anticipated Move: Continuation to Wave ⑤

Invalidation Level: Below $0.672

THETA/USD Forecast & Trading Strategy

Theta (THETA) has recently concluded a corrective phase, completing Wave V at a crucial support level. This marks the start of a potential new bullish structure. Currently, an Impulse Wave I is taking shape, and price action suggests it is in the Wave ④ phase.

Price is testing the key Fibonacci Retracement zone between 38.2% and 50%, or roughly $0.906 – $0.854, from Wave ③. A sustained hold above this level followed by an upward move could confirm the onset of Wave ⑤, the final upward wave in this cycle.

Swing Trading Strategy – Daily Chart

✅ Buy Zone: Watch for bullish entries between $0.85 – $0.90, especially upon confirmation of a reversal pattern.

🟥 Risk Level: A drop below $0.672 invalidates the bullish count and warrants reevaluation.

THETAUSD Elliott Wave Analysis – 4-Hour Chart | TradingLounge

Technical Summary: Elliott Wave THETA/USD

Function: Trend-Following

Mode: Motive

Wave Structure: Impulse

Current Position: Wave ④

Next Target: Wave ⑤

Wave Invalidation Level: Below $0.672

Short-Term Trading Strategy – THETAUSD 4H Outlook

Following a strong V wave formation at a major support, Theta (THETA) is showing signs of recovery. The chart indicates formation of Impulse Wave I, with current action likely forming Wave ④.

Price is consolidating within the 38.2% – 50% Fibonacci retracement zone ($0.906 – $0.854) from Wave ③. Sustaining this level could signal the next leg up, Wave ⑤, completing the bullish cycle.

Swing Trader Setup – 4H Chart

✅ Buy Opportunity: Focus on the $0.85 – $0.90 area, particularly if a reversal candlestick pattern confirms upward momentum.

🟥 Risk Alert: Falling below $0.672 negates the bullish scenario and suggests a new wave count.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: XRPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support