Unlocking Insights: Gold Elliott Wave Analysis

Discover the latest in Elliott Wave Analysis for Gold (XAUUSD) as of February 14, 2024, providing valuable insights into market trends and potential opportunities.

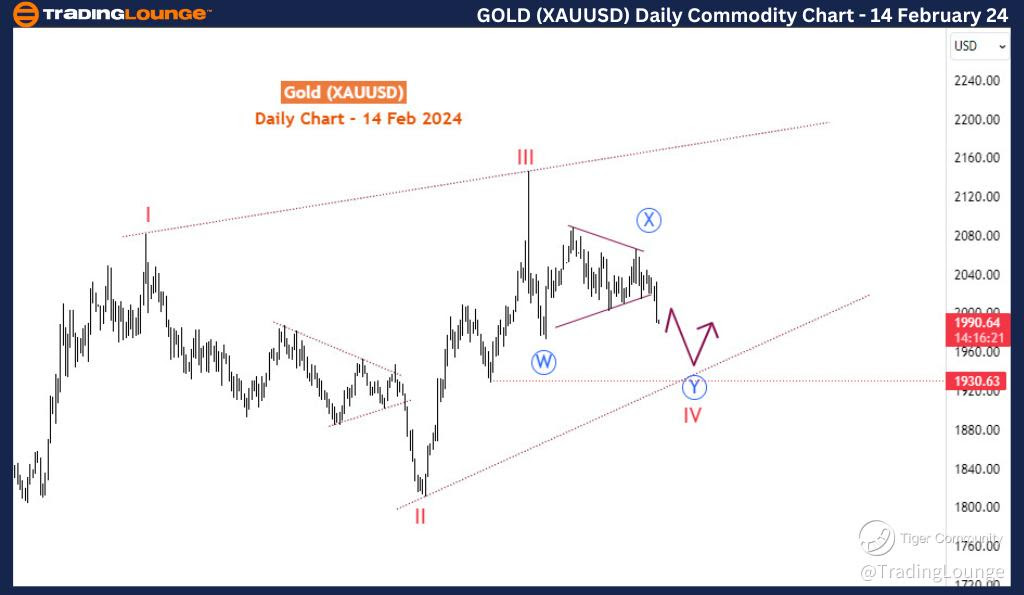

Gold Elliott Wave Analysis

At a Glance:

- Function: Counter-trend

- Mode: Corrective

- Structure: Zigzag

- Position: Blue Wave Y of Red Wave IV

- Direction: Blue wave Y of red wave IV remains active.

Insightful Details: Following the completion of Wave (E) within the triangle wave X, culminating at $2044, a subsequent breakdown beneath the low of Wave (D) at $2014 ensued. Presently, the larger degree blue wave Y continues its descent and may potentially extend in 3-waves towards $1940. Consequently, the revised invalidation level for this forecast has shifted to $2045, corresponding to the high of wave (E).

Enhancing Your Analysis: Stay informed and ahead of market movements with our comprehensive Elliott Wave Technical Analysis. Explore potential trading strategies and decision-making insights tailored to your trading goals and risk appetite.

Take Advantage of Opportunities: Leverage the power of Elliott Wave Analysis to identify potential entry and exit points, optimize risk management, and capitalize on market fluctuations. With our expert analysis, navigate the complexities of the Gold (XAUUSD) market with confidence.

Optimizing Your Trading Strategy: Integrate Elliott Wave Analysis into your trading toolkit and refine your approach to trading Gold (XAUUSD). Harness the predictive power of wave patterns to make informed decisions and achieve your trading objectives effectively.

Technical Analyst: Sanmi Adeagbot

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD)

Conclusion: Empower your trading journey with actionable insights from our Gold Elliott Wave Analysis. Gain a deeper understanding of market dynamics and unlock opportunities for profitable trading. Stay tuned for regular updates and analysis to navigate the ever-evolving landscape of the Gold (XAUUSD) market.