UnitedHealth Group Inc. (UNH) Elliott Wave Analysis: Trading Lounge Insights for March 20, 2024

Discover the latest insights into UnitedHealth Group Inc. (UNH) with our Elliott Wave analysis. Gain valuable perspectives on the daily and 4-hour charts, exploring potential trends and corrective movements for informed trading decisions.

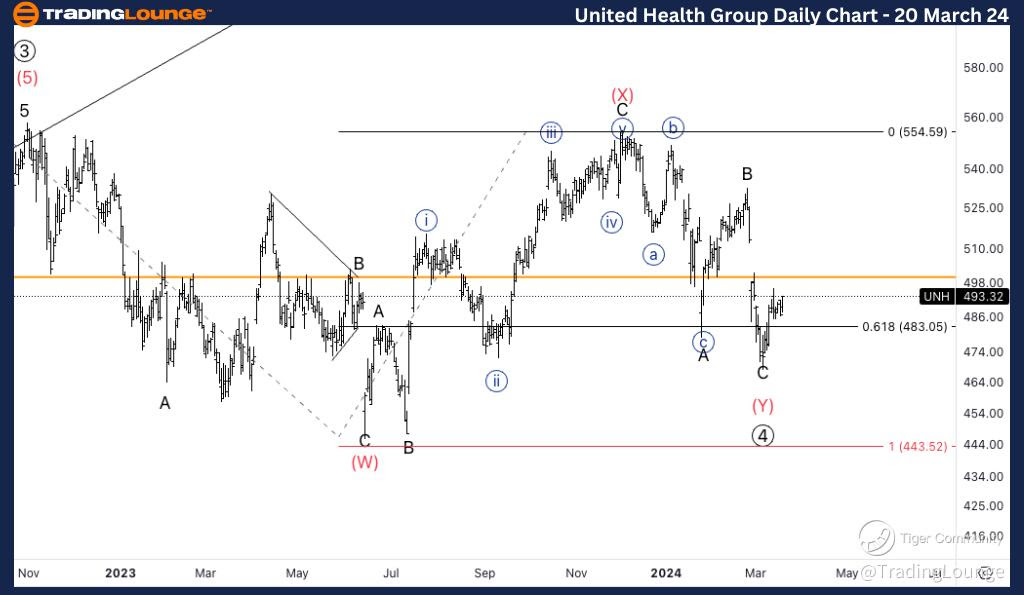

UnitedHealth Group Inc. (UNH) Daily Chart Analysis

Unlock the potential of the daily chart with our Elliott Wave technical analysis for UNH.

UNH Elliott Wave Technical Analysis Highlights:

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Intermediate wave (Y)

Direction: Wave (Y) of 4

Insightful Details:

As we delve into the daily chart, our analysis suggests a counter-trend scenario with corrective movements characterized by a complex structure. Positioned within intermediate wave (Y), the current direction indicates Wave (Y) of 4.

Key Observations:

We're keenly observing a potential bottom formation in wave (Y). However, it's crucial to acknowledge the possibility of Wave (Y) evolving into Wave (C) of a triangle. Maintaining a price range fluctuating around $500 is pivotal, signalling potential upside movements in the future.

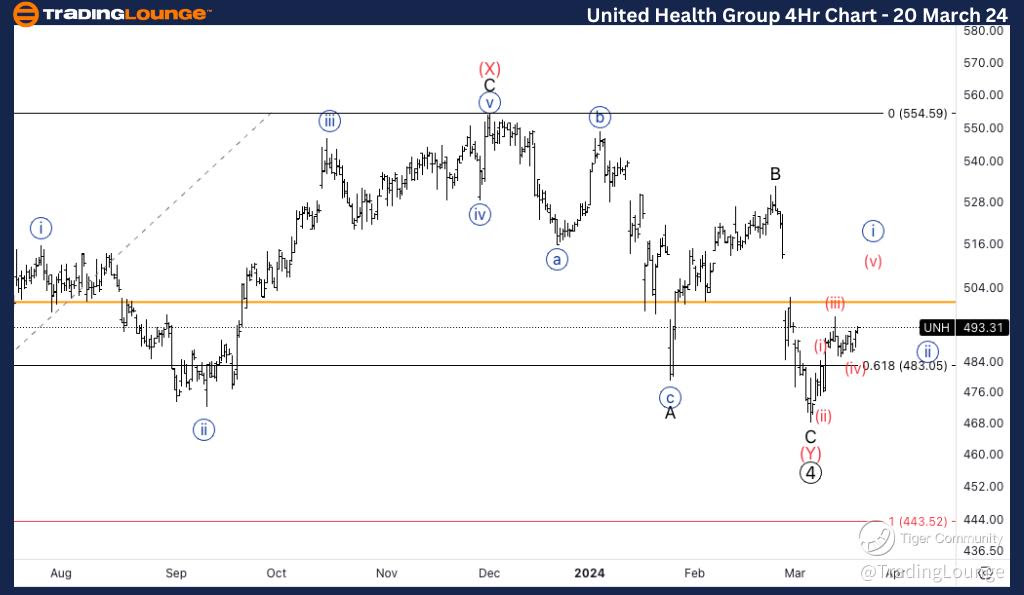

Trading Lounge UNH Elliott Wave Analysis 4Hr Chart, 20 March 24

UnitedHealth Group Inc. (UNH) 4Hr Chart Analysis

UNH Stock Analysis: Gain deeper insights into short-term trends with our Elliott Wave analysis on the 4-hour chart for UNH.

Elliott Wave Technical Analysis for UNH Highlights:

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute wave {i}

Direction: Completion of wave {i}

Insightful Details:

Dive into the 4-hour chart, where our analysis points towards a trend-oriented scenario marked by impulsive movements. The structure exhibits a motive pattern, with the current position indicating Minute wave {i}.

Key Observations:

Exploring from the $468 bottom, there's potential for an impulsive move to unfold. Our focus lies on completing a five-wave sequence in wave {i}, anticipated to reach $500 before initiating a pullback in {ii}.

Incorporating Elliott Wave analysis into your trading strategy provides invaluable insights into potential price movements and trend developments for UnitedHealth Group Inc. (UNH). Stay ahead of the market with our comprehensive analysis, guiding you towards informed trading decisions.

Unlock the power of Elliott Wave analysis today and elevate your trading game with Trading Lounge.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Amazon.com Inc., (AMZN)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.