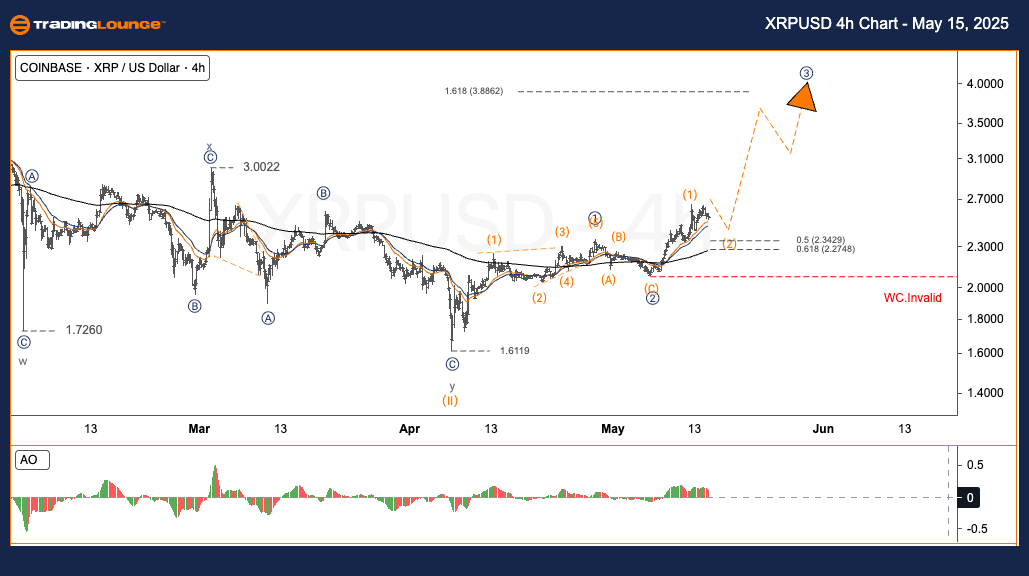

XRPUSD Elliott Wave Analysis – TradingLounge Daily Chart

XRP/USD (Ripple to U.S. Dollar) Daily Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Current Wave: Wave 3

Next Higher Degree Direction: Bullish Continuation

Invalidation Level: Below Critical Support

XRP/USD Daily Chart Forecast: Bullish Wave ③ Breakout Potential

XRP is entering a critical phase in its Elliott Wave cycle, targeting wave ③ formation. A retracement to wave (2) would confirm continued bullish momentum, reinforcing a potential surge toward the $3.88 price target. Traders analyzing XRP/USD should focus on the Fibonacci retracement levels, where trend continuation opportunities may emerge.

XRPUSD Trading Strategy – Daily Chart

Strategy Type:

✅ Swing Trade (Short-Term)

- Identify bullish reversal signals in the $2.27–$2.34 zone.

- Use Fibonacci support zones for optimized trade entries.

Risk Management:

🟥 Protective Stop-Loss: Place stop-loss orders below $2.00 to avoid invalidation of the current Elliott Wave setup.

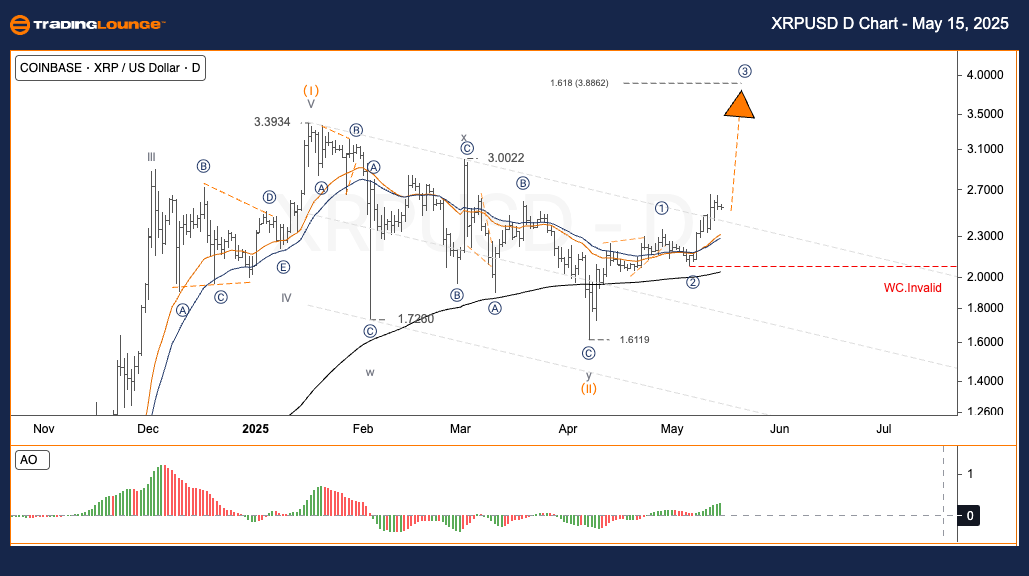

XRP/USD Elliott Wave Analysis – TradingLounge H4 Chart

XRP/USD (Ripple to U.S. Dollar) 4-Hour Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Current Wave: Wave 3

Next Higher Degree Direction: Bullish Continuation

Invalidation Level: Below Critical Support

XRP/USD H4 Chart Analysis: Short-Term Rally Anticipation

The H4 chart reinforces the bullish outlook as XRP prepares for the next impulsive leg in wave ③. Confirmation of wave (2) will likely set the stage for a potential move toward the $3.88 mark. This XRP technical analysis highlights the importance of monitoring Fibonacci zones to capitalise on emerging trends.

Trading Strategy – H4 Chart

Strategy Type:

✅ Swing Trade (Short-Term)

Watch for price action setups in the $2.27–$2.34 range to trigger buy entries.

Risk Management:

🟥 Stop-Loss Strategy

Set stop-losses below $2.00 to mitigate downside risk if wave structure fails.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: LINKUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support